Crypto investors snap up $260,000,000 in Ethereum rival that’s up 220% this year: Santiment

Crypto analytics platform Santiment says investors quickly scooped up around $260,000,000 in Ethereum (ETH) rival Fantom (FTM).

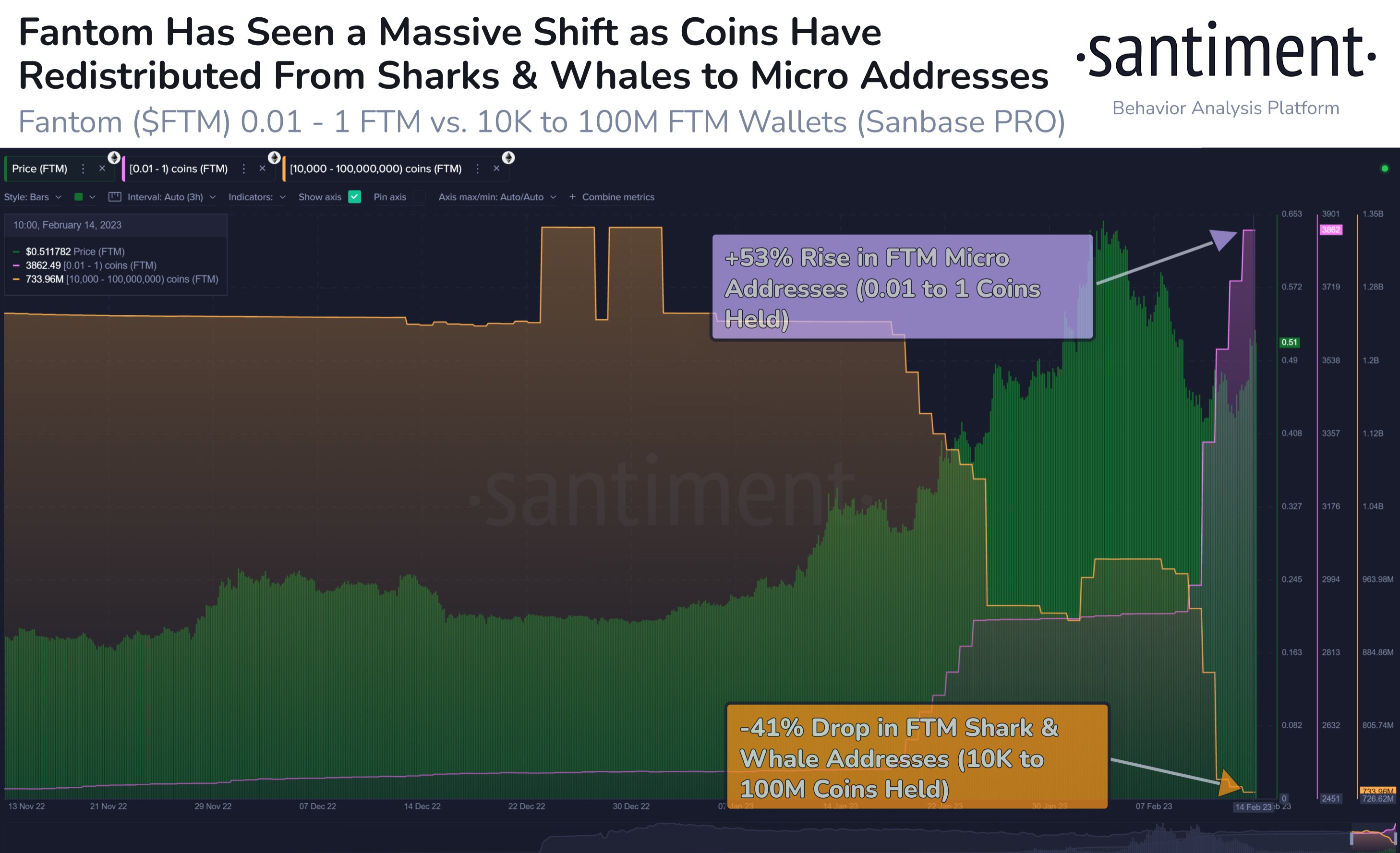

Sentiment says that when Fantom skyrocketed in price this year, Shark and Whale addressed $259.7 million off FTM within weeks.

However, most of the unloaded tokens were intercepted by small recipients holding anywhere between 0.01 and one FTM token.

“Phantom’s shark and whale addresses have dumped heavily during this 2023 rally. Addresses with 10,000 to 100 million FTM have dropped $259.7 million worth of coins in the past four weeks. These coins have been largely acquired by micro addresses that hold 0.01 to 1 FTM.

Fantom opened the year at $0.200 and peaked at $0.656 on February 3, a 228% increase. Fantom is trading for $0.55 at the time of writing.

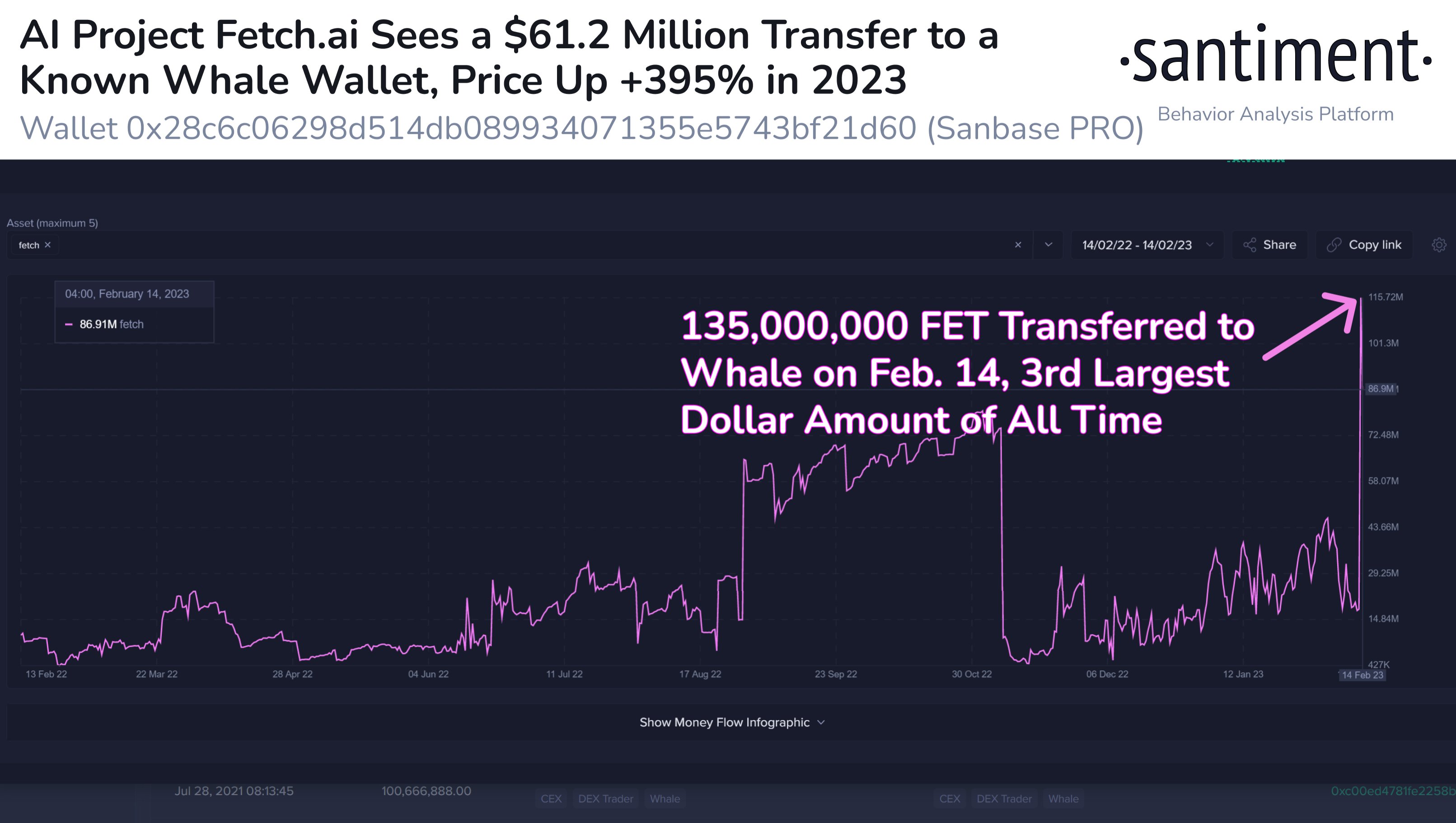

Sentiment too look at the meteoric rise of artificial intelligence (AI) blockchain project Fetch.ai (FET), drawing attention to a massive whale transaction of 135,000,000 FET on February 14.

“Fetch.ai is now #102 by market cap in crypto after skyrocketing +395% in 2023, and has had its largest transaction in 567 days. FET worth $61.2 million has been transferred to an existing whale address, which also holds 224.46 million in Ethereum (ETH).

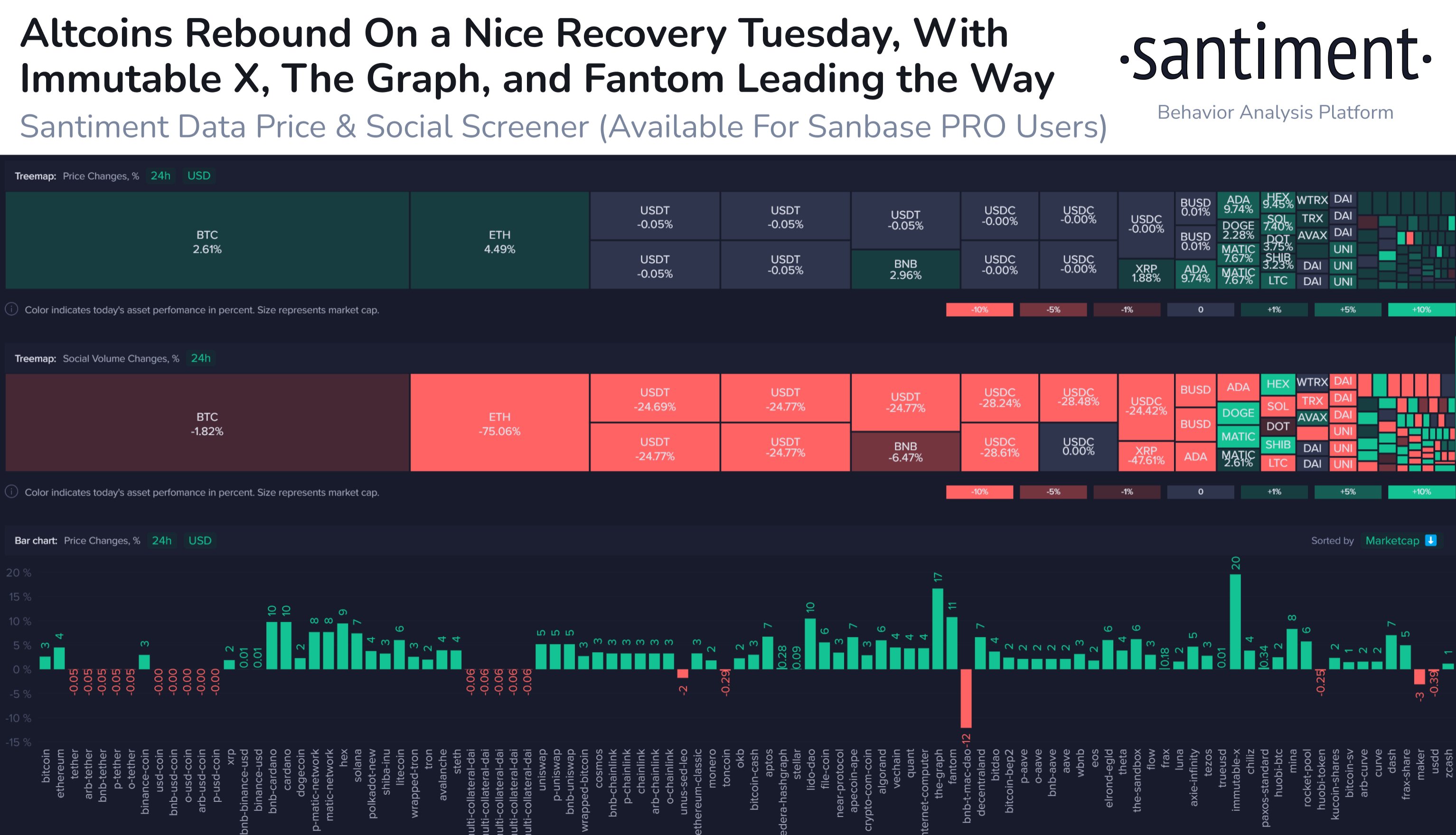

Sanitation says that altcoins in general are showing a lot of strength again as NASDAQ and tech stocks rallied on February 14. They say the strongest performers are FTM along with Immutable X (IMX) and The Graph (GRT).

“Altcoins bounce back big as Nasdaq and tech stocks did well on Valentine’s Day. There remains an obvious correlation between stocks and cryptocurrencies that traders hope will disappear, as a correlation break historically heralds a bull run.”

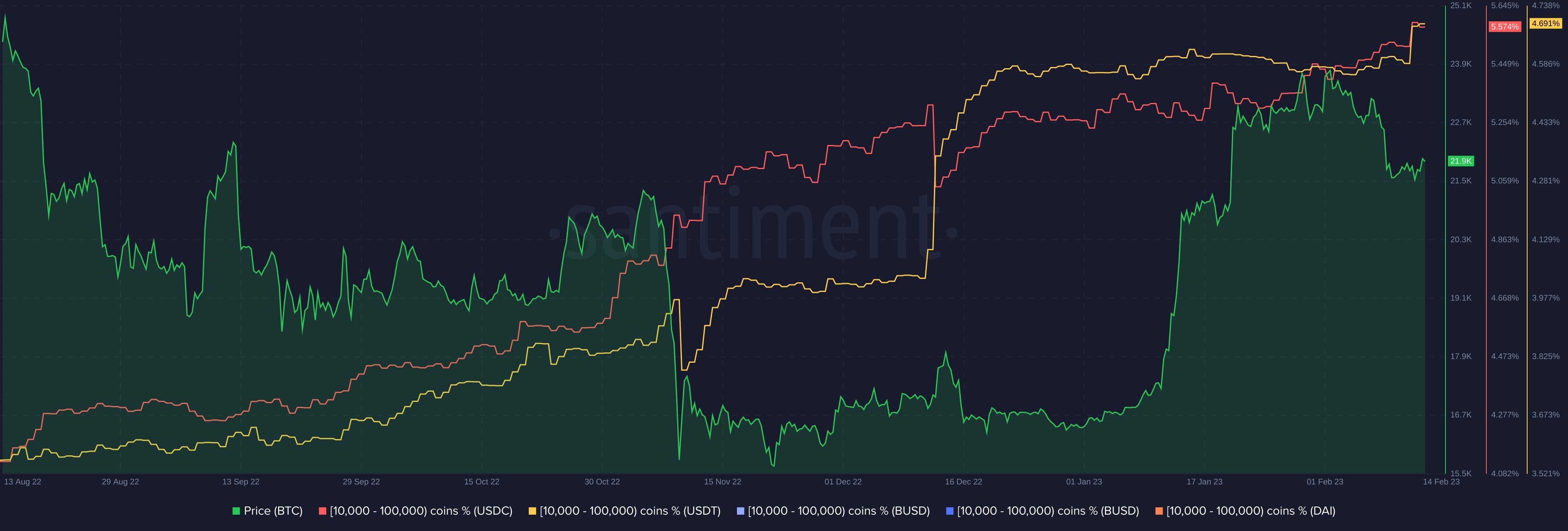

Finally, the research firm says small shark investors are fleeing stablecoin Binance USD (BUSD) after the Wall Street Journal reported that the US Securities and Exchange Commission (SEC) intends to sue the coin company Paxos for allegedly violating investor protection laws. Paxos has already agreed to close stablecoin issuance, but will continue to honor redemptions. BUSD sharks instead invest in Tether (USDT) and USD Coin (USDC).

“When BUSD is in hot water, small shark addresses are quickly dropping for Binance’s stablecoin being sued by the SEC. Instead, these sharks are increasing their positions in USDT and USDC instead.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney