Analysis of cryptowhale activity: Do whales accumulate?

In recent years, the crypto market has become increasingly linked to the world of TradFi. A series of bank failures in the US appears to have triggered a new wave of whale hoarding in the crypto industry.

The recent boom in the crypto market was not fueled by BTC alone. According to blockchain data analytics platform Santiment, a number of altcoins also experienced intense whale activity.

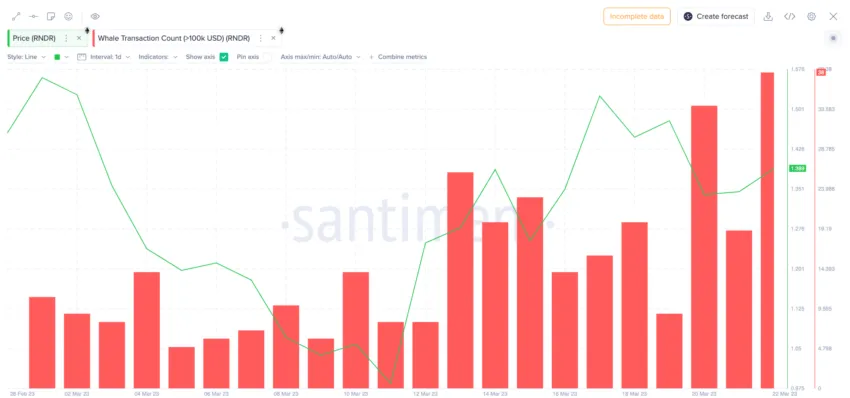

Render Token Whales are positioning themselves for more upside

Render Token benefited from the chatGPT-powered AI hype in early 2023. After a price reduction in late February, the Render Token whales look set to return for more action.

If the whales maintain this level of activity, RNDR holders can expect another series of upswings in the coming weeks.

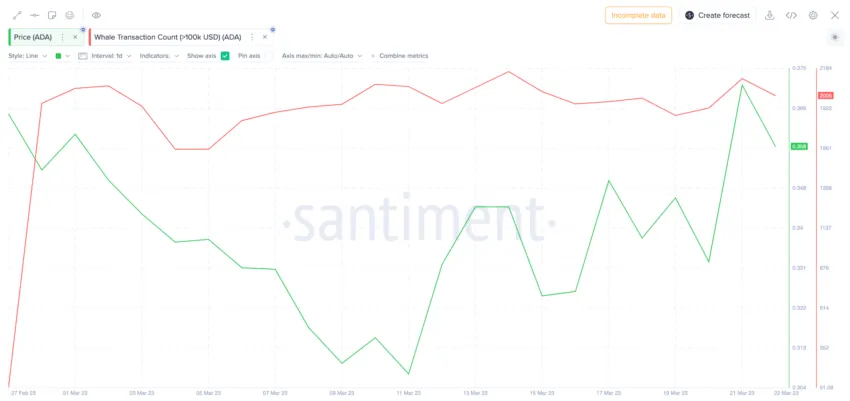

Stablecoin launches Spurred Cardano Whales into action

Cardano recently launched Djed, its own native crypto-backed stablecoin. Since its launch, whale activity on the Cardano network seems to have kicked into a new gear.

If the whales remain active on Cardano, it could soon positively affect the native ADA coin. Tokens for projects hosted on the smart contract network may also see a rise.

Litecoin whales lead the $100 mission

Although short-lived, Litecoin (LTC) regained its $100 status in February. It was the first time LTC rose above $100 since falling below the milestone in the wake of the TerraUST crash back in May 2022.

After returning to below $70 on March 10, continued whale activity appears to be driving the current price uptrend.

LTC may soon break above the $100 zone if the whales remain active.

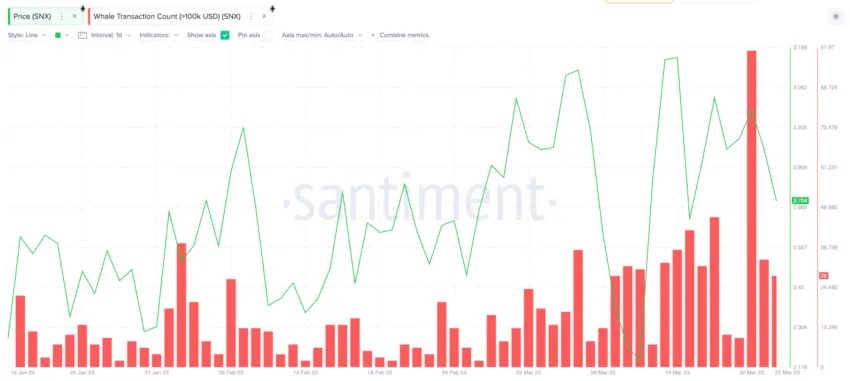

Synthetix swings upwards with buying pressure

Since January, the popular crypto derivatives platform Synthentix has made a series of new highs. Recently, it recorded its highest crypto whale activity peak in three months.

In particular, the prices have been closely correlated to whale activity on the Synthetix network. This could mean more price action for SNX if the whales continue to rally.

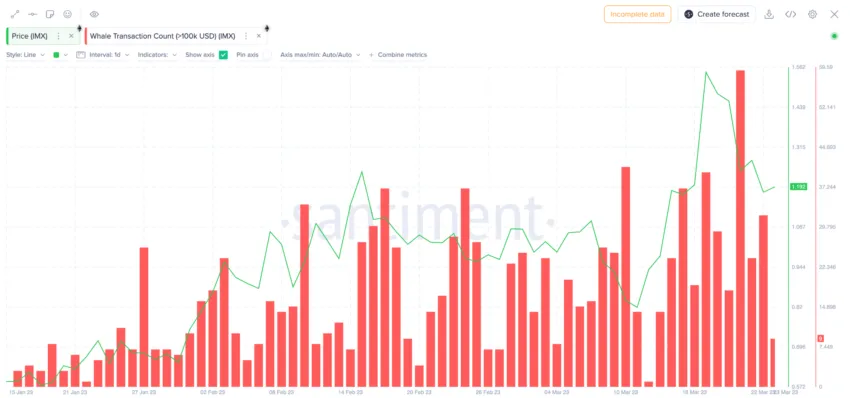

IMX remains in an uptrend

Immutable X (IMX) is a layer-2 scaling solution for NFTs on the Ethereum network. With its fast transaction and almost zero gas fees, it’s no surprise that it has received considerable whale attention in recent weeks.

Just as interest in NFTs continues to pick up globally, IMX has consistently experienced increased transaction activity from whales. After recording its highest whale activity for 2023 on March 20, more price gains could be around the corner.

Crypto whales continue to move the needle as the crypto market takes a positive look at price action. BeInCrypto will monitor these altcoins and observe the level of impact whale activity may have on their prices in the coming weeks.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You agree and understand that you should use all such information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.