On Sunday, the non-custodial market protocol Aave announced that the Aave DAO has approved a new stablecoin for the ecosystem called “GHO.” Aave Companies proposed the stablecoin during the first week of July, and the security-backed stablecoin will be pegged to the value of the US dollar.

A New Security-Backed Stablecoin Created by Aave Companies to Launch After Aave DAO Votes on Genesis Parameters

Aave explained on Sunday that the Aave Decentralized Autonomous Organization (DAO) approved a proposal to create a stablecoin token called “GHO.” “The community has given the green light for GHO,” the official Aave Twitter account detailed. “The next step is to vote on the genesis parameters of the GHO, look out for a proposal next week at the governance forum.”

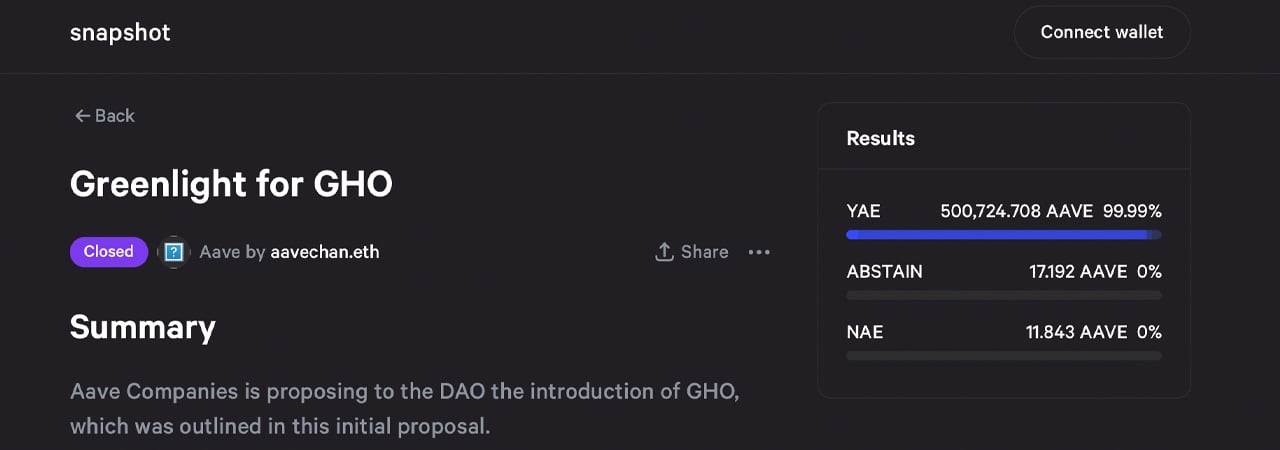

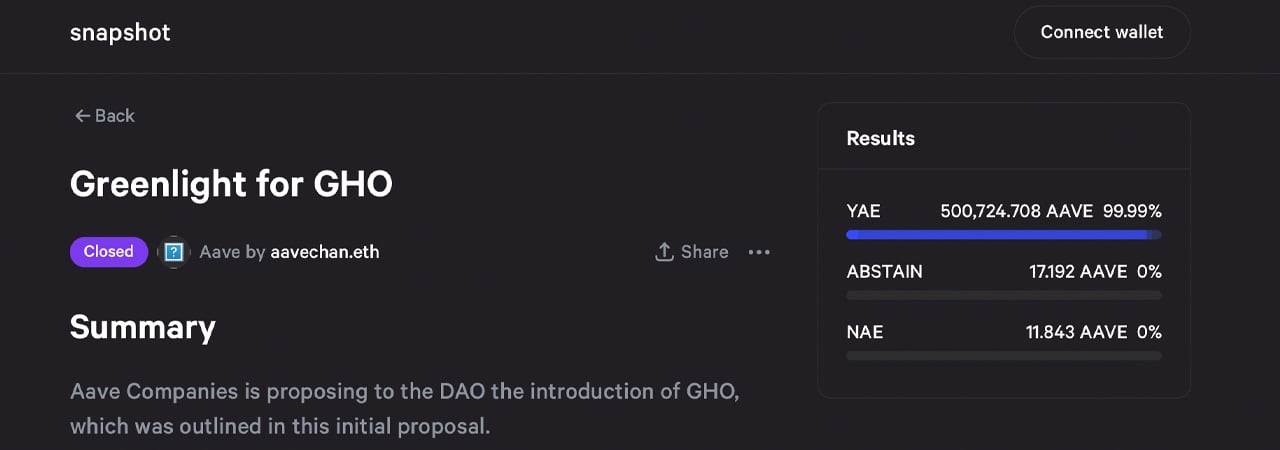

GHO’s introductory blog post, published on July 7, 2022, states that the stablecoin will be “backed by a diversified set of cryptoassets chosen at the discretion of users, while borrowers continue to earn interest on their underlying security.” The governance proposal was approved by a large majority of Aave DAO voters, as more than 99% of eligible participants voted to launch GHO.

The governance proposal approval moment states that GHO will “provide benefits to society via Aave DAO by sending 100% of interest payments on GHO loans to DAO” and GHO will be “administered by Aave governance.” Aaves stablecoin will join the stablecoin economy, which is currently valued at $153 billion. Tether (USDT) leads the stablecoin pack and usd coin (USDC) follows USDT, in terms of total market cap.

GHO will also join stablecoin crypto-assets that leverage civil assets and some that leverage the method of over-security. Makerdao’s DAI stablecoin is over-collateralized and Tron’s USDD is also over-collateralized, meaning that there is more collateral than necessary to cover the stablecoin’s support during times of extreme market volatility.

“As a decentralized stablecoin on the Ethereum network, GHO will be created by users (or borrowers),” explains Aave Companies’ blog post on the subject. The blog post further adds:

Similarly, when a user repays a loan position (or is liquidated), the GHO protocol burns that user’s GHO. All interest payments accrued by coiners of GHO will be directly transferred to the Aave DAO fund; instead of the standard reserve factor collected when users borrow other assets.

Aave Companies says the community was very engaged in the GHO governance proposal

Aave also has a native token that is ranked 45 out of more than 13,000 cryptoassets today. The digital asset has a market cap of around $1.46 billion and aave (AAVE) has surged 84.7% in the past month. The open source decentralized lending protocol is the third largest decentralized finance protocol (defi) in terms of total value locked. Data from defillama.com indicates that Aave has $6.59 billion locked up as of July 31. In mid-May, Aave launched a Web3, smart contract-based social media platform called the Lens Protocol. The Lens platform has more than 50 applications built on top of the Polygon network (MATIC).

Regarding the GHO stablecoin, Aave Companies said the community was “very engaged with the GHO proposal, providing incredibly useful and informative feedback.” Aave described some of the things mentioned by the community that the team will focus on, which include DAO-listed interest vulnerabilities, supply caps, a pin stability module, and “the need to properly evaluate potential facilitators.” Currently, the community must participate in the vote on the stablecoin’s genesis parameters before the crypto token is issued.

Tags in this story

Aave, Aave DAO, collateral-backed, collateral-backed stablecoin, community vote, cryptotoken, decentralized autonomous organization, decentralized finance, DeFi, Defi protocol, GHO, GHO protocol, GHO Stablecoin, Governance proposal, Lens Protocol, new stablecoin , Stablecoin , stablecoin issuance, token, USD backed token, voting

What do you think about the upcoming Aave stablecoin project called GHO? Let us know what you think about this topic in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 5,700 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.