Algorand: the best crypto and NFT projects

The creation of crypto and NFT on Algorand is possible thanks to the ‘Algorand Standard Assets’ framework, which allows the network to compete with the many infrastructures on the market.

Let’s take a look at the best crypto projects on Algorand, with a special focus on the presence of non-fungible tokens.

What is Algorand Crypto and what are the main NFT marketplaces?

Algorand is one of the most interesting Layer 1 blockchains in the industry, with a clear focus on scalability and environmental sustainability.

Algorand is a decentralized open source blockchain, born in 2019 and founded by Italian Silvio Micali, a researcher and teacher at the prestigious Massachusetts Institute of Technology (MIT).

The main features of Algorand are the scalability of transactions, the energy carrying capacity of the blockchain and a special selective programming language.

Through a two-layer structureAlgorand is able to process many more transactions than Bitcoin and Ethereum, with a negligible commission cost of less than one cent.

«Pure proof of the effort” consensus algorithm provides an inclusive structure where any holder of at least 1 ALGO can validate a block and receive a prize proportional to their allocation.

In terms of sustainability, one of the main pillars of the project is “carbon neutrality” status that the blockchain enjoys.

At a time when the issue of CO2 emissions is a serious problem facing the world, Algorand makes environmental friendliness one of the main reasons for its marketing campaignswhich is much less polluting than bitcoin and its network of miners.

The BLUE GREEN programming language is very different from Solidity, Rust, Javascript and Cairdo, a lot more difficult to use and selective.

The complexity of programming smart contracts with TEAL is a limitation for the development of dapps in the ecosystem, but at the same time it provides greater safety on the wrong side, as it is. more difficult to find faults in the system.

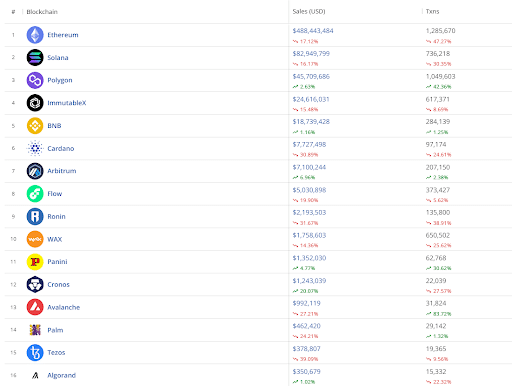

Regarding crypto and NFT on Algorand, the first thing to say is that compared to Ethereum, Solana, Polygon and ImmutableX, the numbers on Silvio Micali’s blockchain is significantly lowerbut potentially the technology has all the cards on the table to join the big boys in the sector.

Algorand’s main NFT market platforms include Rand Gallery, ALGOxNFT, Exa Market, Shufl, Dartroom, Algogems, Abris, Aorist, Creecon and Republic. Many of these projects present solutions that are green for the environment and strengthen the power of content creators in Web3 world.

Algorand crypto: some NFT data

Although Algorand is a very technical Layer 1 infrastructure specializing in transaction scalability, one of the most sought-after features of blockchain, it is not yet on par with other competitors when it comes to exchange volumes in the Non-Fungible Token market.

NFT cryptos on Algorand have not been appreciated by large investors and top performers, who prefer to mine their collections on Ethereum, the main place for creating decentralized applications and smart contracts.

Consider that in April, according to CryptoSlam data, the volume of NFT sales on Algorand was around $350,000 compared with Ethereum is $488,000,000or more than 1000 times less!

In total, since its inception, Algorand has seen volumes of around $38 million, while Ethereum has seen over $43 billion.

These numbers clearly show that this type of activity on the decentralized network is still not appreciated by the masseswho prefer the traditional infrastructure for trading NFTs.

Recently, many users have even discovered that they can create non-fungible tokens on the bitcoin blockchain through digital objects derived from the inscription of individual satoshi, making them distinct from each other.

This has done nothing but shift the spotlight away from Algorand’s potential, at least in the NFT niche.

The best projects in the ecosystem

Beyond non-fungible tokens, the Algorand ecosystem has many different types of applications used every day by users in the Web3 world.

These include DEX, lending protocols, self-custodian solutions, oracles and bridges, gaming applications and much more.

The expansion of the number of protocols on the chain is much more positive than the number of NFT cryptos sold on Algorand’s marketplaces.

Actually when analyze TVLi.e. the total value locked in Algorand’s protocols, we can see that the project is among the top 20 with a figure on around 130 million dollars.

Very interestingly, while the rest of the DeFi world lost value during 2022, Algorand stopped the trend and grew strongly in this respect, only with a sharp fall in TVL at the end of 2022, but partially recovered in Q1 2023.

Most of the liquidity is placed on Algofi, a DeFi hub where classic decentralized financial transactions such as swaps, earning interest on stakes, lending assets, etc. can be performed.

Just after Algofi, which accounts for almost 68% of TVL, we find protocols such as Folks Finance, Lofty and Pact.

Lofty in particular seems very interesting, as it is one of the first prototypes of dapps that fractionalize property on the blockchain, through the process of tokenization of real assets.

Other notable projects built on Algorand include LimeWire, a decentralized social media platform, PeraWallet, a crypto asset storage solution, and Dequency, a platform dedicated to developers. On the gaming front, the most popular applications with the largest following on Algorand are The Drone Racing League, Zone and Algoseas.