a new Algorand blockchain-driven divination exchange

Venue One, a new blockchain-driven divination exchange, will soon launch live operations on Algorand. Deployment on the Algorand chain will enable Venue One to deliver super-speed, flexibility and security.

In May 2022, Venue One announced that beta testing would begin. The platform had full beta functionality, and beta testers were able to make predictions and provide feedback to the Venue One team.

After a final revision is completed, the launch date will be imminent. However, the Venue One team noted that the official launch date will depend on current market conditions.

Decentralized, non-warning prediction protocol built on Algorand blockchain …

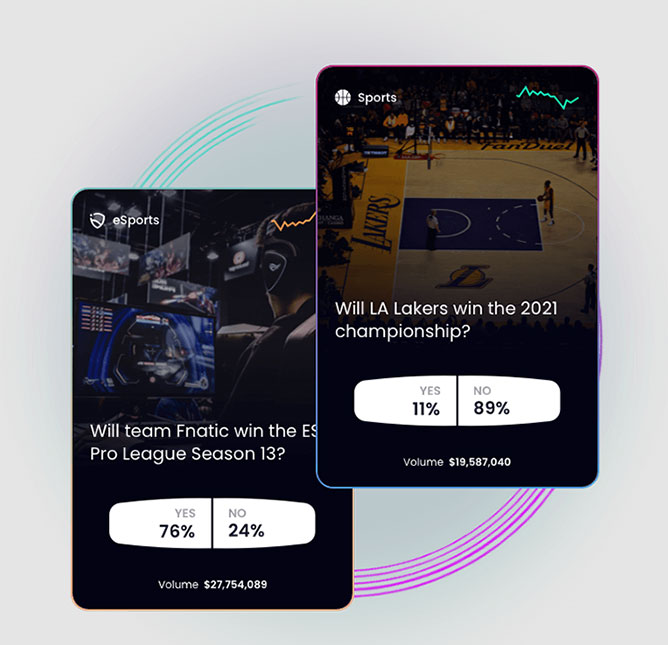

At Venue One, users can take positions in sports, eSports, finance, events and more, with a focus on short-term markets and events.

In addition to supporting USDC and USDT stablecoins, Venue One has its original token lubricated $ VENO, which drives players and liquidity by providing rewards.

Players can interact with the platform in three ways:

- Classic games – which demand and supply between buyers and sellers defines the price or odds. Basically, people will bet on a yes or no result for certain events.

- Liquidity pools of mutual games – where the liquidity in the pool determines the outcome.

- Economy – Venue One is working on an upcoming stock exchange for financial assets and indices.

One of the prominent features of the Venue One prediction protocol is that it allows users to deposit security and access payouts in stack coins (USDC and USDT). Those who do not operate stablecoins can use fiat and $ ALGO on-ramps.

Essentially, players can put security against their predictions and receive payouts in stack coins.

Liquidity providers (LPs) can deposit money while betting on certain outcomes to ensure that the market built around an event has enough liquidity. This constructs high-volume markets in sports, eSports and other categories, while helping LPs secure generous, low-risk rewards.

Final outcomes at stake will be a hybrid approach, which uses decentralized third-party data to confirm outcomes. Eventually, the Venue One team plans to decentralize results by using oracles on the chain to verify results.

Founder

The protocol was created by George Cotsikis, who trained as an engineer and has more than two decades of experience in traditional finance, mainly trading in quantitative portfolios. He held senior positions at Salomon Brothers and Citigroup, which eventually bought the former.

By utilizing Algorand, Venue One provides the following benefits:

- Low fees – Algorand uses a consensus mechanism called Pure Proof of Stake (PPoS), which enables fast transactions at a low cost. If it went for other large blockchains, users could have ended up spending more than $ 50 to make a $ 100 transaction, which is not affordable or feasible.

- Immediate finality – on Algorand, each transaction finally reaches in less than five seconds. Elsewhere, it can take several minutes to more than an hour to confirm a transaction on Proof of Work blockchains (PoW). In the worst case, a trading venue must solve the prices in seconds. When a player places a bet or switch, he must know at what level they have traded immediately, not in half an hour.

- Safety – Algorand is in itself a secure ecosystem since it depends on chance as the main principle for how the committee for validation of nodes is chosen. It also provides a developer-friendly ecosystem that enables smart contract developers to avoid potential loopholes and errors.