Bitcoin self-defense and financial sovereignty – Bitcoin Magazine

This is an opinion piece by Kudzai Kutukwa, a passionate advocate for economic inclusion who was recognized by Fast company the magazine as one of South Africa’s top 20 young entrepreneurs under the age of 30.

The release of Bitcoin White Paper in 2009 after the financial crisis in 2008 was one of the most important events of the 21st century. For the first time ever, an untrustworthy, peer-to-peer monetary system for the digital age that was independent of intermediaries and central banks was now a reality.

At first, Bitcoin was dismissed as a passing fad and a worthless Ponzi scheme, but 13 years later, no one is laughing at Bitcoin anymore. In fact, it is now being ruthlessly attacked in several ways. These attacks have included the 2021 ban on Chinese bitcoin miners by the Chinese government; the continued denial of a spot Bitcoin exchange-traded fund by the US Securities and Exchange Commission (SEC); the design of Bitcoin as an environmental hazard (which later led the EU to consider banning proof-of-work mining); and, lastly, the EU’s attack on “non-hosted wallets”. The latter is not only an attempt to regulate the capture of Bitcoin, but it is also an attack on your financial privacy. You can think of it as the 21st century version of the Executive Order 6102.

Financial regulators around the world have slowly turned up the heat and cracked down on the use of wallets that are not hosted, but before we move on, we need to address the elephant in the room, which is the term “wallet that is not hosted”. What in the world is a wallet that is not hosted? It is simply a non-storage wallet (also known as a self-storage wallet) where the user owns the private keys and has 100% control over their money as opposed to handing them over to a third party for “storage”. A simple example of a wallet that is not hosted can be your physical wallet or purse that is not linked to any financial institution, contains as much money as you want to put in it and is 100% under your control. What makes this concept even more bizarre and dangerous is that it means that our personal financial data must be “hosted” on someone else’s server. The implication is that self-defense is dangerous, suspicious and wrong.

Introducing the term “unhosted wallet” is a subtle but effective attack meant to maintain the role of “reliable third parties” that Bitcoin was created to replace. It makes absolutely no sense for an unlicensed and untrustworthy system to require a green light from gatekeepers before it can be reached.

Where Gigi expressed this idea perfectly when he said: “The discussion should not be about ‘hosting’ in the first place. It must be about control. Who can access your money? Who can freeze your account? Who is the Lord, and who is the slave? Just like “the cloud is someone else’s computer,” a “hosted wallet” is someone else’s wallet.

There is no Bitcoin without self-storage, only IOUs from centralized exchanges. This is why “not your keys, not your coins” is more than just a slogan, but a reminder to remain financially sovereign.

Since Bitcoin is resistant to censorship and cannot be effectively banned, the choke points that are now being exploited are the entry and exit ramps in and out of the cash system. Given the fact that the average person is likely to acquire bitcoin from a centralized exchange, know that your customer rules are then put into play with the intent of linking a public ID and physical address to a “Bitcoin address.” The ultimate goal is a state where each transaction is linked to an identity that leaves an audit trail for the authorities, where they can easily perform financial monitoring and exercise control as they already do in the fiat system. Furthermore, your personal data is at risk of data leaks and hackers if the exchange is compromised, as is usually the case with centralized databases. A recent example of this would be the breach of the Shanghai Police Department’s database which resulted in the theft of one billion people’s personal data. Your bitcoin and your personal security are at risk if this should happen with a centralized exchange where you have a host-based wallet. This is why the use of misnomer as “unhosted wallet” should be seen for what it is: regulatory capture.

This attack was put on hold in October 2021, when the Financial Action Task Force (FATF), in its “Updated Guide to a Risk-Based Virtual Asset and Virtual Asset Service Providers”, specified that transactions between non-hosted wallets constitute specific money risk of money laundering and terrorist financing, and that certain transactions between non-hosted wallets in certain situations fall under the travel rule. In March 2022, regulators in Canada, Japan and Singapore mandated centralized exchanges to collect personal information, such as the names and physical addresses of non-hosted wallet owners, who receive or send bitcoin or other cryptocurrencies to the customers of those exchanges. These requirements were implemented in Canada shortly after the government had frozen bank accounts and even “hosted wallets” for truck drivers protesting COVID-19 mandates. Similar rules to those implemented by Canada, Japan and Singapore entered into force in the Netherlands on 27 June 2022.

In order not to be overlooked in this statistical overhaul, the European Parliament reached a preliminary agreement on their cryptocurrency bill, called “Markets in Crypto-Assets (MiCA)”, which aims to regulate and place “unhosted wallets” under financial supervision. According to a statement issued by Parliament in a press release:

“Transfers of cryptocurrencies will be tracked and identified to prevent money laundering, terrorist financing and other crimes,” said the new legislation, which was passed on Wednesday. The rules will also cover transactions from so-called un-hosted wallets. by a private user) when interacting with hosted wallets managed by CASPs [Crypto Asset Service Providers]. “

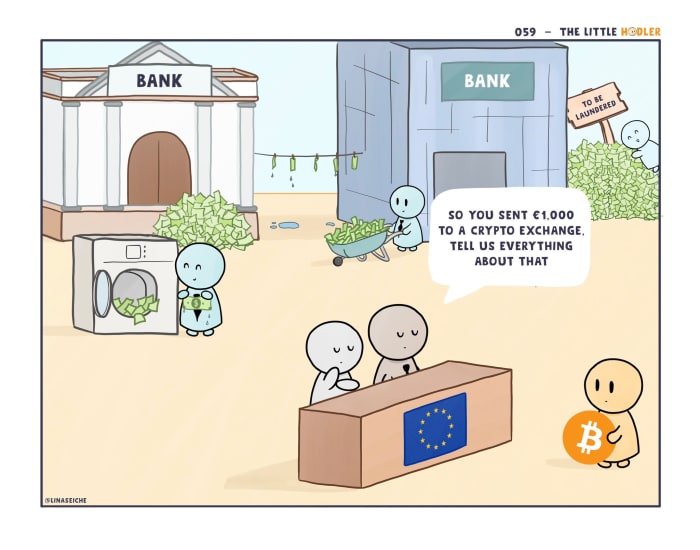

Ernest Urtasun, a Member of the European Parliament, put out a celebration thread on Twitter which outlines some of the key aspects of the bill that “will put an end to the wild west of unregulated crypto.” According to one of tweetene In this thread, the new regulations will mandate centralized exchanges to reveal the identity of the owner of a non-hosted wallet before “large” amounts of crypto are sent to them – mostly they mean € 1,000 or more. In a subsequent statement, he praised the new regulations as the right means to combat money laundering and reduce fraud.

The irony of the matter is that despite their “good intentions” when trying to curb money laundering, an estimated 2-5% of global GDP ($ 1.7 trillion to $ 4.2 trillion) is being laundered globally, mainly through the traditional the banking system according to UNODC. More money is laundered annually through the banking system than the entire market value ($ 1 trillion at the time of publication) for all cryptocurrencies combined. It gets worse: The effect of anti-money laundering (AML) laws on criminal financing is 0.05% – meaning that criminals have a 99.95% success rate when it comes to money laundering – and compliance costs exceed the value of confiscated illegal funds a hundred times. Real criminals get a free card while financial institutions and the average law-abiding citizen are punished. According to the Journal of Financial Crime, AML laws are totally ineffective in stopping the flow of ill-gotten gains. Between 2010 and 2014, a paltry 1.1% of criminal profits were seized in the EU, according to a report from Europol. No wonder AML laws have been called the most ineffective anti-crime measures anywhere! Still, it seems that the biggest problem is unhosted wallets and “wild west of unregulated crypto.” Talk about misplaced priorities.

(Source)

Despite the obvious flaws of the AML in the traditional financial system, lawmakers and regulators still insist on targeting non-hosted wallets with burdensome and impractical regulations. Not only will MiCA stifle innovation within the EU, it will also result in capital flight to more Bitcoin-friendly jurisdictions such as El Salvador. One would be forgiven for speculating that laws such as MiCA are a slow creep against the direct ban on self-deposit wallets and are forerunners that will pave the way for the introduction of central banks’ digital currencies (CBDC): a more Orwellian form of money. The architecture of hosted wallets and CBDCs is similar in that they are both centralized, subject to financial oversight, and controlled by a third party.

In a world where digital payments are the rule and not the exception, it is crucial to have payment systems and tools that are sufficiently decentralized and efficient to maintain privacy. The importance of having financial privacy was perfectly summed up in Eric Hughes’ “Cypherpunk Manifesto”:

“Privacy is necessary for an open society in the electronic age. Privacy is not a secret. A private matter is something you do not want the whole world to know, but a secret matter is something you do not want anyone to know. Privacy is the power to selectively reveal oneself to the world … Therefore, privacy in an open society requires anonymous transaction systems. Until now, cash has been the primary system. An anonymous transaction system is not a secret transaction system. An anonymous system allows individuals to reveal their identity when desired and only when desired; this is the essence of privacy. “

These words are still true today. When your identity is linked to a wallet, your privacy is compromised and it becomes easier to track all your transactions in the chain forever. If you do not control how much you can have or where you can store it, you do not own your money. The one who controls your money controls you. Centralized financial systems – of which host-based wallets are a part – are every authoritarian’s dream and are designed to give the power of economic omniscience to the state. Bitcoin was designed to empower the individual through the separation of money and state. Self-storage wallets are integrated into preserving it.

This is a guest post by Kudzai Kutukwa. Expressed opinions are entirely their own and do not necessarily reflect the opinions of BTC Inc. or Bitcoin Magazine.