Almost 60% of digital consumers in Vietnam use fintech solutions | Sci-Tech

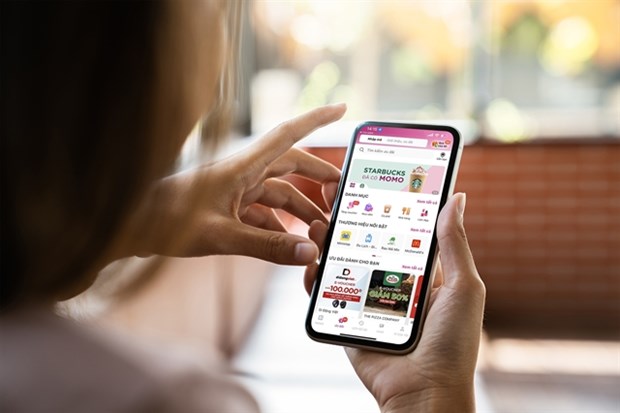

A customer uses their MoMo e-wallet to pay for a cup of Starbucks coffee. Vietnam is a top market for adopting new technology. (Image courtesy of MoMo)

A customer uses their MoMo e-wallet to pay for a cup of Starbucks coffee. Vietnam is a top market for adopting new technology. (Image courtesy of MoMo)Hanoi (VNS/VNA) – Vietnam is a top market when it comes to new technology adoption, where 58% of digital consumers have used online banking solutions, e-wallets, money transfer applications and digital banking.

According to “SYNC Southeast Asia” report on digital consumers in Southeast Asia in the new stage of development, Vietnam has almost 80% of the population represented as digital consumers. Moreover, the average contribution of e-commerce to total retail sales has continued to grow by 15% over the past year , higher than India’s 10% and China’s 4% growth, with an online-to-total retail share of 6%.

About three years into the pandemic, research shows that regional consumers are at a new stage of development, prioritizing an integrated shopping experience that effectively combines online and in-person services.

After the pandemic, 10% of Vietnamese respondents moved at least one of their shopping categories from online to direct channels because of the “interface” factor that direct sales channels bring. However, there are still certain shopping categories that consumers still prefer to opt for “closing” online, indicating that online shopping continues to serve as an important channel for digital shoppers in the country. In the “discovery” phase, 84% of Vietnamese customers see the web as their favorite channel to browse and find products.

According to the report, this is a period when Vietnamese digital consumers using more platforms than ever before, with the dominance of the e-commerce market accounting for 51% of online spending. At the same time, social networks account for almost half of online discoveries, including images at 16%, social media videos at 22% and related tools such as messaging at 9%.

Social media and related tools such as messaging were important channels for Vietnam’s digital customers during the review period, accounting for 44% of survey respondents.

“Consumers’ openness to interaction and experimentation has also driven behavioral change, with 64% of respondents saying they’ve interacted with a business conversation account in the past year. As customers seek more engagement, the content creation economy is also showing many positive signs.

“In Vietnam, the average sales volume related to entertainment, streaming and related products to content creators in the three months prior to our survey has increased 12 times,” said Le Khoi, country director of Vietnam Market of Meta, adding: “In the context of digital consumption , Vietnamese users are switching brands more often and increasing the number of platforms they use to find a better value, with 22% of online orders made on various e-commerce platforms.”

He added: “Value is one of the main factors driving this behavior when ‘better price’ is chosen as the main reason for switching platforms, followed by product quality and delivery times. As a result, the number of online platforms Vietnamese consumers use will increase from 8 in 2021 to 16 in 2022.

Last week, in the seminar “Promoting Digital Transformation for Organizations and Enterprises”, Nguyen Ba Diep, co-founder of MoMo Ewallet, said: “Digital transformation for retail is an inevitable trend.”

Diep added that with more than 31 million customers on MoMo, they have solutions to help businesses, especially SMEs, banks, credit institutions and investment funds, reach more customers quickly and efficiently.

He said MoMo would continue to coordinate with tens of thousands of other partners to expand this service ecosystem specifically for retail solutions.

He said that over the past four years, they developed the finance-insurance service on MoMo with more than 10 million users, including consumer credit, accumulated investment and insurance.

The report also shows that thanks to advanced thinking, Vietnam is among the best markets to adopt future technologies such as fintech and metaverse, along with Indonesia and the Philippines. Currently, 58% of digital consumers in Vietnam have used fintech solutions such as online banking, e-walletsmoney transfer applications and almighty digital banking.

It also said that the use of digital technology in Vietnam is mature and mainly driven by functionality and convenience, adding that 7 out of 10 digital consumers in the country used metaverse technology such as cryptocurrencies, augmented reality, virtual reality, virtual world and NFTs in 2022 Notably, Vietnam has the highest share of VR applications among Southeast Asian countries, with 29%/.