A relief rally for BTC/USD and ETH/USD?

Bitcoin, BTC/USD, Ethereum, ETH/USD – Technical Outlook:

- Bitcoin remains confined within a narrow range.

- Ethereum may stage a minor rally.

- What is the outlook and what are the key levels to watch?

Recommended by Manish Jaradi

Get your free Bitcoin forecast

BITCOIN SHORT TERM TECHNICAL OUTLOOK – NEUTRAL

Bitcoin seems to be setting a tentative base for now and could be preparing for a minor rally in the near term. However, there is plenty of resistance ahead that could cap any pullback.

Over the past few months, BTC/USD has been holding around fairly strong support at the June low of 17590. Despite holding above support, BTC/USD has yet to see a meaningful reversal in momentum. Most recently, there are preliminary signs of renewed upward momentum. Any break above immediate resistance at the top of 20465 in early October could open the way to the September top at 22774. The biggest resistance is at the August top at 25201, near the 200-day moving average.

BTC/USD Daily Chart

Chart created using TradingView

A decisive break above resistance at 25201 could pave the way towards the May high of 32376. However, the odds of such a move seem low for now. There is a good chance that BTC/USD could reverse its gains if it approaches the August high as the broader downtrend remains intact. A failure to break above immediate resistance at 20465 could expose downside risk towards 17590.

Recommended by Manish Jaradi

Get your free introduction to cryptocurrency trading

ETHEREUM SHORT TERM TECHNICAL OUTLOOK – BULLISH

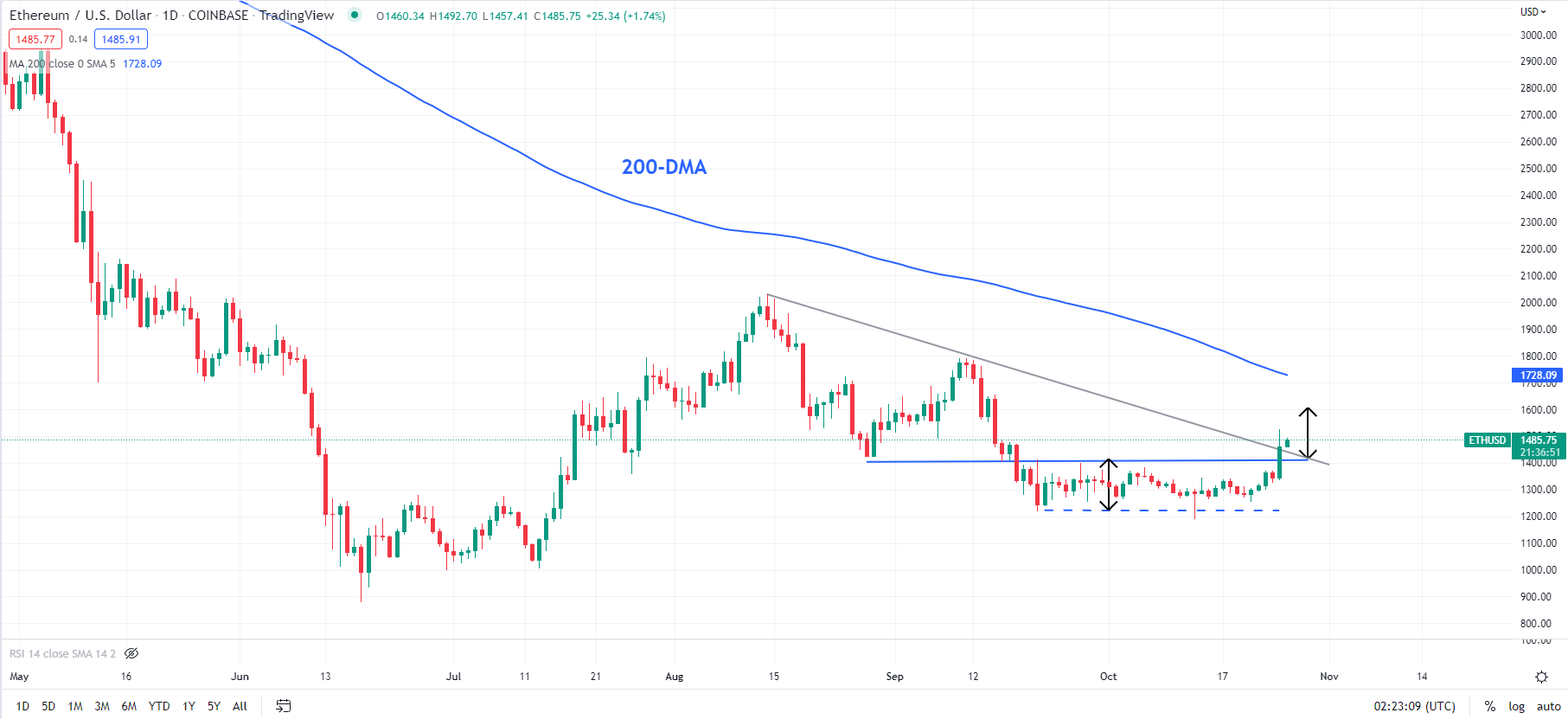

While BTC/USD may form a double bottom at the June and September lows, ETH/USD is about to stage a higher low this month, relative to the June low. A higher secondary low (relative to the previous one) in ETH/USD versus a potential double bottom in BTC/USD is a reflection of the relative strength of the former cryptocurrency.

ETH/USD daily chart

Chart created using TradingView

From a relative perspective, ETH/USD Daily charts appear to be one step ahead of BTC/USD. Not only did the former make higher September-October lows (relative to its own June low), but it has also risen above resistance at 1421. In contrast, BTC tested its June low in June and has yet to reach its immediate resistance.

The next resistance is at the 200-day moving average (now at about 1725), followed by the September high at 1790. The biggest resistance is at the August high of 2031. ETH/USD may find it difficult to break 2031, in that smallest in this move. On the downside, 1220 is the first support, with stronger support at the June low of 879.

Recommended by Manish Jaradi

Building trust in trade

— Posted by Manish Jaradi, Strategist for DailyFX.com