Bitcoin Price and Ethereum Prediction: Almost 5% Recovery

Over the past few days, the prices of Bitcoin (BTC) and Ethereum (ETH) have seen a significant increase, recovering almost 5% of their value. This price movement has been welcomed by cryptocurrency investors and enthusiasts alike, as the crypto market has experienced a downward trend in recent weeks.

While the recovery is a positive sign, the question for everyone is – what’s in store for the weekend? Will the recovery rally continue or will we see a reversal of the trend?

In this blog post, we will analyze the recent price movements of BTC and ETH and examine the factors that may affect their prices over the weekend.

Crypto Market Insights: Basic Outlook Update

Although economic statistics in the US have led to speculation that the Federal Reserve may become more aggressive with interest rate hikes, Bitcoin (BTC), the world’s largest cryptocurrency, has risen above the $24,000 level and has continued to gain momentum throughout the day.

Meanwhile, Ethereum, the second largest cryptocurrency, has also gained significant attention and is currently trading above the $1,700 mark.

Despite recent regulatory actions and rumors, investor interest in cryptocurrency remains strong. This is due to several positive developments in the market, including increased use of Bitcoin (BTC) by businesses.

On the other hand, investors reacted positively to the release of economic data on February 14, which showed a 5.6% year-on-year increase in the US consumer price index, and on February 15, which showed a 3% monthly increase in retail sales. sale.

Also, the US dollar began to lose momentum and fell slightly on the day as the market adjusted ahead of the long weekend and anticipated signals from the Federal Reserve on how it intended to tackle continued high inflation. As a result, the negative US dollar was seen as another important element that had a positive impact on BTC prices.

Crypto Market Mood: Analyze current sentiment and trends

The global cryptocurrency industry has grown in popularity and is now valued at over $1.12 trillion. Most cryptocurrencies gained value during the day, possibly in response to January’s US Consumer Price Index (CPI) numbers.

The reduction of regulatory concerns in the cryptocurrency industry, as well as the recent positive developments in the market, have also had a significant impact on the overall cryptocurrency market.

Moreover, the growing popularity of non-fungible tokens (NFTs) and decentralized finance (DeFi) has further fueled the growth and value of cryptocurrencies.

However, the gains in the crypto market may be short-lived as economic statistics in the US have led to speculation that the Federal Reserve may take more aggressive action with rate hikes to counter persistent inflation. As a result, there may be increased uncertainty and volatility in the cryptocurrency market going forward.

Export prices rose 0.8% year-on-year, beating forecasts for a 0.2% decline. In addition, recent data released on Thursday showed a monthly increase in producer prices in January and a lower-than-expected number of claims for unemployment benefits for the previous week.

These developments suggest that the US economy may be strengthening, which could affect the cryptocurrency market as investors consider the potential impact on the value of cryptocurrencies.

El Salvador is pioneering Bitcoin diplomacy with plans to establish a US embassy

El Salvador has announced plans to open the world’s first “Bitcoin Embassy” in the United States. The embassy will act as a hub to promote the use of Bitcoin (BTC), the most widely used cryptocurrency worldwide.

Earlier this year, El Salvador became the first country in the world to recognize Bitcoin as legal tender. The country is now expanding its Bitcoin strategy through a new partnership with the Texas government, which is expected to further increase the adoption and integration of cryptocurrencies in both countries.

El Salvador and the government of Texas have announced a partnership to establish a “Bitcoin Embassy”, which will serve as a representative office for El Salvador in Texas. This intergovernmental effort is aimed at promoting the adoption of Bitcoin, and the embassy will provide a platform for members to collaborate on creating new initiatives.

The news was shared by Milena Mayorga, the Salvadoran ambassador to the United States, on Twitter on February 14. The embassy is expected to help drive global adoption of Bitcoin, and facilitate new partnerships between governments, businesses and investors in the cryptocurrency industry.

Accordingly, this development was considered one of the key drivers behind the recent surge in BTC prices.

Shanghai upgrade and the future of Ethereum

The Ethereum Shanghai hard fork is scheduled for March 2023 and will represent the final phase of the network’s transition to a proof-of-stake (PoS) consensus mechanism, which began with the merger on September 15, 2022. Once the Shanghai upgrade is implemented, Ether which was previously locked in strike will gradually become fluid again.

However, the implementation of Shanghai has been postponed until December 2022, which is when the unlocking process is expected to begin.

According to on-chain Etherscan data, around 16.6 million ETH are currently locked in the proof-of-stake (PoS) staking protocol, with a total value of $28 billion as of February 16, 2023. With the transition from proof-of – work (PoW) to PoS, Ethereum’s original goal of making Ether’s supply deflationary has begun to take effect.

In the 154 days since the merger, nearly 24,800 ETH have been burned, resulting in a deflationary effect of 0.05% on the token’s annual basis.

The total supply of Ether is 120 million, and starting February 16th, just over 10% of this amount will be unlocked, resulting in yield benefits that will become available after the implementation of the Shanghai upgrade.

Bitcoin price

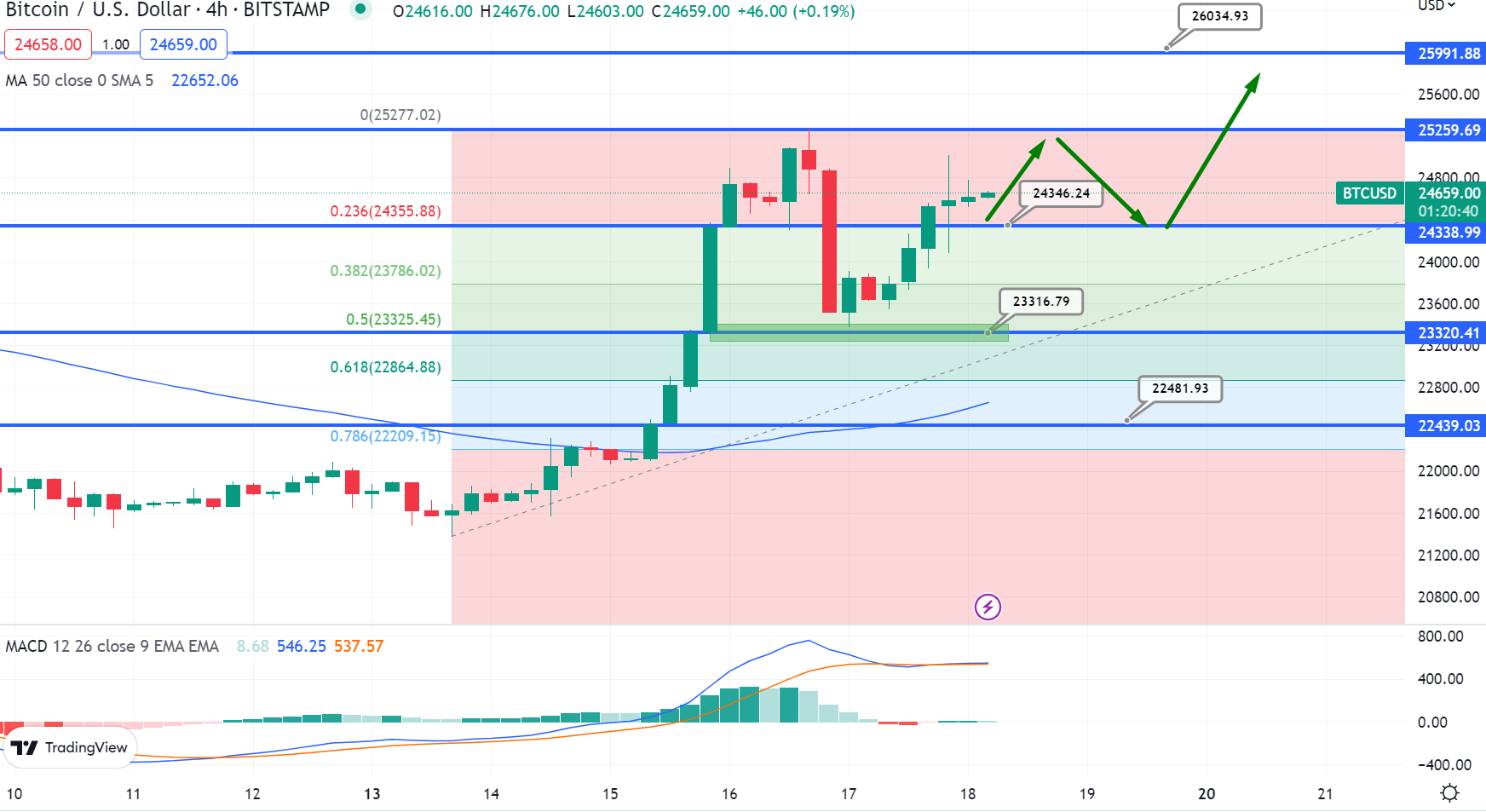

Bitcoin is currently trading at $24,600, with a 24-hour trading volume of $38 billion and an increase of 3% in the last 24 hours.

After finding support near $23,325, a 50% Fibonacci retracement level, Bitcoin has rebounded and started an uptrend. The recent candle close above this level led to a buying trend in Bitcoin, which has contributed to the bullish sentiment in the market.

Looking ahead, the next resistance level for Bitcoin is at $25,300. If a bullish crossover occurs above this level, it could potentially push the BTC price higher to $26,000.

The 50-day moving average increases the likelihood of a sustained uptrend in Bitcoin. To capitalize on this trend, investors may consider looking at the $24,250 level as a potential entry point to take a long position in Bitcoin.

Buy BTC now

Ethereum price

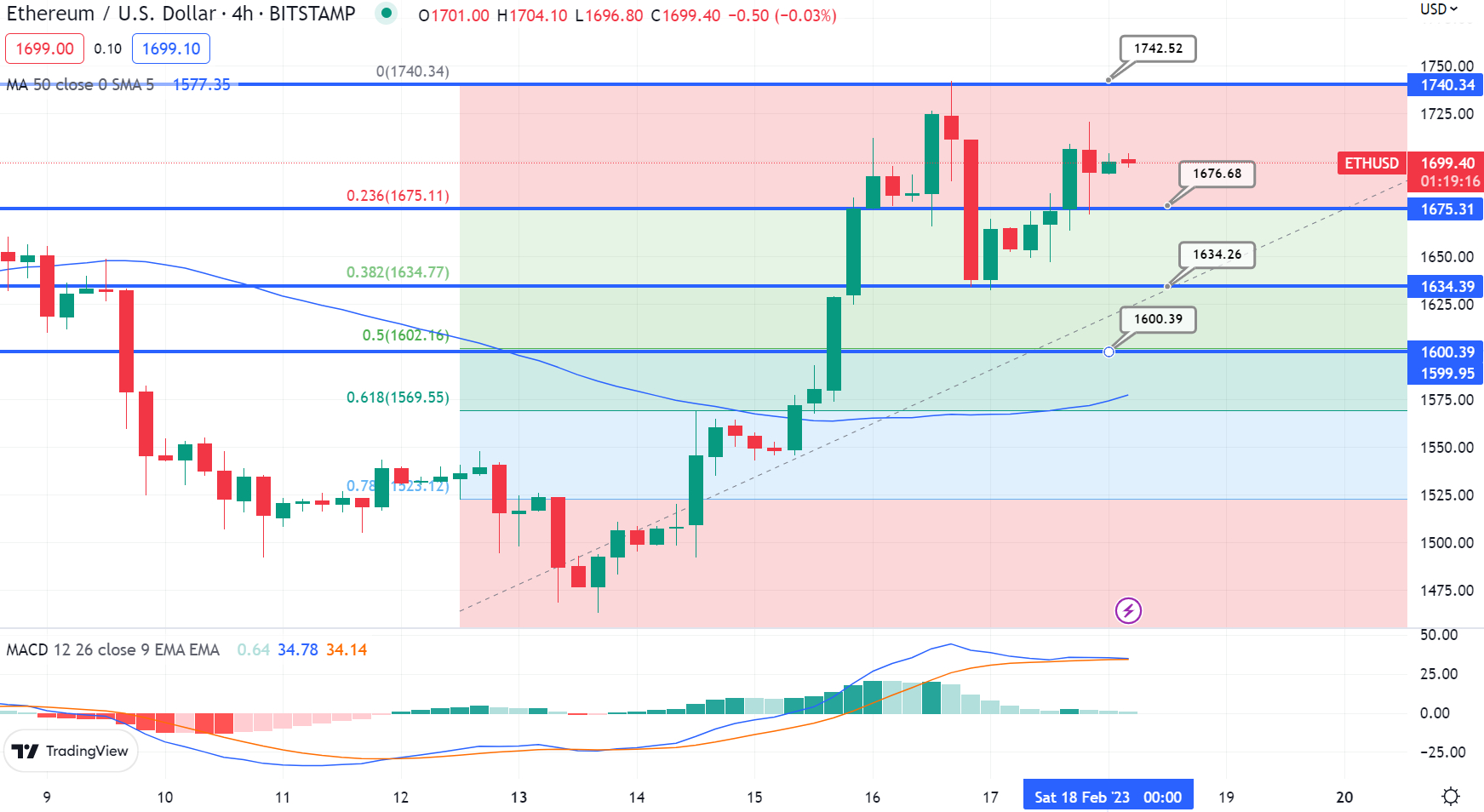

Ethereum is priced at $1,700, with a 24-hour trading volume of $9.2 billion and an increase of 2.30% in the last 24 hours. On Saturday, the ETH/USD pair broke through the key resistance level of $1,670, signaling a bullish breakout that could lead to further buying opportunities up to the $1,750 mark.

A successful breakout above the $1,750 level could potentially drive the ETH price towards the $1,825 and $1,875 levels. Conversely, immediate support for Ethereum rests at the $1,670 level, and a break below $1,600 could trigger a sell-off towards the $1,550 level.

Overall, investors are advised to keep a close eye on the $1,670 level for potential buying opportunities, while keeping an eye out for any breakouts or breakdowns.

Buy ETH now

Bitcoin and Ethereum alternatives

In addition to BTC and ETH, there are several other altcoins in the market with high potential. The CryptoNews Industry Talk team has analyzed and compiled a list of the top 15 cryptocurrencies for 2023.

The list is updated weekly with new altcoins and ICO projects, so it’s a good idea to check back often for new entries.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

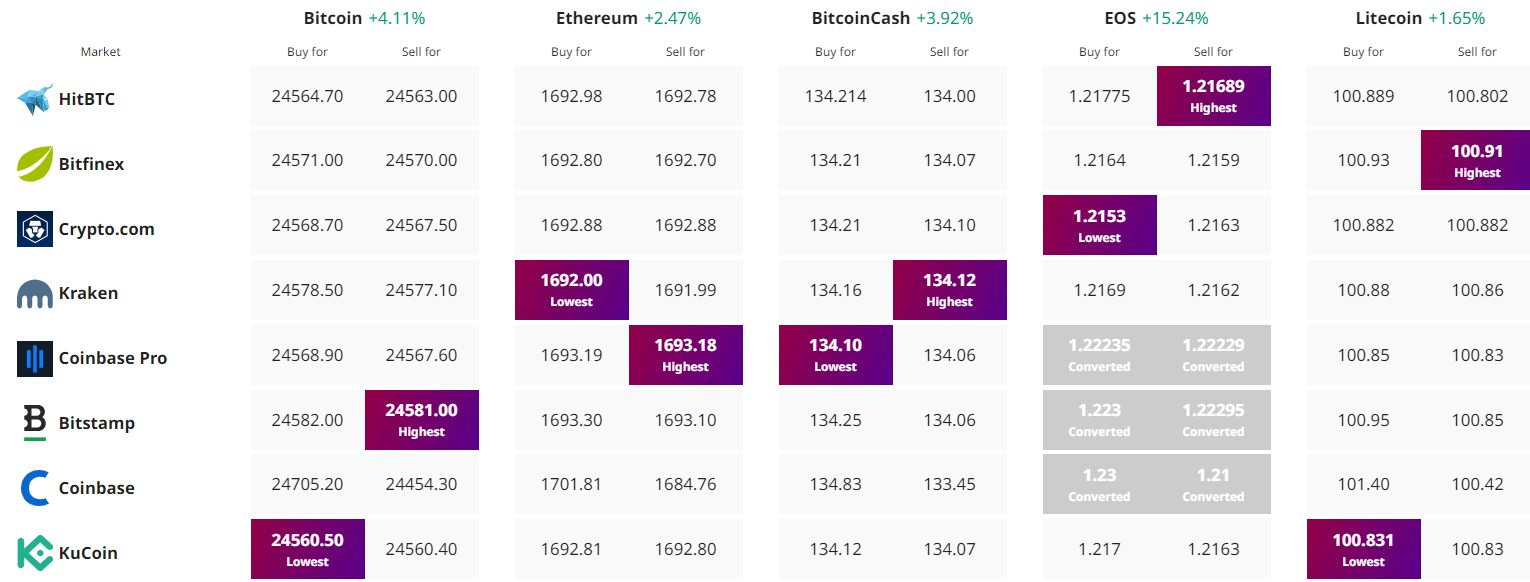

Find the best price to buy/sell cryptocurrency