Crypto.com (CRO) Price ready for continuation

Crypto.com (CRO) price has regained its footing after a correction and may continue its upward movement.

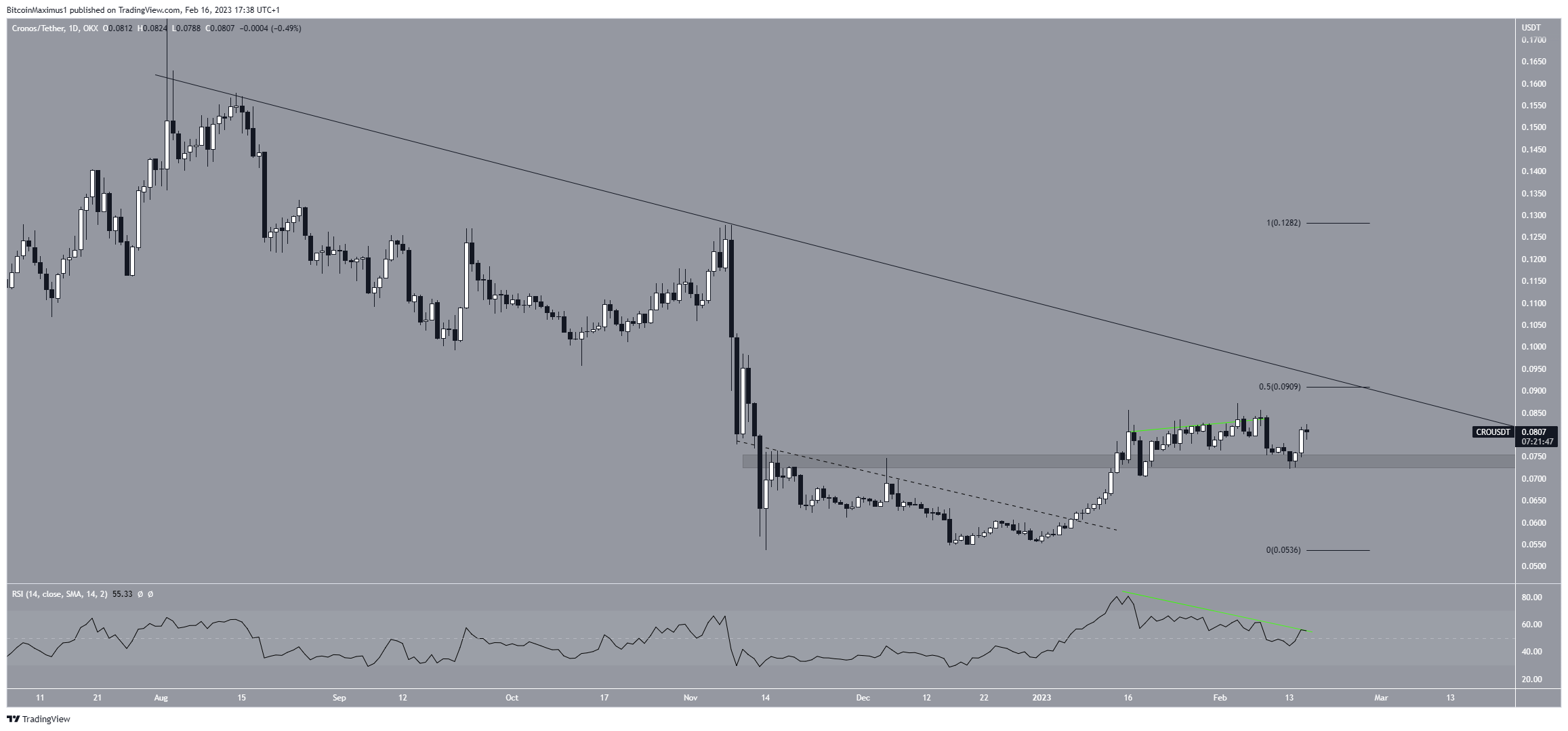

CRO price broke out from a descending resistance line on January 7. It continued its rise until it hit a high of $0.087 on February 4. The price subsequently fell, validating the horizontal area of $0.074 as support. This is a crucial area as it had previously provided resistance for more than two months.

The entire downward movement was preceded by a bearish divergence in the daily RSI (green line). The indicator is now at 50, a sign of a neutral trend. Moreover, it has not broken out from its bearish divergence trend line. Until it does, the trend cannot be considered bullish.

If the ongoing rally continues, the nearest resistance area will be $0.091. This is the 0.5 Fib retracement resistance level and a long-term descending resistance line.

A breakout from this line will confirm that the trend is bullish. If so, the price could rise towards at least $0.130.

However, if the CRO token price breaks down from the $0.074 support area, a drop towards $0.055 could follow.

The short-term six-hour price action suggests that the CRO price is in the fifth and final wave of an upward movement (black). The defining feature of this formation is the rising parallel channel that contains wave four.

Using an external retracement of wave four, the most likely target for the top of the move is $0.093. It is found using the 1.61 external retracement of this wave.

However, this bullish forecast will be countered by a drop below the four wave lows of $0.072 (red line). If so, the trend will be considered bearish. Therefore, the CRO coin price may fall towards $0.05.

To conclude, the most likely CRO price forecast is an increase towards $0.093. However, a drop below $0.072 would invalidate this bullish forecast. If so, the CRO price may fall towards $0.050.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use this information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.