Adyen: An Emerging Fintech Giant (OTCMKTS:ADYEY)

AsiaVision

Investment thesis

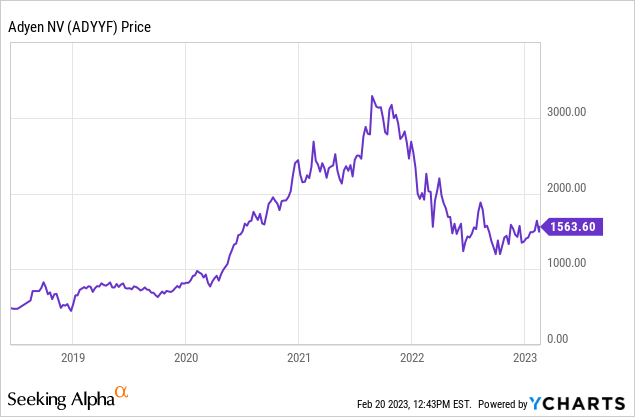

Adyen (OTCPK:ADYEY) is a fintech company that not many people know about. However, it has grown rapidly and has the potential to become an important player in the industry. The company benefits from the massive fintech market which continues to expand rapidly thanks to digital transformation. Despite a challenging macro backdrop, the latest earnings results continue to show strong growth with superb margins, although the bottom line stalled due to higher expenses. The share price has pulled back significantly due to rising rates and other macro issues, but the current valuation is priced to perfection. I like the company, but I think the upside is limited at current levels, so I rate it a hold.

Why Adyen?

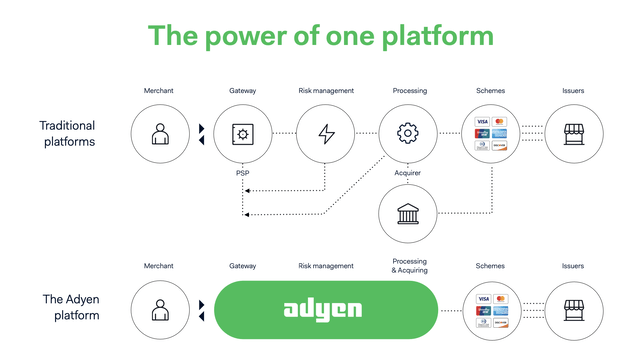

Adyen is a Netherlands-based financial technology company founded back in 2006. The company helps customers process payments through various channels and methods such as mobile, POS (point of sale), credit card, bank transfer and others. The integrated platform also offers other services such as card issuing, risk management, reporting and fraud protection, allowing customers to do everything in one place. Unlike other high-profile fintech companies such as Mastercard (MA) and PayPal (PYPL), it mostly operates behind the scenes. A majority of your transactions are probably being processed by the company without your knowledge. For example, all payments on Spotify (SPOT) or McDonald’s (MCD) is actually done through Adyen. The client list also includes other blue-chip companies such as Microsoft (MSFT), Booking inventory (BKNG), and Uber (UBER).

Adyen

Fintech is one of the most important segments within digital transformation with enormous growth opportunities. Emerging industries like e-commerce, travel couriers, food delivery, etc. are only made possible because of digital payments. These industries continue to expand rapidly, providing strong tailwinds for the fintech market. According to Allied Market Research, the TAM (total addressable market) of fintech is projected to grow from $110.57 billion in 2020 to $698.48 billion in 2030, representing a whopping CAGR (compound annual growth rate) of 20.3%.

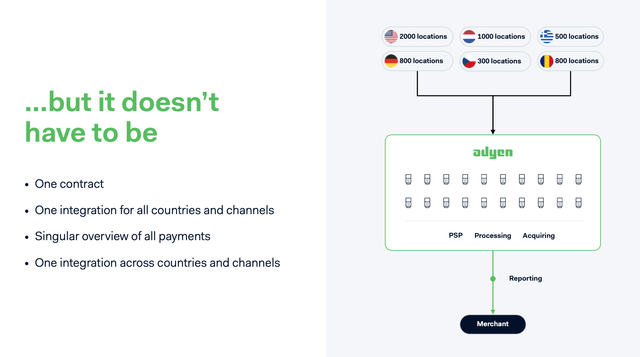

The fintech market is quite crowded, but company growth continues to outpace its peers. A major advantage of Adyen is its simplicity and scalability. The company’s single platform approach allows customers to simplify payment processing steps and improve efficiency. It also provides an extremely convenient integration process through drop-in or API, which reduces the friction of onboarding new customers and allows the company to easily expand its global presence without having to significantly increase its CAPEX costs. This together with the large and expanding TAM should continue to drive growth going forward.

Adyen

Economy

Adyen reported its H2 2022 financial earnings in early February and top line growth continues to be very strong while the bottom line was quite underwhelming due to higher expenses. The company reported revenue of €721.7 million, up 30% year-on-year, compared to €556.5 million. Growth is driven by strong processing volume, which grew by 49% year-on-year from €300 billion to €421.7 billion. This was led by POS volume which increased by 62% on the year from €41.8 billion to €67.6 billion, as more customers adopt the newly released POS terminals for unified commerce.

Ingo Uytdehaage, CFO, on POS growth:

Our points of sale were €67.6 billion, up 62% year-on-year and representing 16% of total volume processed. This number underscores the continued appetite for advanced multi-channel experiences and the unique ability of our single platform to meet this need. To stay at the forefront of consumer journeys, in H2, we relentlessly sought new avenues of innovation. This resulted in the launch of several product iterations, with an online check-out, rolling out our new terminals and piloting our embedded financial services suite.

The bottom line was slightly soft due to increased expenditure on expansion. Total expenses grew by 77.9% year-on-year from €218 million to €387.8 million. Due to the increase in hiring, wage and salary expenses increased by 91.7% year-on-year from €100.9 million to €193.4 million. Hiring is likely to be brought forward as management indicates a decline in hiring going forward. This resulted in operating income being flat year-on-year at €333.8 million compared to €333.7 million. The operating margin fell from 60% to 46.7%. Net income was €26.5 million compared to a net loss of €(13.8) million the previous year.

Investor Takeaway

Despite the fall in the share price, Adyen’s valuation is still very stretched. The company currently trades at a fwd PE ratio of 65x and a fwd EV/EBITDA ratio of 42.9x, meaningfully above other payment processing partners such as Mastercard, Visa and Shit4 Payments (FOUR). The three companies have an average fwd PE ratio of 35.9 which represents a significant discount of 44.8%. The company’s fundamentals are strong and the expanding market should continue to provide solid tailwinds. It generates best-in-class growth and margins despite a weakened economy. However, its current valuation looks like it’s priced to perfection, limiting its potential upside. Therefore, I consider the company a hold and will wait for a better price point.

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Be aware of the risks associated with these stocks.