A “new wave of crypto debasement” is likely underway, with bitcoin itself poised to drop another 25% amid a “cascade” of margin calls.

That was the grim assessment JPMorgan gave clients on Wednesday as the world’s third-largest crypto exchange, FTX, teetered on the brink of bankruptcy after a potential bailout from fellow exchange Binance fizzled. The recent cryptocurrency drama that has unfolded in recent days has triggered heavy losses across the sector.

“What makes this new phase of crypto deconstruction induced by the apparent collapse of Alameda Research and FTX more problematic is that the number of entities with stronger balance sheets capable of rescuing those with low capital and high leverage is shrinking within the crypto ecosystem,” said a team of strategists led by JPM’s Nikolaos Panigirtzoglou.

The crisis began after Binance CEO Changpeng Zhao announced the exchange’s decision to liquidate its remaining position in the original FTX Token, FTT. Alameda Research is the trading company of FTX owner Sam Bankman-Fried.

“Given the size and interconnections of both FTX and Alameda Research with other entities in the crypto ecosystem, including DeFi platforms, it appears that a new cascade of margin calls, deleveraging and crypto company/platform failures is beginning in the same way we saw in May of last year/ June after the collapse of Terra, he said.

Venture capital firm Sequoia Capital said early Thursday it had written down its FTX stake to $0 in anticipation of the exchange possibly filing for bankruptcy protection.

Alameda’s reported $8 billion liabilities are “large enough to create a similar wave of deleveraging to that seen after the $20 billion collapse of Terra USD last May. And similar to what we saw after the collapse of Terra USD, this deleveraging is likely to last at least a few weeks unless a bailout for Alameda Research and FTX is agreed quickly,” JPM analysts said.

Read: Crypto investors rattled as Binance abandons its proposed acquisition of rival FTX

On the positive side, while deleveraging may take several weeks, the hit to crypto market capitalization is expected to be less in the wake of the Terra collapse given advanced deleveraging ahead of the Alameda/FTX saga, JPM said.

But bitcoin BTCUSD,

which has lost about 19% in the past seven days, is headed for more losses, the analysts warned.

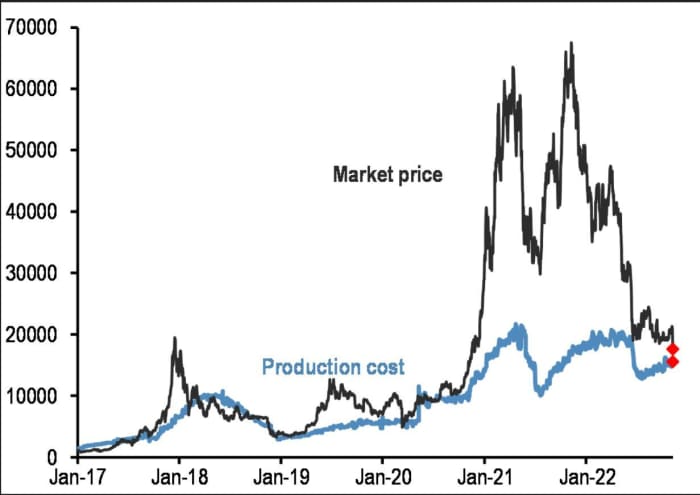

“One way to think about the downside in the coming weeks is the bitcoin production cost which historically served as a floor for the bitcoin price. Currently this production cost is at $15,000, but it is likely that it will return to the lows of $13,000 dollars seen over the summer months, which represents a decline of about 25% from here, said Panigirtzoglou, who provided the following chart:

JPMorgan

That 25% downside would bring the crypto market cap to a low of $650 billion, strategists said.

Bitcoin sales had cooled on Thursday as the broader market bounced back from softer-than-expected inflation. The No. 1 cryptocurrency was trading around $17,282 after falling to a November 2020 low of $15,554 on Wednesday. The crypto is down 65% so far this year.

JPMorgan said the Alameda/FTX saga will no doubt “increase investor and regulatory pressure” on crypto companies and entities to disclose more balance sheet information, to keep client assets safe and limit asset concentration. More careful management of counterparty risk among crypto market participants is also likely.