African Fintech Sector Had One of the Highest Year-on-Year Growth Rates in Funding in 2021 – Fintech Bitcoin News

By 2021, African fintech startups accounted for 61% of the $2.7 billion in venture capital funding distributed on the continent, a new study has found. While the share of global fintech funding is just over one percent, the continent’s fintech sector still recorded one of the highest year-on-year growth rates globally.

“Record high number of closed deals”

According to the findings of a new Mastercard study, African fintech startups – whose numbers grew from 311 in 2019 to 564 in 2021 – accounted for “61% of the USD 2.7 billion distributed across Africa in 2021”. The findings also show that fintech’s share “of the record number of closed deals” that year was 27%.

Compared to the $131.5 billion raised globally, African fintech’s share of the total remains very low – just over 1% of the total in 2021. However, in terms of the funding growth rate, the study noted that the continent – particularly sub-Saharan Africa – had a of the highest year-on-year growth rates globally. The study report explained:

In the sub-Saharan Africa (SSA) region, fintech startups recorded 894% year-on-year growth in funding in 2021 – the second highest in the Middle East, Africa and Pakistan region during the period, and the highest annual growth rate in recent the five years. SSA received US$1.56 billion in funding, the highest in the region by a wide margin.

In terms of the funds raised by fintech startups per country, the study findings show that Nigeria, home to some of the continent’s fintech unicorns, had indeed emerged as a leading fintech hub not only in Africa but across the Middle East and Pakistan . According to the study’s findings, the West African nation’s fintech alone accounted for “a third of all funding distributed to fintech in 2021.” Within the country, fintech’s share of all venture capital collected in the same period topped 71%.

Fintechs and the Financial Exclusion Gap

As for why the fintech sector continues to receive a disproportionate share of funding, the study, titled “Future of Fintech in Africa,” points to the continent’s long-standing financial exclusion gap and how fintechs are “building inclusion from the ground up.”

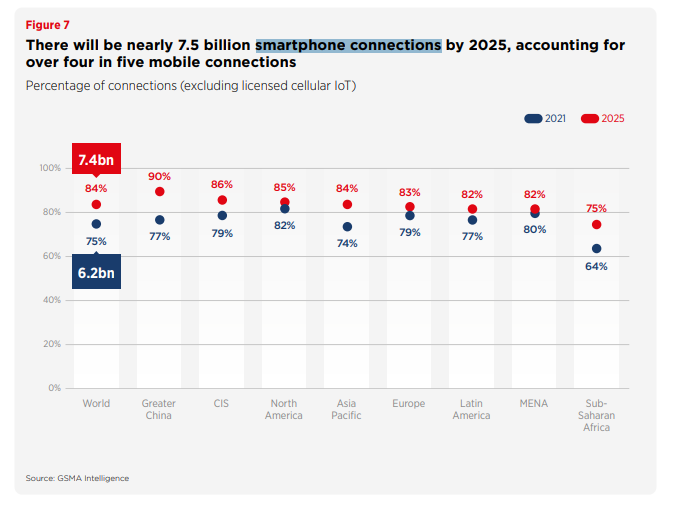

Much of the sector’s past and expected future success is also linked to improved smartphone penetration. As shown in the 2022 GSMA report, there is an expectation that the number of smartphone connections will grow from 6.2 billion sets in 2021 to 7.5 billion by 2025.

Meanwhile, the report suggested that Nigeria, along with South Africa and Kenya, will continue to drive sector growth. However, the study suggested that the growth rate of the fintech sector will depend on regulators’ and policymakers’ continued prioritization of “reasonable internet and mobile penetration.”

Register your email here to get a weekly update on African news delivered to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.