GBTC Yes, Bitcoin No: The Genesis Bankruptcy Angle

CNBC/NBCUniversal via Getty Images

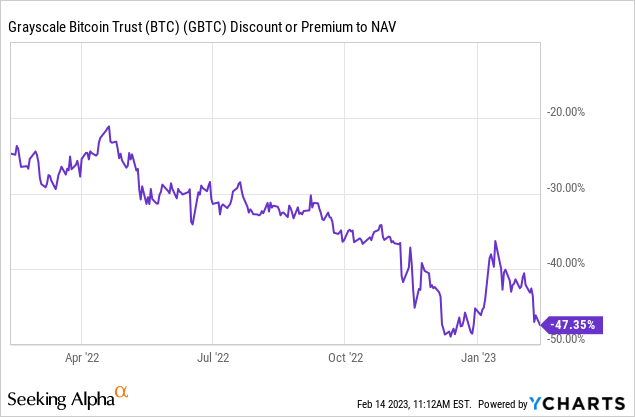

Despite heightened fears and doubts, the ongoing Genesis bankruptcy drama is likely to only marginally affect the pricing of major digital assets going forward. Bitcoin (BTC-USD) and Ethereum (ETH-USD) even rallied strongly to end the week of bankruptcy archiving. Interest rate-sensitive names, including digital assets, had been significantly down that week even with the somewhat favorable ones PPI release. However, rumblings from the bankruptcy filing in mid-January have largely returned the discount to the NAV of Grayscale Bitcoin Trust (GBTC), which had shrunk significantly at the beginning of the year before the filing (see lower right in the graphic below).

So where from here? Short-term indicators signal that Bitcoin remains overbought. But as detailed below, the eventual Genesis bankruptcy settlement shouldn’t add renewed selling pressure to Bitcoin or be all that meaningful to the closely knit Grayscale Bitcoin Trust, especially in the medium term. More generally, there is now a better balance between buyers and sellers among Bitcoin traders after the first FTX (FTT-USD) driven sales in November and the period of deleveraging immediately after the stock exchange’s collapse.

The FTX collapse actually tightened the supply of coins on exchanges as holders moved to cold storage in this cycle’s “not your keys, not your crypto” moment. Coinbase (COIN) saw Bitcoins held on Coinbase Pro fall from over 600k to under 500K from the FTX bankruptcy. This move away from exchanges, especially exchanges with yield programs like Gemini’s, triggered the current case at Genesis and caused the general liquidity-duration mismatch at the lending institutions. And this tightening of supply has been partially sustained in recent weeks as a few hundred million dollars in shorts were liquidated with the move from $16k to $23k.

Genesis Bankruptcy And The Digital Currency Group

Fear-based selling and forced selling were two of the key components of the 2022 contraction phase of the crypto cycle. While the Genesis bankruptcy news will continue to inject uncertainty and heighten fears of further contagion, the unfolding of the bankruptcy itself may not add significant forced selling to either the Bitcoin market or GBTC shares. Below, we briefly recap the Genesis bankruptcy story, look at the “First Day” information and last week’s pact with creditors, as well as provide color on possible links to crypto sector prices.

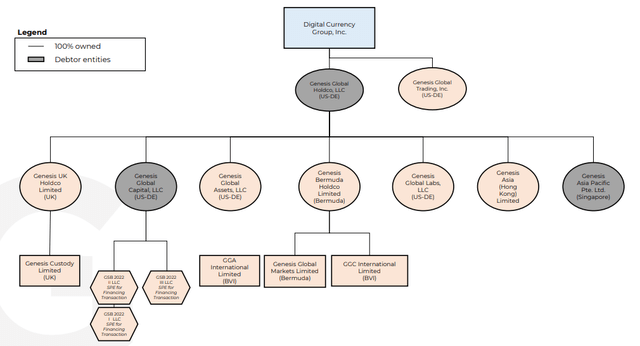

Genesis is a subsidiary of Digital Currency Group which is also the parent of Grayscale, which sponsors the prominent Grayscale Bitcoin Trust. One arm of Genesis is among the largest OTC trading desks for the crypto sector, handling over $170 billion in trading volume in 2021. The other arm was a significant institutional lender with $130 billion in lending in 2021. It is this lending arm that is directly listed in the bankruptcy, see gray shading below.

Note that the graphic only outlines the Genesis companies, specifically Genesis Global Holdco and its sub-units. In addition to Genesis and Grayscale, Digital Currency Group subsidiaries include Foundry, one of the largest Bitcoin mining pools, and CoinDesk, a top media company in the crypto sector. Plus DCG is invested in 200 companies and funds including the well-reputed Circle; an outbreak of the portfolio is here.

Genesis structure (restructuring.ra.kroll.com)

In November, the Genesis lending arm put withdrawals on hold. The Three Arrows bankruptcy in July had left a billion-dollar deficit on its balance sheet that only surfaced after the FTX and Alameda collapses. While Genesis’ lending arm then still had no exposure to Alameda, the FTX news heightened fears and triggered a “run on the banks” scenario among crypto lenders, including Genesis. Note that Genesis’ trading arm, which was not initially part of the bankruptcy filing, has $175 million in exposure to FTX.

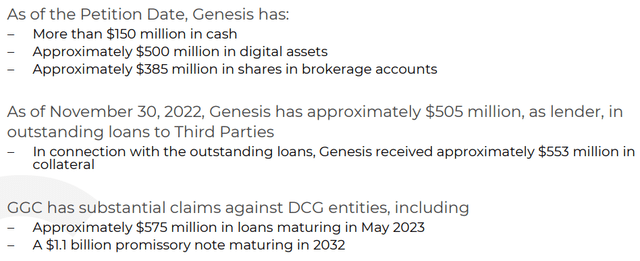

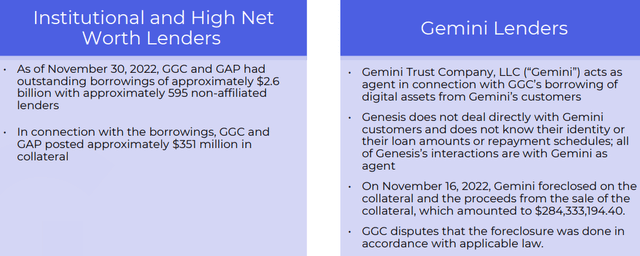

So how bad is it? The First day consultation presentation roughly outlined both the assets and the liabilities:

Genesis Global Holdco Assets (restructuring.ra.kroll.com)

Genesis Global Holdco Obligations (restructuring.ra.kroll.com)

So two things jump out. First, depending on how the security tranches are accounted for, Genesis’ liabilities outweigh their assets by a few hundred million dollars. And secondly, as mentioned just above, half of Genesis’ assets are, interestingly enough, owed to parent DCG.

The quality and present value of the $1.1 billion DCG promissory note has been a point of contention with Cameron and Tyler Winklevoss, the majority owners of the Gemini exchange, a major creditor of Genesis. Note that customers in Gemini’s return program have claims of around $780 million against Genesis. The Winklevoss twins’ main concern is their claim that the DCG bill was represented to them as a current asset, even though it had a 2032 maturity.

While there are these legitimate questions about the promissory note, it is important to remember that this debt was created when DCG assumed the obligations Three Arrows owed Genesis. So in a reasonable light, DCG assumes that these commitments have enhanced the recovery that Genesis’ creditors will receive. And while DCG is now in the creditors’ committee for the Three Arrows liquidation proceedings, it seems unlikely that they will recover a meaningful percentage of the loans originally made to Three Arrows by Genesis.

Genesis agreement with creditors and DCG

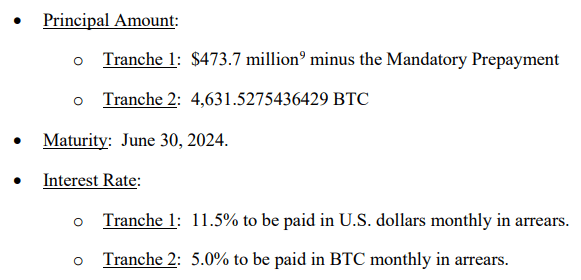

On 6 February, Genesis announced an agreement in principle with DCG and a large group of creditors. The main outcome is that DCG will exchange its $1.1 billion 2032 promissory notes for newly issued convertible preferred stock. Details of the preferred share plan can be found on pages 7-8 of the archive Term Sheet for restructuring.

In addition, DCG will be allowed to refinance its 2023 term loans through a new facility maturing on 30 June 2024.

Proposed new second lien (assets.ctfassets.net)

DCG is also giving its equity stake in the Genesis trading arm to bankruptcy recovery, with plans to start a sale process for this asset. For its part, Gemini agreed to provide up to $100 million to affected customers in its return program.

Takeaway: Agreement buys critical time

The short-term dominant factor for both Bitcoin and GBTC remains monetary policy and interest rate expectations. Last week I had a piece covering this topic titled February Fed and 6 more weeks of crypto winter. The general idea is that we will not see a real pivot in Fed policy until there is sustained downward movement in core services inflation. And Tuesday’s CPI is just a further indication that interest-sensitive technology stocks and the crypto sector will be somewhat negatively affected by the growing narrative of significantly higher interest rates for much longer than previously expected. For this reason, I am a “hold” on major additions to most Bitcoin names, including the miners, with a short-term price above $21k.

But GBTC is a different story. The Genesis bankruptcy drama has extended the Trust’s discount to NAV to 47%. However, the fear driving this divergence seems exaggerated. Grayscale is not directly affected in the Genesis restructuring deal, and the fear that DSG will somehow be forced to relax some of the Grayscale products, thereby increasing the coin supply, now seems remote.

If implemented, the deal also buys DCG time before it is forced to sell a large portion of its own holdings in the Grayscale products at a discount. DCG along with its other subsidiaries reportedly owns a billion dollars worth of Bitcoin Trust. The refinancing of the May 2023 loans up to and including June 2024 greatly reduces the need for immediate liquidity. It also allows time for the sale of other non-coin assets such as CoinDesk.

Financial Times hair reported that DCG recently sold part of its Greyscale Ethereum Trust (OTCQX:ETHE) holdings. But mind you, at $22 million dollars, this is a relatively small percentage of their entire Grayscale holdings, and their other sales were also concentrated in altcoin holdings, rather than Bitcoin.

Furthermore, time is critical as Grayscale pursues litigation against the SEC regarding the possibility of converting their Bitcoin Trust into an ETF. Conversion to an ETF will provide a mechanism through redemptions to reverse the discount to NAV. Oral arguments are set for March 7 and a ruling is expected in the second quarter. This lawsuit is just the first step in reversing the discount to NAV apple, but neutral legal pundits somewhat surprisingly favor Grayscale’s argument in the lawsuit.

Simply put, Grayscale’s main claim is that the SEC acted arbitrarily by treating Grayscale’s ETF conversion proposal differently than “equivalent” Bitcoin futures ETFs.

If the exchange’s monitoring sharing agreement with CME is sufficient to detect and deter fraudulent or manipulative activity in spotbitcoin markets, spotbitcoin ETPs and bitcoin futures ETPs are equally protected against such activity.

Grayscale v. SEC, Enrollment writer10/11/22, p. 32

Regardless, the coming year should bring increased clarity on how Grayscale plans to implement a mechanism that will naturally reverse the discount to NAV on Bitcoin Trust. Equally important, fears about Grayscale’s overall relationship with the Genesis bankruptcy, along with concerns that DCG will become a large forced seller of GBTC shares as part of the bankruptcy restructuring, are likely exaggerated. The deal even carefully aligns creditors with the long-term success of DCG and Grayscale.

Due to the current 47% discount to NAV, I confirm my December “buy” upgrade on GBTC for those with a sufficiently long investment horizon. The risk remains high, but the compensation even if the discount appears to be too great.

My new marketplace service is coming soon. Complete Crypto Analytics will launch in the near future and will provide model allocations for Bitcoin and Bitcoin adjacent names such as GBTC and the miners. Keep reading my articles here for updates so you can reserve your spot as a senior discount member. Thank you for following my work.

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Be aware of the risks associated with these stocks.