Bitcoin is set to end the week ~14% higher after a huge rally sees it break past $25K

Olemedia

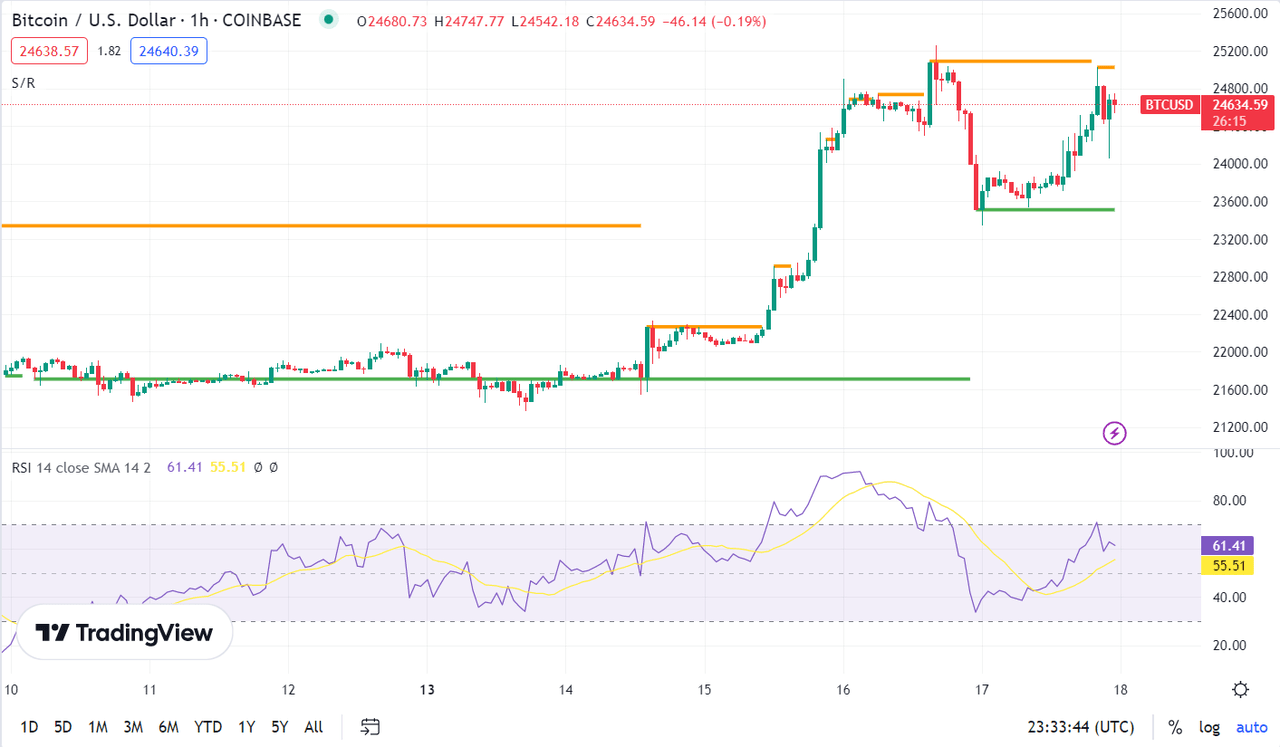

Bitcoin (BTC-USD) on Friday was on track to end the week 13.8% higherin stark contrast to broader stock markets that were weighed down by concerns over the future of the Federal Reserve’s interest rate hikes.

The weekly rally was organized of the world’s largest cryptocurrency by market capitalization saw it surge past the $25,000 mark on Thursday to hit a multi-month high. Part of the return has been due to a so-called “short squeeze” which has resulted in more short liquidations than normal, according to Coinglass data on Wednesday.

In a rare dynamic, the rise in prices across cryptocurrencies this week has diverged from the price performance of broader US stocks. Crypto traders appeared to have a strong appetite for risk and appeared to shrug off concerns over more rate hikes by the Fed following reports of warmer-than-expected CPI and producer price indices.

“Bitcoin is in retreat at the end of the week, not immune it seems to the sharp shift in risk appetite across the markets. It comes after a huge rally earlier this week that saw it hit an eight-month high on Thursday.” said OANDA analyst Craig Erlam.

“Regardless, bitcoin bulls will no doubt be excited by the latest price developments and may feel more bullish than they have since 2021,” Erlam added.

Some of the shine was taken off Friday’s rally, with cryptocurrencies weighed down by headlines surrounding Binance (BNB-USD) (BUSD-USD) , which was reportedly on the way and cutting ties with certain US business associates.

“Many crypto traders are closely following the report that Binance may exit relationships with US companies as pressure from regulators mounts,” said OANDA analyst Edward Moya.

“Binance is the world’s largest exchange, and if it abandons key US relationships, it’s a huge setback for the cryptoverse,” Moya added.

The news about Binance came a day after the Wall Street Journal reported that the exchange expected to pay fines to settle US regulatory and law enforcement investigations into the business.

Looking at the broader picture, Bitcoin’s (BTC-USD) weekly gain boosted the global crypto market cap, which currently stands at $1.12T, up 3.3% over Thursday, according to CoinMarketCap.

SEC pressure continues

The weekly rally in cryptocurrencies came despite continued regulatory intervention from the US Securities and Exchange Commission (SEC). Some of the acts this week include:

- On Friday, the SEC said it had filed charges against NBA Hall of Famer Paul Pierce over misleading statements about tokens sold by EthereumMax.

- On Thursday, the SEC charged Terraform Labs PTE and Do Hyeong Kwon with allegations of perpetrating a multi-billion dollar securities fraud.

- On Monday, Bloomberg reported that the SEC had drafted a proposal that could allow hedge funds, private equity firms and pension funds to work with cryptocurrency-related firms.

- Also on Monday, the Wall Street Journal reported that the SEC would potentially file charges against stablecoin issuer Paxos Trust for violating investor protection laws. Paxos was also ordered by the New York Department of Financial Services to end its relationship and stop issuing new dollar-pegged BUSD (BUSD-USD) tokens.

- The SEC actions this week come in the wake of the commission’s crackdown on crypto exchange Kraken last week.

Other countries law about crypto

- The Bank of Russia will launch a pilot program for the country’s digital central bank currency in early April, according to the report on Friday. Meanwhile, the Bank of Japan said it would launch a pilot program in April to test out its digital yen.

- CoinDesk reported Thursday that cryptocurrency exchanges operating in Canada will come under increased regulatory scrutiny.

- The United Arab Emirates capital Abu Dhabi said on Wednesday that the tech ecosystem, referred to as Hub71 Digital Assets, had committed more than $2B in capital to support web3 and blockchain technologies startups.

- Britain’s financial regulator said on Tuesday it is taking enforcement action against unregistered cryptocurrency ATM operators.

Other notable news

- Exchange-traded funds related to bitcoin (BTC-USD) and the blockchain in general have soared in 2023, with a few names jumping close to or more than 100%.

- Katie Stockton, founder and managing partner of independent research provider Fairlead Strategies, told CNBC that stocks and crypto are likely to see retracement amid “greedy” sentiment.

Bitcoin price

- Bitcoin (BTC-USD) was up 3.5% to $24.63K at 1841 ET and Ether (ETH-USD) was higher by 3.2% at ~$1.70K.

- SA contributor Kevin George warned on Monday that while investors have cheered the January rally in bitcoin (BTC-USD), the rally was technical in nature and nothing had fundamentally changed in the world’s largest cryptocurrency.

Here’s the performance of some crypto-related stocks on Friday: Coinbase (COIN) -0.6%Marathon Digital (MARA) +6.8%MicroStrategy (MSTR) +3.5%Riot Platforms (RIOT) +3.6%Bakkt Holdings (BKKT) +0.6%Hut 8 Mining (HUT) +1.5%.