Alex Mashinsky took control of Celsius’ trading strategy months before bankruptcy

In January, Celsius Network CEO Alex Mashinsky gathered his investment team to tell them he would take control of the crypto lender’s trading strategy ahead of an upcoming US Federal Reserve meeting.

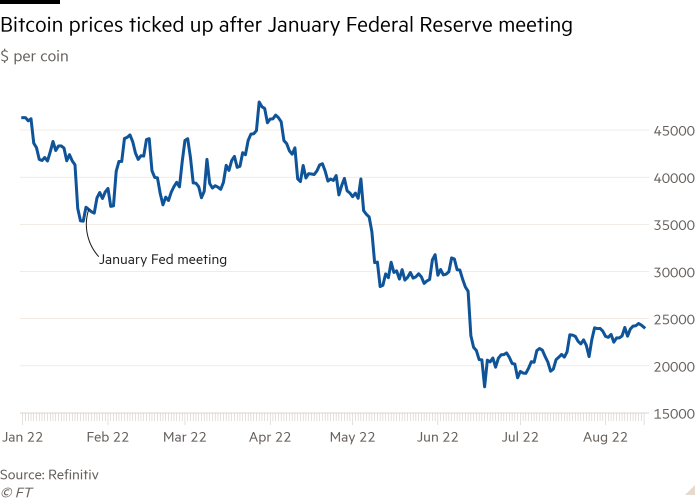

The prices of popular cryptocurrencies such as bitcoin and ether had fallen from their all-time highs and the former telecoms founder said Celsius had to guard against further declines. A hawkish outcome, he was convinced, could crash crypto prices.

In the days before the Fed met, Mashinsky personally directed individual trades and overruled managers with decades of financial experience, according to several people familiar with the matter.

In one instance, Mashinsky ordered the sale of hundreds of millions of dollars in bitcoin, refusing to wait to double-check Celsius’ often unreliable information about his own holdings. Celsius — which at the time had $22 billion in customer crypto assets — bought back the bitcoin a day later at a loss.

“He ordered the traders to massively switch the book from bad information,” one of the people said. “He was throwing around huge chunks of bitcoin.”

Another person familiar with the events said that while Mashinsky may have made his views known based on his knowledge of crypto markets, they insisted that “he was not running the trading desk”.

Mashinsky’s fears were not confirmed in the short term. The Fed confirmed plans to raise interest rates and crypto markets shrugged. Celsius made $50 million in trading losses in January, some of the people said, although it is not clear how much is attributable to Mashinsky.

The previously unreported events highlight the troubled internal dynamics at Celsius in the months leading up to its July bankruptcy filing, including its weak asset-tracking systems, Mashinsky’s fear of a downturn and his willingness to involve himself directly in trading decisions, unlike typical chief executives in large financial institutions.

Celsius built itself by accepting crypto from its customers and promising them eye-popping returns it generated by distributing tokens in digital asset markets. Its hundreds of thousands of customers are now facing significant losses on the crypto they have entrusted to the company, which has a $1.2 billion hole in its balance sheet.

Mashinsky and Celsius’ lawyers Kirkland & Ellis have told the New York court that the company was pushed into bankruptcy not by mismanagement, but by the broader collapse this year in crypto asset prices. Lawyers representing Celsius’ unsecured creditors, overwhelming the customers, have vowed to investigate Mashinsky’s conduct.

A lawyer for Mashinsky declined to comment. Celsius and its lawyers in Kirkland did not respond to a request for comment. In a bankruptcy court filing last month, Mashinsky said Celsius’ assets had grown faster than its ability to invest them and acknowledged that it “made what in retrospect turned out to be certain poor asset allocation decisions.”

Trade with “high conviction”.

At the start of the year, Celsius had confidence in a business that had just completed a $600 million fundraising round led by two major investors, Canada’s second-largest pension fund Caisse de dépôt et placement du Québec and U.S. investment group WestCap.

The December 2021 funding round had valued Celsius at $3 billion. The fast-growing lender, founded in 2017, boasted that it was hiring “traditional financial leaders”. But problems bubbled beneath the surface.

Although Mashinsky claimed that Celsius’ business of taking crypto deposits and lending them was safe – he publicly insisted that it did not trade customer funds – the company had suffered huge losses from crypto tokens it had not disclosed to customers.

One incident involved a US-based lender called EquitiesFirst, which in July 2021 had been unable to immediately return $500 million in bitcoin Celsius had promised to secure a loan, Mashinsky told the bankruptcy court last month.

Another, not previously reported, involved a significant investment in Grayscale Bitcoin Trust, the world’s largest bitcoin fund whose GBTC units offered investors a tradable product that tracked the digital token.

Celsius had bought into GBTC when it was trading at a premium to the underlying bitcoin in the fund. In September 2021, Celsius held 11 million GBTC, then worth around $400 million, but traded at a 15 percent discount to the trust’s net asset value.

Celsius was offered a deal to exit the position that month that would have cut the company’s losses, but Mashinsky blocked the sale, arguing the discount could be limited, according to two people familiar with the matter. Instead, it got worse. Celsius would not fully budge its position until six months later in April, when the discount was 25 percent.

The company’s total loss on the GBTC trade was around $100m to $125mn, according to one of the people familiar with the matter.

Celsius had partially covered the losses by borrowing from other crypto ventures. It pledged crypto tokens it held as collateral for loans of stablecoins — the dollar equivalent of crypto — that it would use to buy crypto assets to replace those it had lost, several people familiar with the matter said.

These arrangements made Celsius vulnerable if crypto prices fell sharply. Customers can claim the crypto back at the same time that Celsius had to send more to its lenders as additional collateral for its stablecoin loans.

The company would have little of its own money to fall back on in such a situation. Celsius had paid out more in interest to customers on tokens such as bitcoin and ether than it generated through its investments, according to people familiar with the matter. And it invested much of the $600 million it raised from investors led by CDPQ and WestCap into its capital-intensive crypto-mining business and the acquisition of an Israeli startup, Kirkland told the bankruptcy court last month.

On Sunday, Celsius revealed that its current monthly net cash flow was significantly negative. Between August and October, the company estimated it would lose $137 million, mostly due to its mining operations. The figures included $33 million in restructuring costs.

Balance sheet figures previously disclosed in the bankruptcy proceedings showed that Celsius’ liabilities were already greater than its assets in March this year, except for the holdings of its own digital token CEL. Two people familiar with the matter said the situation has existed since 2021.

In January 2022, it seemed that a moment of crisis had arrived. The company had lost much of the month with the decline in crypto prices. On a call on Jan. 21, the Friday before the Fed meeting, Mashinsky told his investment team that the coming week would be the most defining of their careers.

“He had a high belief about how badly the market could go south. He wanted us to start cutting risk like Celsius could,” said one of the people familiar with the events. Not everyone agreed.

Over the coming days, Mashinsky repeatedly clashed with his then-chief investment officer Frank van Etten, a former Nuveen and UBS executive, over which trades Celsius should make, but also over Mashinsky’s involvement in such decisions.

Van Etten, who joined in September 2021, left in February of this year, according to his LinkedIn listing. In a January 14 press release, Mashinsky cited his arrival at Celsius as an example of “top-level talent” joining the company. Van Etten said he was not in a position to comment at this time.

Crypto finance

Critical intelligence on the digital asset industry. Explore the FT’s coverage here.

The sale and then buyback of bitcoin Mashinsky ordered came just a day or two before the Fed meeting. One reason he had pushed for Celsius to sell was linked to the issue with EquitiesFirst in 2021.

EquitiesFirst owed Celsius bitcoin and Celsius had hedged this exposure by buying bitcoin before repayment. Mashinsky argued that EquitiesFirst can pay back its bitcoin debt faster as prices fell.

If that happened, Celsius would have more bitcoin than is currently predicted. It usually tried to maintain a neutral position on its crypto holdings to balance assets and liabilities. By selling bitcoin now before prices fell, Celsius could make money, Mashinsky reasoned.

“It wasn’t an irrational thought,” said another of the people familiar with the events, but there was simply no evidence that EquitiesFirst would pay back any faster. “There was a lot of speculation,” they added.

EquitiesFirst said: “We entered into an agreement well in advance of the aforementioned January date. Any change to that agreement would have required the consensus of all parties.” The company added that it would satisfy all of its obligations to Celsius.

Mashinsky’s fear of the market turned out to be ill-timed, to say the least. While the Fed confirmed plans to raise interest rates in March, there was no collapse in crypto prices until May. In fact, the bitcoin price surged in the weeks following the January Fed meeting.

An internal audit report was then presented to the board and Celsius investors WestCap and CDPQ in February that recommended accelerating investment in the company’s technology. WestCap and CDPQ declined to comment.

The report noted that the audit was requested by Mashinsky. It covered the period from January 1 to January 21, according to two people familiar with the matter. It is unclear why the audit did not include the trade just before the Fed meeting.

The Celsius employee leading the internal audit, a former banker with nearly two decades of internal audit and controller experience, was moved shortly thereafter to work on new commercial product and partnership ideas.

Click here to go to the Digital Assets dashboard