With cryptocurrencies entering the mainstream, more investors are using them to diversify their portfolios. Still, the high volatility of cryptocurrencies has made many investors skeptical, if not afraid, of investing their hard-earned money.

Enter crypto-ETNs, an exchange-traded product used in the traditional financial world for years. Now they provide investors with a unique opportunity to invest indirectly in cryptocurrencies without scaling the steep learning curve of cryptocurrency.

So, what exactly are crypto ETNs, what are their benefits and risks, and are there any good ETN examples?

What is a cryptocurrency ETN?

Cryptocurrency Exchange-Traded Notes (ETNs) are financial products that track the price of a particular cryptocurrency, such as Bitcoin, Ethereum or Solana. An ETN issuer, which is usually a financial institution, promises to pay an investor the return of the underlying cryptocurrency minus fees and other costs.

The financial institution does not need to purchase the underlying cryptocurrency. Rather, they can invest it in whatever they want as long as at the end of the investment period they pay the investor the upfront interest corresponding to the return earned by the cryptocurrency.

Meanwhile, investors can trade ETNs on an ETN exchange, just as they would cryptocurrency or stocks. This system allows anyone to invest in the cryptocurrency market without necessarily buying crypto.

What is the difference between Cryptocurrency ETNs and ETFs?

ETNs and ETFs (Exchange-Traded Funds) have a close relationship based on their similarity to mutual funds with the added benefit of being tradable. However, there is one thing that sets them apart.

While ETNs only represent a tax liability of the issuer, ETFs hold the underlying cryptocurrencies and the companies involved in their development. Therefore, an ETN provides exposure to the return of the underlying cryptocurrency, while an ETF provides exposure to the performance of the underlying cryptocurrency.

What are the benefits of Cryptocurrency ETNs?

Cryptocurrency exchange-traded notes (ETNs) offer several benefits, including:

- Convenience: ETNs provide an easy way to invest in cryptocurrency without buying. Therefore, you don’t need to set up a wallet, manage your private keys or worry about the security of your digital assets.

- availability: ETNs are listed and can be easily bought and sold through a brokerage account. You don’t need to master the scope and function of cryptocurrencies or have the technical expertise and resources to invest.

- Diversification: ETNs provide exposure to specific indices by simply promising to pay the index’s return rather than investing in the cryptocurrency. This allows investors to diversify their portfolios and gain access to new asset classes.

- Reduced tracking error: As the return of an ETN complements the return of the underlying cryptocurrency, it means you get a good match to a particular cryptocurrency index if that was your investment plan. This is in contrast to ETFs, where you have to constantly rebalance portfolios to match the index, which can result in errors.

- Tax benefits: Ideally, cryptocurrencies are taxed as property, and profits from the purchase, sale or transfer of crypto-assets are taxed. ETNs are different; they are taxed as capital gains, resulting in lower tax bills. Additionally, in some jurisdictions, this type of long-term capital gains tax is usually less than the short-term capital gains tax payable on any interest.

What are the risks of cryptocurrency ETNs?

Although ETNs seem like a simple investment option, they are not without risk. They include:

- Standard: There is always a risk that the financial institution or issuer will not be able to pay back the return or even the principal to the investor, despite how established they are. Crypto market volatility and issuer credit risk can cause payment defaults, resulting in losses.

- No claim on underlying assets: In most cases, investing in ETNs is like buying an unsecured bond. Your investment is not backed by any assets. You only rely on the creditworthiness of the issuer. A security ETN would be a wiser option.

- Liquidity: Although ETNs are publicly traded, most do not have high trading volumes. Therefore, it may be difficult to sell the ETN to another trader during low trading volumes or other market conditions.

Are Cryptocurrency ETNs Riskier Than ETFs?

While cryptocurrency ETNs and ETFs have market risk, meaning that market changes affect your investment, ETNs have an additional credit risk of the issuer not being able to meet its repayment obligations. Therefore, ETNs are considered riskier than ETFs. Nevertheless, the overall level of risk depends on the specific product, underlying assets, investment practices and marketing conditions.

The 5 Best Cryptocurrency ETNs

Cryptocurrency investment firms can create as many ETN products as they want from any of the cryptocurrencies on the market. But here are the top five Bitcoin ETNs.

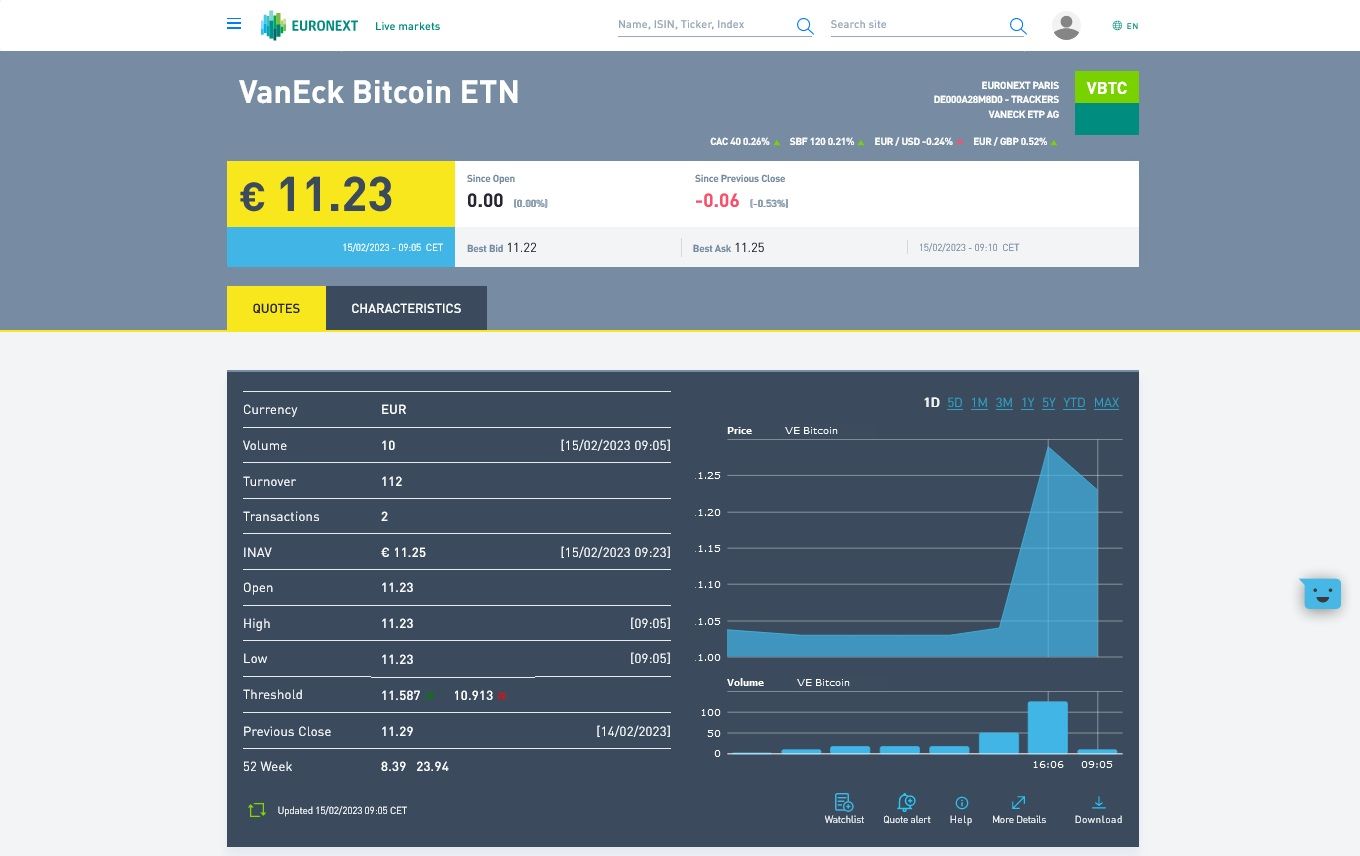

1. VBTC VanEck Bitcoin ETN

This Bitcoin ETN is issued by VanEck, a global investment manager founded in 1955 to provide investment options. It offers a 100% security ETN based on the MVIS Cryptocompare Bitcoin VWAP Close Index and closely tracks the Bitcoin price. It is available

for trading on secondary exchanges such as XETRA, SIX and Euronext. Other available VanEck ETNs include Ethereum, Solana, TRON and Avalanche.

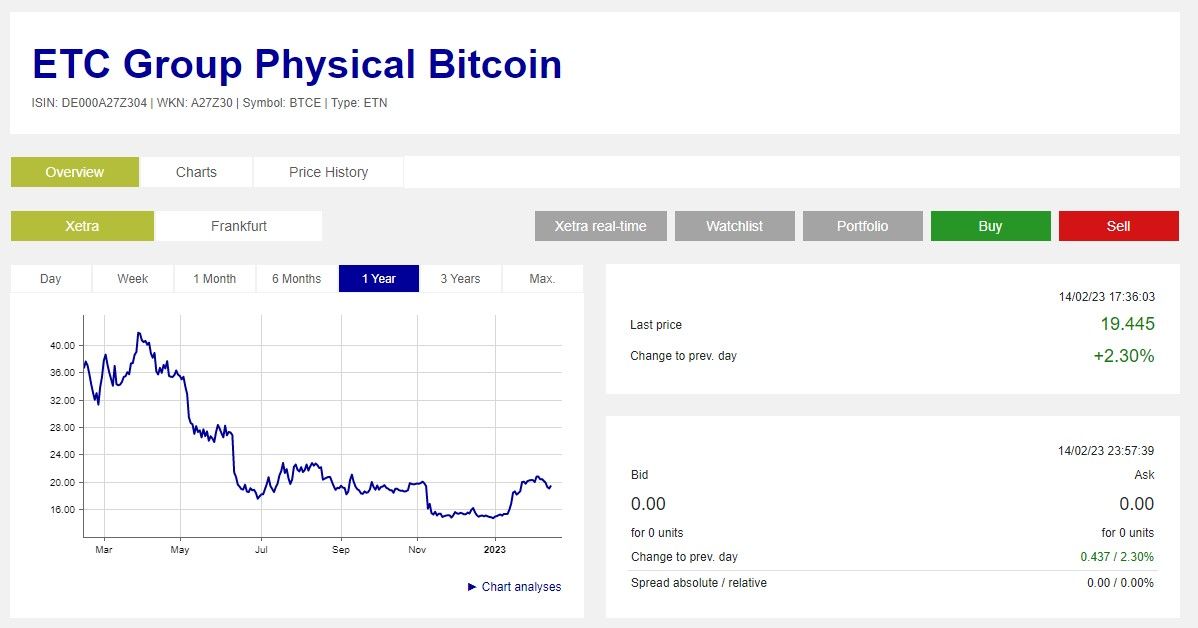

2. ETC Group Physical Bitcoin

ETC Group is a German-based crypto investment company that offers ETC Group Physical Bitcoin, a fusion between an ETF and an ETN, backed by a security note. The ETC Group Bitcoin ETN is issued in Germany under the supervision of the German government and is listed in USD and available for trading on Aquis Exchange UK, Deutsche Börse XETRA, Euronext Amsterdam and SIX Swiss Exchange. Other ETNs offered by ETC Group include Ethereum, Litecoin, Solana, Polygon, XRP, Cardano, Avalanche and Polkadot.

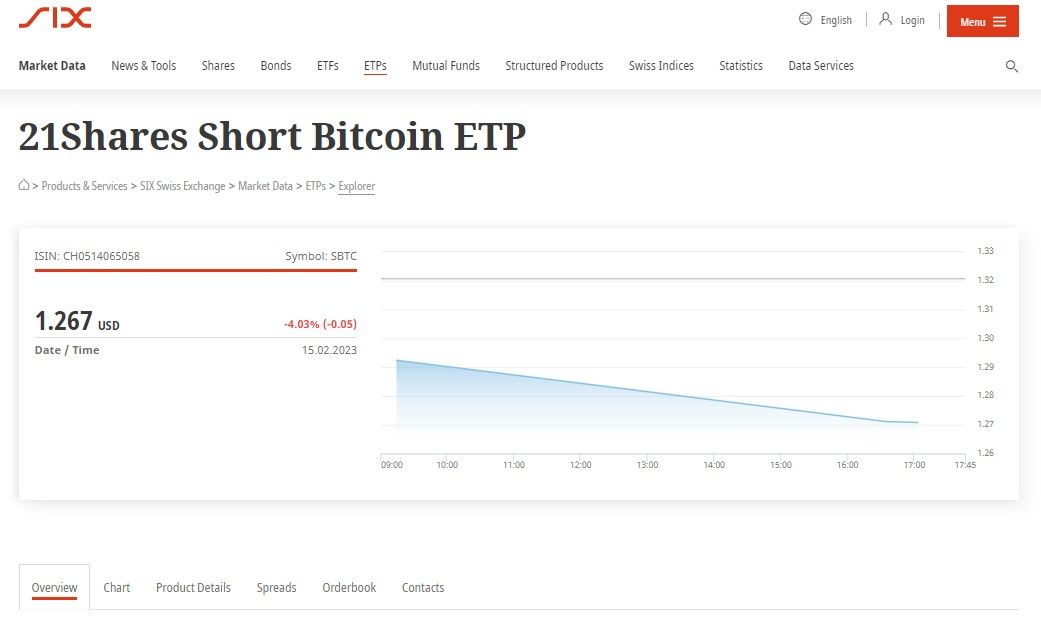

3. SBTC 21Shares Short Bitcoin ETP

21Shares, a cryptocurrency-only investment company, offers one of the largest collections of exchange-traded products (ETPs). Bitcoin ETN ranks highly in terms of portfolio performance. It is intended to allow investors to profit from bitcoin’s volatility and can be traded globally in USD on Euronext Amsterdam and the SIX Swiss Exchange. Other cryptocurrency ETNs offered by 21Shares include Binance BND, Ethereum, Polkadot, Algorand, Solana, Stellar and XRP.

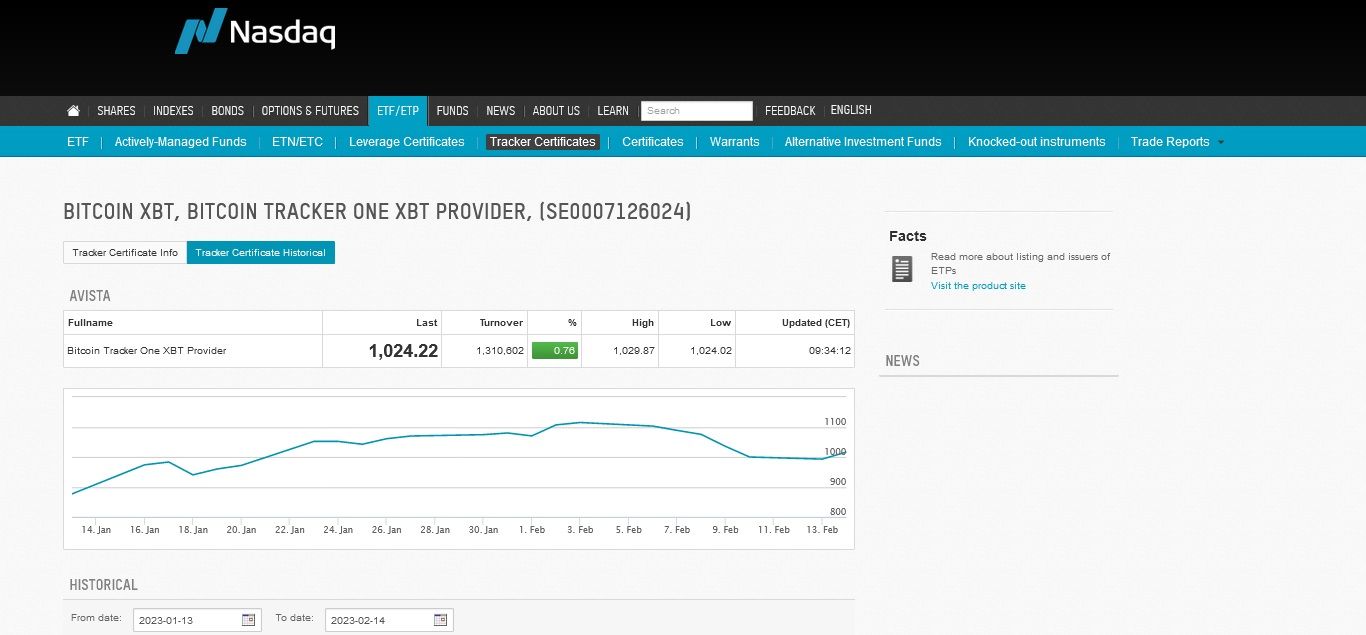

4. Bitcoin Tracker One XBT Provider (Coinshares)

Coinshares is a London-based global digital asset investment company founded in 2013. It established the first exchange-traded bitcoin product, Bitcoin Tracker One, which was listed on NASDAQ/OMX in Stockholm in 2015. Coinshares has extensive experience in regulated investments in digital assets, and their ETPs are physically backed. US citizens can trade ETNs through any of the 25 listed brokers. Other crypto ETNs offered by Coinshares include Ethereum, Litecoin, XRP, Polkadot, Tezos, Solana and Chainlink, among others.

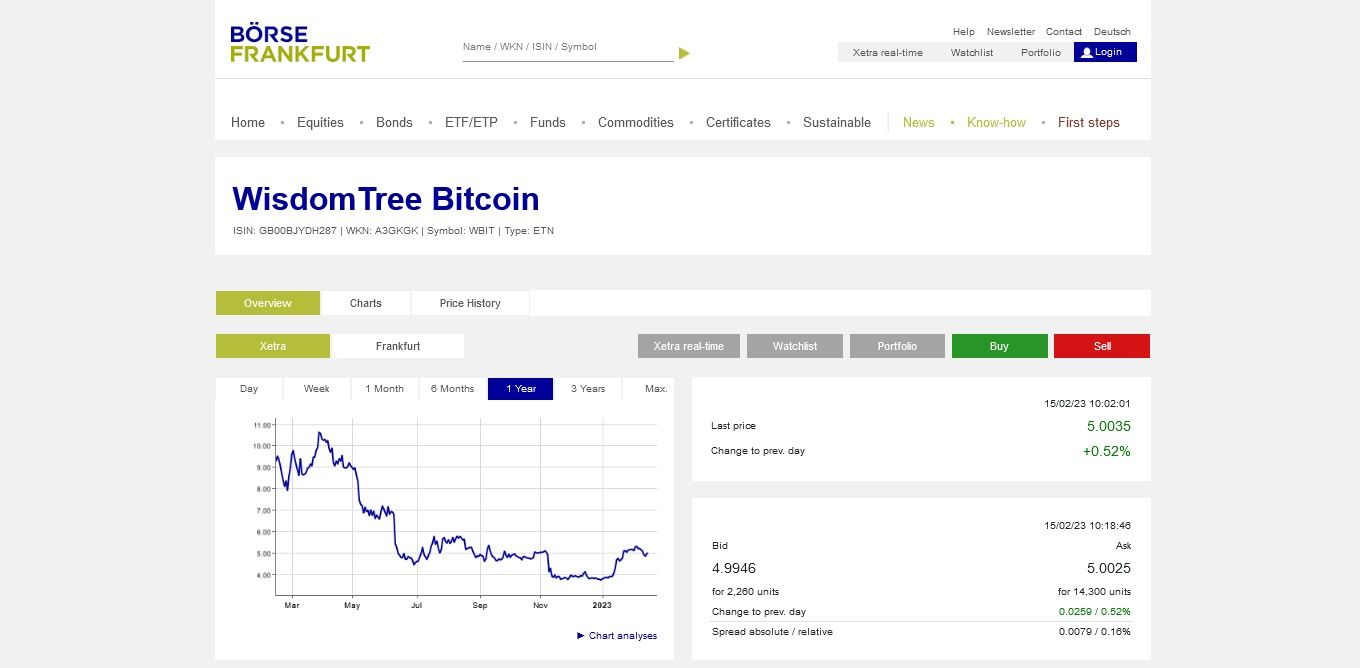

5. WisdomTree Bitcoin

WisdomTree is a New York-based ETP sponsor and asset manager. It offers the Wisdom Tree Bitcoin ETP, a product physically backed by Bitcoin listed with USD as the base currency on Euronext, SIX, XETRA and the Frankfurt Stock Exchange. Investors from passported countries can invest directly in the product, while others must use a broker, such as a bank. Other ETNs offered by WisdomTree include Ethereum, Cardano, Polkadot and Solana.

Should you invest in crypto with an ETN?

As a union of a relatively new decentralized financial technology and an old financial market concept, ETNs give you a unique opportunity to trade crypto.

However, it is important to carefully consider the risks before investing in cryptocurrency ETNs. As with all investments, research and consult a financial advisor before making any major investment decisions.