AI and ML Fintech Plateau in Southeast Asia ‘Can’t Last Long’

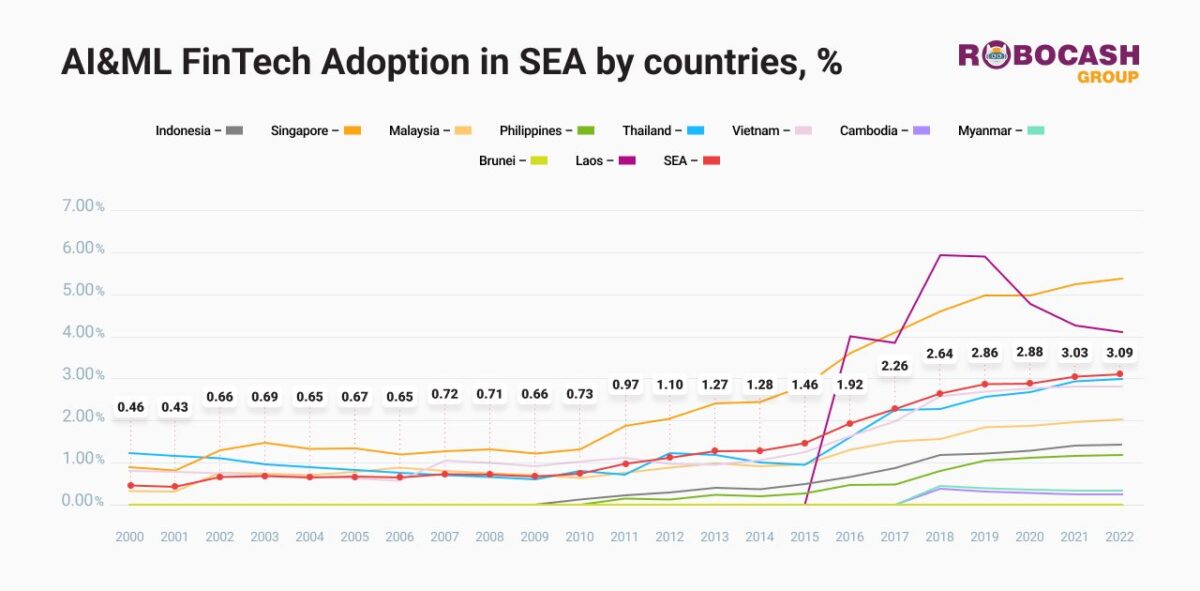

Artificial Intelligence (AI) and Machine Learning (ML) make up just 3.1 percent of Fintech operations in Southeast Asia, indicating an abundance of potential for the technology.

Fintech in Southeast Asia is beginning to tap into the potential of AI and ML despite an observed plateau, and its use must be operational and target specific to maximize benefits.

This statement is thoroughly underlined through the findings of Robocash Groupits latest survey of the current use of these technologies in the region, including who and where it is being used best. The assessment was based on the proportion of 26,105 regional fintechs that have AI and ML tools in their technology stack.

Top players

Of the countries surveyed, which include Singapore, Thailand, Malaysia, Bangladesh, Indonesia, Cambodia, the Philippines, Vietnam, Laos, Myanmar and Brunei, the highest rate of AI and ML penetration in fintech was seen in Singapore.

Exactly 5.36 percent of fintechs from the city-state had the tools in their stack in 2022, which the findings attribute to their particularly high level of digitization and private fintech investment in AI.

In addition, the country has seen a high overall economic development, which is around 0.5 per cent of global GDP.

As a result, the research measures penetration in Singapore as 2.27 percent above the SEA average of 3.09 percent, or 807 companies. In total, in 2022, 97 percent of citizens had access to the internet, 94.4 percent had smartphones and 97 percent had a financial account.

Thus, Singapore can boast of an environment that cultivates the use of the most innovative technology.

Twelve hundred miles away, the research also identifies Laos for its equally promising AI and ML fintech penetration rate of 4.08 percent.

Fintech development is still in its infancy in Laos, with only 49 companies out of 26,105 in the region, meaning even a small penetration of the sector is significant.

Sector analysis

The digital insurance sector has the highest penetration rate of AI and ML technologies, and the number of companies using the technology is growing at an average of 35.6 percent per year. An example of this includes general insurer MSIG Singapore comes along with Fermion Merrimen in February this year to fight auto insurance fraud with the power of AI.

Just below this is the digital accounting sector at 33.5 per cent and the digital banking sector at 31.5 per cent.

Acknowledging the wider scale of adoption taking place across SEA’s fintech landscape, the research shows average increases across cryptocurrency and blockchain at 28.7 per cent, digital investment at 21.4 per cent and e-commerce at 19.4 per cent .

The sectors with the lowest results include e-wallet, payments and transfers and financial advice with 17, 15.4 and 14 percent respectively.

Steady growth

While the numbers cited in the study are small, with the aforementioned 2022 SEA average for AI and ML penetration at 3.09 percent, it is part of a consistent increase in the technologies’ adoption across the region.

Before the latest findings, Robocash Group measured average penetration at 3.03 percent in 2021 and 2.88 percent the year before.

Still, according to Robocash Group analysts, “AI and ML integration in the SEA fintech domain went through its peak period between 2016 and 2019.”

“The fintech world has reached a ‘plateau’, although it may not last long,” analysts advise.

Fintechs in SEA are certainly starting to actively exploit the technologies’ potential, which Robocash Group says “can result in improved production.”

However, it also reinforces that “AI and ML-based technology is not a one-size-fits-all solution that can guarantee success by itself,” adding that “businesses must tailor them to their own operations and goals to achieve the greatest possible benefits .”