Tags in this story

Americans, Crypto Investments, Fondness, Gallup Poll, Gallup Poll, Gold Investments, Investment Choice, Long Term, Stuck, Preference, Real Estate, Shift, Skyrockets, Stock Investments

all about cryptop referances

A recent Gallup poll shows a significant decline in the percentage of Americans who favor real estate as their preferred long-term investment, despite its continued popularity. Conversely, the Gallup survey indicates that the perception of long-term investments in gold has almost doubled compared to last year’s opinion poll on the same topic.

Gallup, Inc., the research and advisory company headquartered in Washington, DC, recently unveiled its latest Gallup Long-Term Investing Survey on May 11, 2023. With a history dating back to 1935, Gallup has conducted opinion polls around the world.

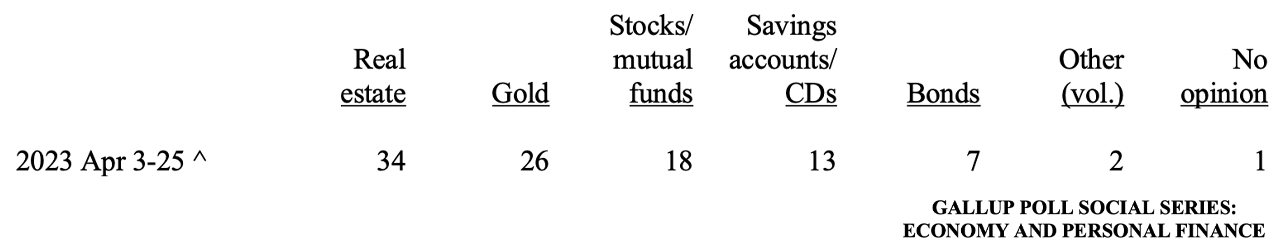

The poll, conducted from April 3 to April 25, 2023, taps into various investment options such as real estate, gold, stocks, bonds and crypto-assets. The results were obtained from telephone interviews conducted during the same period, with a randomly selected sample of 1,013 adults aged 18 and over living in the United States.

Gallup’s latest poll revealed that real estate emerged as the preferred long-term investment, but the allure of this asset has seen a significant decline among Americans. The proportion of respondents favoring property fell from 45% last year to a current figure of 35%.

Lydia Saad, the author of the Gallup Poll report, highlighted that this current rate is consistent with the typical sample rate observed between 2016 and 2020, “before housing prices skyrocketed during the pandemic.” Saad further explained that the housing market’s appeal has waned over the past year, as higher interest rates have dampened investor enthusiasm.

While sentiment on U.S. stock indexes has remained largely flat compared to the previous year, there has been a slight decline from 24% in 2022 to today’s 18%. On the other hand, the appeal of gold as a long-term investment has seen a remarkable increase since last year.

Gold has risen from 15% to 26%, outperforming stocks and claiming the position as the second most favored long-term investment, according to Gallup’s respondents. “Today’s preference for stocks is at the low end of the 17% to 27% range of Americans who have chosen it since 2011,” Saad detailed.

According to the author of the Gallup poll, 8% of the Americans polled favored crypto-assets as their preferred long-term investment. However, the appeal of choosing cryptocurrency for long-term investments has dropped to 4%. Saad attributed this decline to the FTX contagion and the price decline experienced by bitcoin (BTC) in 2022, which has dampened enthusiasm for cryptoassets.

The survey also highlighted an interesting trend: when cryptocurrencies were included as an option in the poll, participants were less likely to choose stocks, but their preference for stocks increased when cryptoassets were not among the choices. While cryptoassets outperformed bonds as a long-term investment option last year, bonds scored 7% in the latest poll.

What are your thoughts on the changing landscape of long-term investment choices revealed by the Gallup poll? Share your insights and let us know which investment options fascinate you the most in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.