About 70% of crypto millionaires used these 5 tools to maximize profits

While most crypto investors have been tightening their belts in the current bear market, crypto millionaires have profited from innovative decentralized finance (DeFi) products, including Uniswap, Aave, PancakeSwap, DAO Maker and self-custodial wallets like MetaMask.

The bear market is taking its toll on the average crypto investor. But why not learn how DeFi pros are making millions using tools you may never have heard of.

Crypto Millionaire Tip #1: Uniswap Gems

Uniswap is a decentralized exchange (DEX) on the Ethereum blockchain that offers DeFi users the opportunity to earn transaction fees by contributing liquidity. Anyone can make markets by putting both assets of a trading pair into a smart contract, removing the gatekeeper in liquidity creation.

DEX charges a fee of 0.3% on all trades. Liquidity providers earn passive income from these fees, proportional to the amount of liquidity they contribute minus permanent losses.

Say you deposit 4 DAI and 4 USDC. The ratio between them is 1:1. Any change in the price relationship between the two results in a permanent loss. Liquidity providers prefer high trading volumes and low lasting losses.

Sometimes traders create markets with lesser-known altcoins called “gems”. These are cryptoassets with market capitalizations below $20 million that have solid fundamentals and the potential for a 100x price increase. Traders can use Uniswap to make a trade early before these coins are listed on exchanges and increase in price.

A crypto trader turned $800 into $1,000,000 by trading assets less than a day old and making money in less than 3 hours. They learned about these assets through Uniswap listing bots and Telegram’s pre-sale marketing.

Crypto millionaire tip #2: Aave

Crypto millionaires also use Aave to earn passive income. Aave is a borrowing and lending protocol that allows DeFi power users to earn passive income.

Lenders who deposit funds into a smart lending contract set interest rates using an algorithm. Borrowers pledge collateral for a crypto-asset in a smart loan contract to earn returns or lend other cryptos. They can usually only lend assets worth up to 75% of the collateral.

One of the ways they use this to their advantage is by depositing an asset like Bitcoin, which yields low returns in DeFi due to its huge ownership, to borrow a stablecoin. They can then make a higher return on stablecoins by putting them into a DEX liquidity pool. Aave also offers an annual percentage rate of 8% to borrow stablecoin USDT.

Aave will liquidate your position and take your collateral if the collateral falls below a certain threshold. This liquidation risk prevents many from participating.

Crypto Millionaire Tip #3: Yield farming

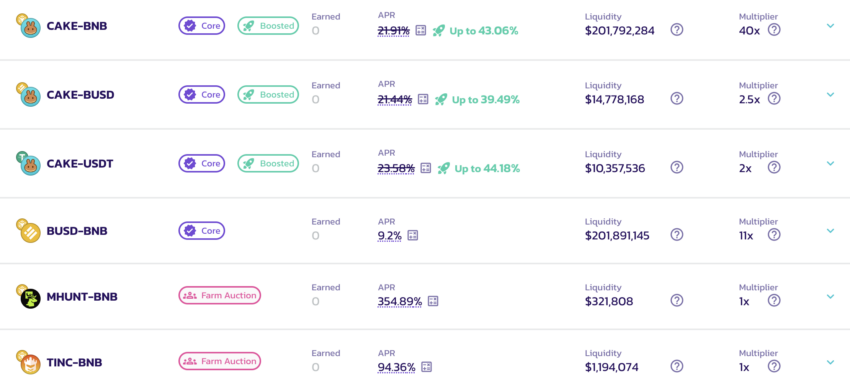

Another more complex strategy that crypto millionaires use is yield farming, which can occur on a decentralized exchange like PancakeSwap.

On PancakeSwap, traders earn Liquidity Provider tokens by contributing a cryptocurrency trading pair to a liquidity pool. The LP token allows them to enter a FARM on the DEX, where they can stake their LP tokens with other traders to earn annual percentage rates between 2% and 200%. They are paid out in CAKE through a harvesting process.

To maximize profits, CAKE can be automatically or manually harvested and re-invested in the same pools using syrup pools.

Crypto Millionaire Tip #4: IDOs

An initial DEX offering (IDO) is a new way that crypto millionaires have discovered. A decentralized protocol collects funds from investors by issuing a token that can represent a newly listed asset on their platform.

DAO Maker is an incubation and fundraising platform for new decentralized autonomous organizations that provide DAO tokens to investors in projects. DAO token holders, who are proven investors, can participate in an IDO’s Strong Hold Offer (SHO) token sale.

Since its launch in 2021, the DAO token has generated returns as high as 41x for early bird adopters.

Crypto Millionaire Tip #5: Self-Custodial Wallet

A common requirement for using DeFi products is a self-custodial crypto wallet.

A crypto wallet is software or hardware that essentially stores unique strings of numbers and letters called keys that give you access to use crypto. Each wallet contains both a public key and a private key. The public key is used when you send crypto to someone, while a recipient can use a private key to spend crypto in their wallet.

When someone wants to use crypto in their wallet, they present a public key and a signature created from the private key. These two pieces of information tell the blockchain network that the user owns the funds they use.

While some crypto users give up control of their keys to companies like Coinbase, Binance or Kraken, users who are heavily engaged in DeFi generally retain control of their keys. They store them in a self-custodial wallet instead of a custodial wallet managed by a company.

The responsibility for controlling and managing these keys then becomes your sole responsibility. If they lose their private key, they lose access to their crypto because they cannot create a public signature to use the crypto they receive. Hence the mantra, “Not your keys, not your crypto.”

Popular DIY Wallets

Popular self-service wallets include MetaMask and LedgerNano. MetaMask is a software wallet that you can download as an extension for the Google Chrome browser.

Once installed, the MetaMask software will ask you to enter a password. The software will create a wallet for you. It will then display a 12-word mnemonic phrase that you can use to recover your money if something happens to your computer. It is important to store this phrase securely as anyone who finds it will have access to your wallet.

Ledger Nano is a USB-based hardware wallet that works through a companion app. You can buy the wallet on Amazon or directly from Ledger, although the latter is safer.

After you install the app, it will ask you to answer some questions to ensure that your device still has the same security programmed at the Ledger factory. Then the device will give you a mnemonic that you must save safely.

Like MetaMask, the mnemonic is the only way to access your money. After saving the mnemonic, you can move your cryptocurrency from exchanges by setting up an account on the companion app for each of the cryptocurrencies you want to move.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.