Another Spot Bitcoin ETF Gets Rejected by the SEC; Google, Coinbase partner for crypto payments

The biggest news in the cryptosphere for October 10 includes Google’s new partnership with Coinbase to start accepting crypto payments, Bittrex’s $30 million fine for violating federal sanctions, and the SEC’s rejection of WisdomTree’s Spot Bitcoin ETF for not having enough monitoring.

CryptoSlate Top Stories

Google will integrate crypto payments with cloud services from 2023 via Coinbase partnership

Google and Coinbase are partnering to launch a crypto payment solution. Following the announcement, COIN shares recorded a 6% spike.

The duo will allow users of Google’s cloud services to pay via Coinbase-supported cryptocurrencies. Google will also store its crypto holdings using Coinbase Prime.

Bittrex to pay $30 million for violating sanctions

Crypto exchange platform Bittrex was fined $30 million by the US Treasury Department’s Office of Foreign Assets Control (OFAC) and the Financial Crimes Enforcement Network (FinCEN) for violating federal sanctions.

Bittrex allowed around 1,800 people from sanctioned regions such as Iran, Crimea and Syria to conduct crypto transactions on its platform between 2014 and early 2017. The exchange agreed to pay the fine and make necessary adjustments to comply with the sanctions.

SEC rejects WisdomTree’s Spot Bitcoin ETF

The US Securities and Exchange Commission (SEC) rejected the Wisdom Tree Bitcoin (BTC) Trust ETF for not offering a valid measure that could protect investors from market manipulation.

The SEC said that given the highly unregulated nature of the crypto market, monitoring was essential before approving any spot Bitcoin ETF.

Temple DAO hacked for over $2.3 million

Temple DAO was hacked on October 11 and lost 1,831 Ethereum (ETH), equivalent to over $2.3 million. The project team offered a bounty on the hacker’s head and shut down the dApp to prevent accidental use.

#PeckShieldAlert Seems @templedao was exploited. The exploiter funded from SimpleSwap and has already transferred 1831 $ETH (~$2.34M) to a new address 0x2B63d…B5A0 @peckshield pic.twitter.com/SVEm8o95U6

— PeckShieldAlert (@PeckShieldAlert) 11 October 2022

Coffeezilla names Celsius founder Alex Mashinsky for dumping CEL tokens

Crypto expert Coffeezilla accused Celsius (CEL) founder Alex Mashinsky of allegedly dumping over 10,000 CEL tokens in the early hours of October 11.

Coffeezilla posted its accusations on its Twitter account as a thread. Mashinsky’s wallet address was later identified by Nansen, who revealed that around 10,000 CEL tokens were actually exchanged for approximately $9,300 USD coins (USDC).

BNY Mellon receives New York approval for crypto custody services

The Bank of New York Mellon (BNY Mellon) was approved to provide custody services for digital assets on October 11. With it, BNY Mellon customers will be able to store keys to their assets with the bank.

CNN’s NFT Market Shutdown Sparks Accusations of Carpet Pulling

CNN’s NFT Marketplace “Vault by CNN” announced its closure. The platform was launched in the summer of 2021 during the NFT boom, and its unexpected shutdown sparked talks of a possible blanket pull.

A CNN spokesperson responded to the community’s concerns by saying that Vault of CNN holders can expect to be compensated approximately 20% of distributions based on the NFTs in the wallet.

Research highlight

Liquidations are expected as Bitcoin opens interest, leverage ratio increases

Given the state of the fiat market and Bitcoin’s relatively flat price movements, which have remained between $18,400 and $22,800 in recent months, Bitcoin may be signaling a disconnect from older markets.

CrytpoSlate analysts examined three different indicators; Bitcoin Futures Estimated Leverage Ratio (ELR), Futures Open Interest and Futures Perpetual Funding Rates (FPFR) to discover that the crypto market is significantly hot and overweight to the upside.

This is an indicator of the upcoming widespread liquidation period, which could reduce asset prices led by Bitcoin.

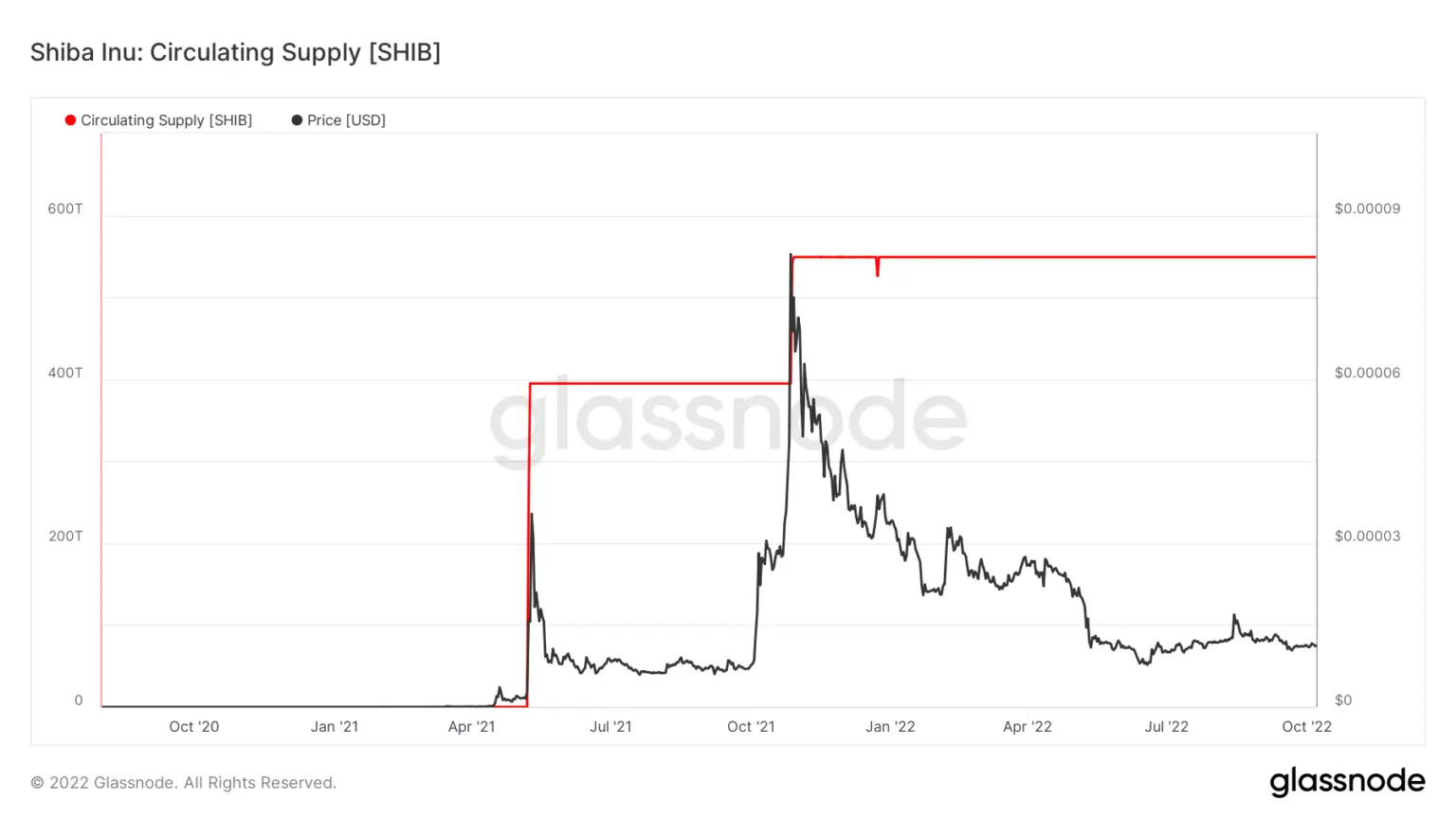

Research: What really happened in 2021 for the Shiba Inu?

Shiba Inu (SHIB) rose through 2021, only to continue falling in 2022. CryptoSlate analysts identified a difference in the amount of SHIB held by exchanges in both major SHIB unlocks.

SHIB was released for the first time in April/May, increasing the price and quantity of SHIB tokens on exchanges. The second major unlock took place in October/November and recorded a new price ATH. However, the SHIB tokens held by exchanges drastically reduced.

The SHIB price only continued to fall from that point. In accordance CryptoSlate data, SHIB fell by 58.32% in the last 365 days and the current price is hanging around $0.000011, which is 88% lower than ATH.

News from the entire Cryptoverse

YugaLabs faces SEC probe for unregistered offerings

Boring Ape creators, Yuga Labs are facing an investigation by the SEC, according to Bloomberg. The commission is investigating the legality of Yuga Labs’ high-value NFT sales.

Crypto market

Bitcoin (BTC) fell 1.19% in the last 24 hours to trade at $19,003, while Ethereum (ETH) also fell 2.02% to trade at $1,282.