I’ve been spending a lot of time lately reading about artificial intelligence, mostly in machine learning and natural language processing.

I recently came across a couple of stories written by a colleague from my days at PC MagazineCade Metz, who now writes for New York Times.

The first story filled me with awe at not only the promise of AI, but what has already been achieved with it. Cade reported that DeepMind Technologies, which is based in London and owned by Alphabet, Inc. (the parent company of Google), recently released predictions for the shape of nearly every protein known to science.

According to history, it represents more than 200 million predictions, all added to an online database freely accessible to researchers worldwide. In a nutshell, this means that researchers have gained a leg up on understanding the shape of such proteins, and can in turn contribute to “accelerating the ability to understand diseases, [and] create new medicines…”

The second, longer piece discussed the widespread and mistaken belief among many that AI has already become sentient. Of most concern is that some with this belief are researchers and developers in the field.

I bring all of this up to help me better illustrate where we are, relatively speaking, with artificial intelligence in financial services.

In our small niche, we find ourselves somewhere in the middle of the pack, nothing that can be mistaken for near-sensing or that will lead to medical breakthroughs, but nevertheless represents significant steps forward in improving daily efficiency.

A recent demonstration and meeting I had with Toggle AI is a good example of where things stand.

With offices in New York, London and Tokyo and a team of 33, including 21 engineers and developers, Toggle already has a global footprint many other startups would envy.

“We started this, in part, to offer investors and professionals a better piece of technology to track, I mean, on average you see 17 news headlines a second coming into the typical Bloomberg terminal on any given weekday,” said Jan Szilagyi, CEO and co-founder of Toggle AI.

Toggle AI CEO and co-founder Jan Szilagyi

Szilagyi worked for Stanley Druckenmiller (who was also Toggle’s first investor) and received his Ph.D. in quantitative finance from Harvard University.

“We’ve built a machine that goes through all that data and taps us on the shoulder and says ‘here’s some stuff that’s probably going to interest you,'” he said, referring to the cloud-based subscription application.

“We in no way try to drive your decision-making, our engine helps you analyze information and it distills it down to a handful of what we believe are timely and actionable investment insights, every day,” said Chief Product Officer RJ Assaly , who previously managed money at AllianceBernstein and has worked in machine learning technology at Kensho Technologies and S&P Global.

Global financial market data provider Refinitiv supplies Toggle with its data and analyst feeds covering more than 40,000 assets, while the St. Louis Federal Reserve Bank’s FRED database powers its platform with US macro and regional economic information.

However, the Toggle team builds its own machine learning and natural language processing algorithms in-house using a combination of Python and Go on the back end. Meanwhile, the front-end user interface, which has an efficient layout and modern look, is built with JavaScript using React.

During the demo I received, which was a real-time view from the platform, the Toggle dashboard noted, “So far today, Toggle has looked at 4.2 million pieces of data, 2.6 million interesting milestones, and 4,171 new Toggle Insights.”

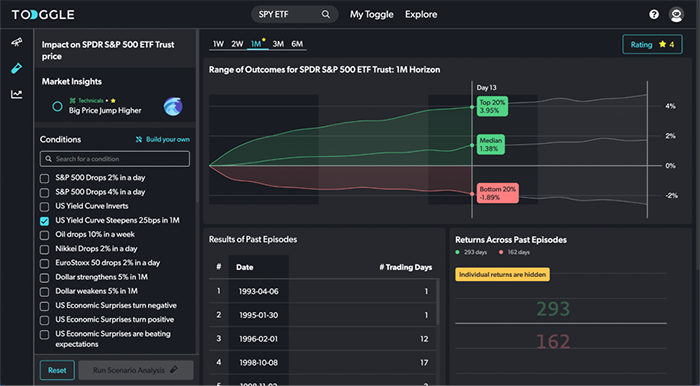

In this case of the Toggle platform, the financial media starts talking about the steepening of the yield curve, and a client calls their advisor to ask what that will mean for the market and their portfolio. A quick click through Toggle and the advisor can share how many times this event has been seen in the past (455 times!) and what it typically means in the short, medium and long term for the S&P 500.

“Think about them [the insights] like ‘smart alerts,’ where we try to find a balance, and present you with the four or five things you need to be aware of,” Szilagyi said, adding that a number of top hedge funds currently use Toggle.

Advisors who have outsourced all of their investing and asset management probably won’t need what Toggle has to offer, unless they use it to stay on top of and analyze the latest trends and do scenario testing.

For those who have a need, the application comes in three different offers. The first is a basic, free plan that provides market data only on US stocks and 400 cryptocurrencies, provides 10 insights per month, has a watchlist limit of 10, delayed market alerts and end-of-day US stock prices. At $99.99 a year, Toggle’s Co-Pilot offering provides coverage of global stocks, crypto, an unlimited number of insight articles, AI news analysis, an unlimited watchlist, saved filters, real-time alerts and stock quotes, and dedicated customer support. A $1,200 per year pro version comes with everything available in Co-Pilot, as well as a scenario testing tool and access to Toggle’s APIs (for developing custom applications for your own company).