An overview of chain calculations for investing in crypto

Important takeaways

- On-chain data helps analyze investor behavior and potentially identify market trends.

- While blockchain data provides a unique perspective on investor behavior, one should also consider technical and fundamental analysis to make well-informed trading and investment decisions.

- Phemex, one of the most popular cryptocurrency exchanges in the industry, offers a wealth of on-chain metrics information to help you become a successful trader.

Share this article

On-chain analysis (also known as blockchain analysis) is an emerging field that gathers information about public blockchain activity.

Leverage on-chain data

For anyone unfamiliar with the technology, blockchains are public databases where information about network transactions (but not the identity of who is making transactions) is available to everyone.

While technical analysis focuses on the price and volume of an asset, chain analytics focuses on extracting data from the state of the blockchain, such as transaction activity patterns, the concentration of token ownership, social sentiment, or exchange flows.

This area of analysis emerged in 2011 with the creation called Coin Days Destroyed (CDD), a metric used to confirm the age of tokens transferred on a given day to measure market participation. Since then, we have seen the creation of a much wider number of analytics tools in the chain (Glass node alone has developed over 75 chain measurements).

The following section is a summary of the most useful and commonly used on-chain indicators crypto investors can use to evaluate activity on the blockchain:

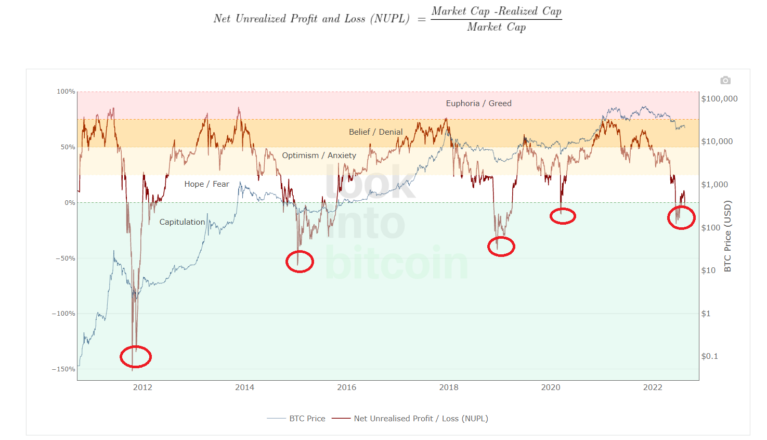

Net unrealized profit or loss (NUPL): NUPL tells us whether the market as a whole has an unrealized gain or loss. In accordance lookintobitcoin.comUnrealized profit/loss is obtained by subtracting realized value from market value.

Market value refers to the current price of a token multiplied by the number of tokens in circulation. The realized value is an average of the added value of each coin when it was last moved, multiplied by the total number of coins in circulation.

By dividing unrealized profit/loss by market value, we obtain net unrealized profit/loss.

A NUPL greater than zero means that investors are collectively currently in a profitable state. If it is less than zero, the market as a whole has an unrealized loss.

Market value to realized value (MVRV): this calculation has helped predict Bitcoin tops and bottoms. It determines whether the current market value is over- or undervalued. MVRV is calculated by dividing market value by realized value daily.

The higher the ratio, the more people will realize profits if they sell tokens. And vice versa: the lower the ratio, the more people will take a loss by selling their coins.

Financing rates and open interest rate: investors use both indicators to weigh interest levels in the crypto market.

Financing rates are regular payments that perpetual contracts (perps) traders must pay to maintain an open position. Perpetuals are a type of Futures contract that does not have an expiration date. These payments ensure that the perp price and the spot price coincide regularly.

On the other hand, Open Interest (a volume-based calculation) is the sum of all open futures contracts. But Open Interest does not tell us whether the contracts are long or short. Open interest is useful as it shows how much capital is flowing into a market and can help predict market tops and bottoms when combined with price trends.

Output Used Profit Ratio (SOPR): this is another tool that helps gauge market sentiment. The ratio indicates whether investors are selling at a profit or loss at a given time. It is obtained by dividing the USD value when the UTXO (wallet balance) is created by the value when the UTXO is spent.

A ratio greater than one means that for a certain time frame there are more people selling coins at a profit. Conversely, a SOPR of less than one means that more coins are being sold at a loss compared to the purchase price.

Exchange flows: Exchange Flows tracks the movement of coins entering and exiting exchanges.

When currency inflows are dominant, we assume that traders sell their tokens to protect gains. Heavy inflow can indicate the beginning of a bear market or correction.

Exchange exchanges may indicate that token buyers are sending their holdings to self-custodial wallets with the intention of holding, thus creating a shortage of tokens in the exchanges and driving up the price.

Combining chain analysis and other technical and fundamental indicators can help investors make wise investment decisions. Phemex provides all this knowledge in one hub, allowing users to make the most of their chain and trading skills, filter out the noise and make money by predicting the next market move.