Analyst Benjamin Cowen Says Crypto Assets Are 50% Undervalued, Predicts When Bitcoin Could Rise to ‘Fair Value’

The popular crypto strategist who continues to build a following with timely Bitcoin (BTC) analysis says the crypto king is grossly undervalued.

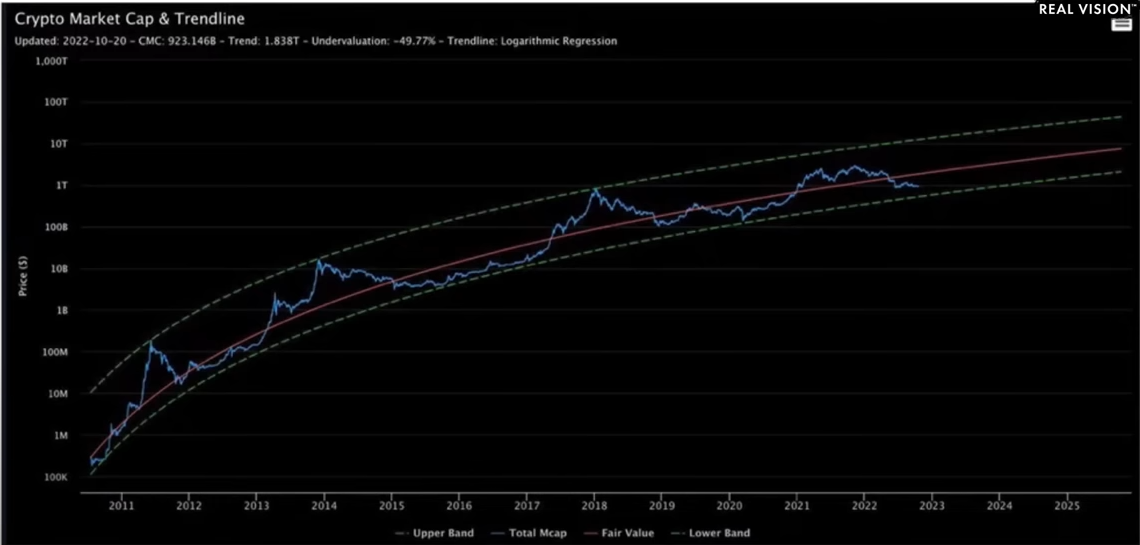

In a new interview on the Real Vision Crypto channel, Cowen says that crypto assets are massively undervalued based on the logarithmic regression model.

“This chart is something I’ve shown a few times in the past. The blue line is the total cryptocurrency market cap. The red line is what’s called the real value logarithmic regression trend line.

The whole idea is that the real value of the asset class [crypto] increases monotonically with time, and we kind of oscillate around the real value.

Right now, the data suggests that we are about 50% undervalued compared to where the fair value is.”

While crypto’s current valuation may look attractive to long-term investors, Cowen warns that the asset class could still fall another 15%.

“But [the chart] also indicates that major bottoms usually occur closer to say 60% to 65% undervalued before we can really sustain another bull market…

We still need a little more time before we can really get out of this bear market.”

As for Bitcoin, Cowen says the flagship crypto-asset will likely take over 14 months before it can rise back to its real value.

“Bitcoin’s price has always been at fair value at halving.

So every single bear market we go below fair value and when we get to the next Bitcoin halving, that’s where the price is.

So I mean for us to get back to fair value, I would say that’s probably going to happen, my guess would be 2024. Sometime early 2024 is my guess.”

I

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Salamahin/Juliana Nan