A fool and his money are soon to be parted

- Bitcoin price continues to experience sideways congestion. Analyzes of the chain suggest that more cuts are probably underway

- Ethereum price begins the expected rise. The chances of crypto transition are still widespread.

- The Ripple price still offers a chance to rally higher. Key levels are identified.

The crypto market is in stagnation mode. An explosive move will likely resolve the congestion, but it may take days to manifest. Placing an early entry is purely speculative at this time.

Bitcoin price is still indecisive

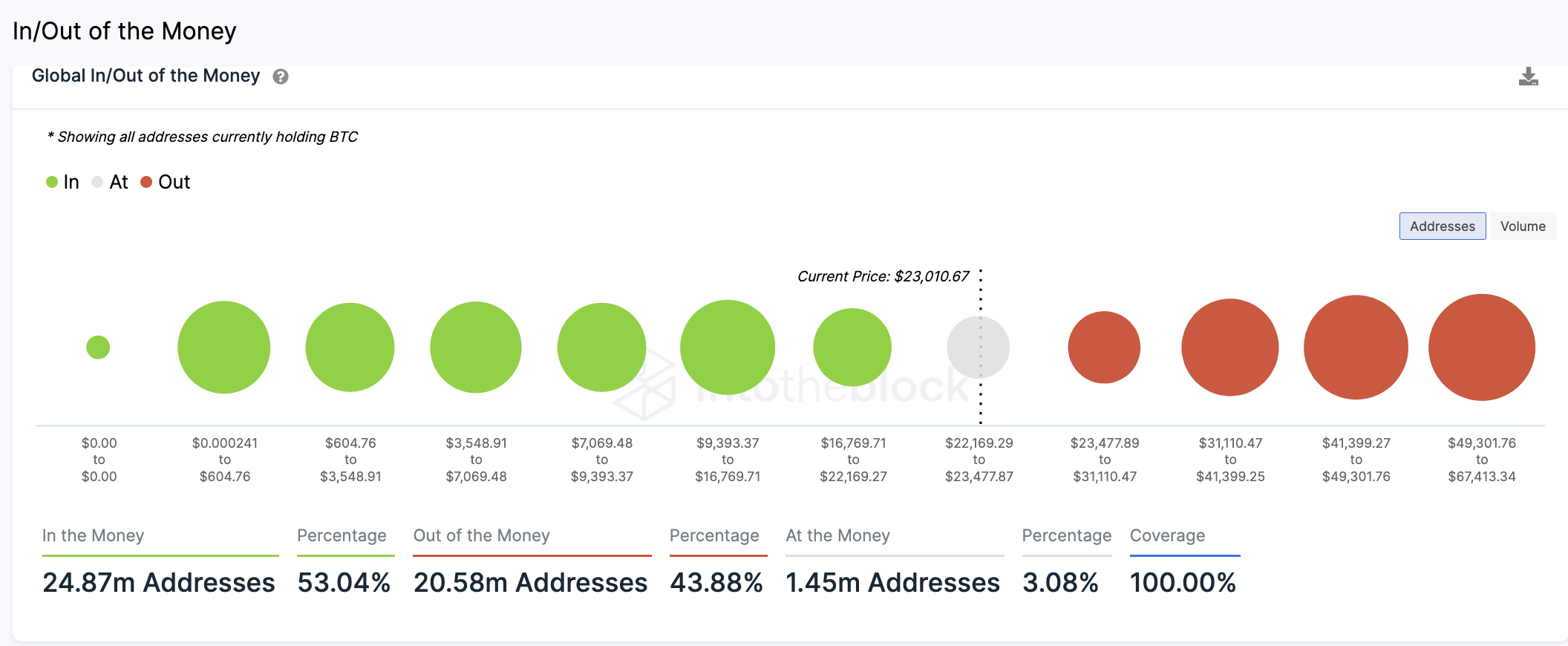

Bitcoin price continues to coil within a wedge-like leading diagonal. Based on the Into the blocks in/out money indicator, 54% of traders who have opened a position are currently in profit.

Thus, the mundane price action will likely continue until smart money has enough liquidity to wreak havoc on one side of the boat. At the present time, it is uncertain which direction the BTC price will go next. Previous forecasts are still targeting higher liquidity levels of $24,600 and $25,200 which are yet to be marked.

Intotheblock: In/Out of the Money Indicator

BTC/USDT 2-hour chart

In the following video, our analysts dive deep into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Ethereum is set to outperform

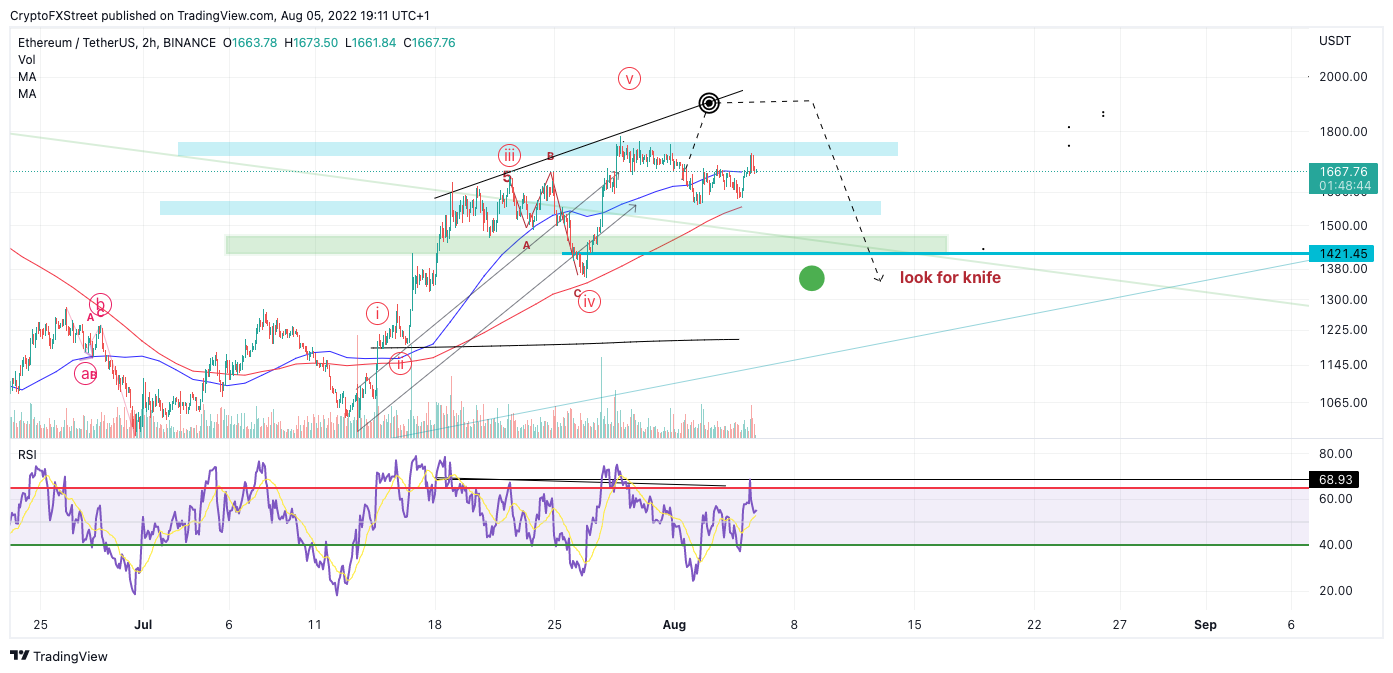

Ethereum price remains in negative sentiment based on community disagreement about the upcoming merger. As the first trading week of August draws to a close, Ethereum is hovering near fresh new monthly summer highs of $1,676. Regardless of what the community assumes, Ethereum price, based on technical and on-chain analysis, appears poised to go higher.

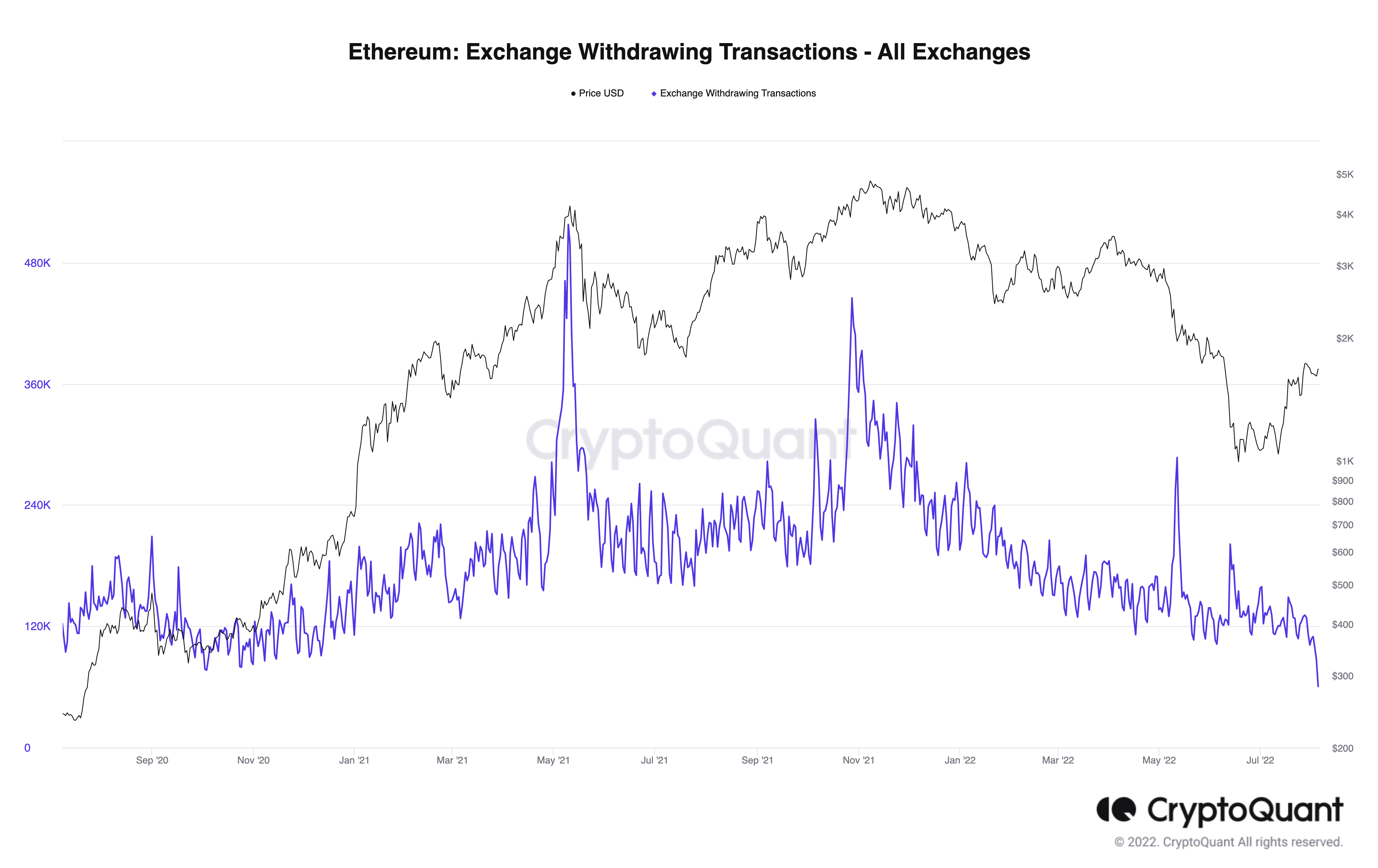

Additionally, the Ethereum price is making new yearly lows on Crypto Quants’ Ethereum: Exchange Withdrawing Transactions indicator. According to Crypto Quant “The total number of withdrawals is counted from all exchanges” In theory, the more withdrawals from exchanges conversely mean fewer participants actively trading the digital token. A less liquid digital asset can also be easier to influence in terms of price.

Crypto Quants – Ethereum: Exchange Withdrawal Transactions – All Exchanges

ETH./USDT 2-hour chart

In the following video, our analysts dive deep into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

XRP price continues to show optimism

XRP price hovers above a key trend channel; median line. The bearish pressure comes on significantly low volume compared to the bullish impulse that enabled the 25% rally towards the end of July. If market conditions are genuinely bullish, a bullish top above $0.38 should be the catalyst for another 25% rally targeting $0.47 in the near term.

The Xrp price has also witnessed an increase in gossip surrounding cooperation with the World Economic Forum. Hype and FOMO could become a new factor for the digital remittance token if market sentiment continues to build positive momentum.

The XRP price should remain on the trading charts over the weekend as smart money may try to start a rally while traders take a break from their screens. Invalidation of the uptrend remains at $0.3250 for now.

XRP/USDT 2-hour chart

In the following video, our analysts dive deep into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team