MicroStrategy’s Bitcoin-powered rally has already started (technical analysis)

Marco Bello / Getty Images News

The relentless sale that took place in risk assets earlier this year caused the prices of growth-oriented assets to plummet. It certainly created some pain for investors, but as I have made clear in my posts over the last month or so, the worst, I think, is some distance behind us. It has made me look forward to assets that I think are bargains, and back in mid-June, which led me to Microstrategy (NASDAQ: MSTR).

MicroStrategy is a software company for companies, but I dare say that no one cares that it has a software business anymore. About two years ago, the company began buying Bitcoin (BTC-USD) to add to the balance sheet, and it has become one of the largest Bitcoin holders in the world. This has made MicroStrategy quite simply an exploited game at the price of Bitcoin, because the software business is far too small to matter in the context of the company’s Bitcoin holdings.

Now I said on June 21 that I thought Bitcoin was at the bottom, and so far so good; I have not seen anything happen in the last month that has put me out of this position. Should we have another collapse, I will come from that, but the facts are the facts and to my eyes they support a sustainable bottom. With that in mind, if you are bullish on Bitcoin, you should be very bullish on MicroStrategy.

In mid-June, I also published a bullish article on MicroStrategy which said that if you are looking for Bitcoin exposure, you will own MicroStrategy.

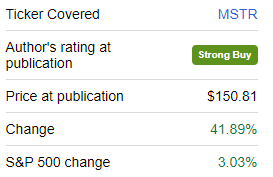

Seeking Alpha

The stock has risen 42% since then, against +3% for the S&P 500. I had several reasons to like MicroStrategy then, and in this article I intend to give an update given we have seen such a huge movement in the past five weeks or so.

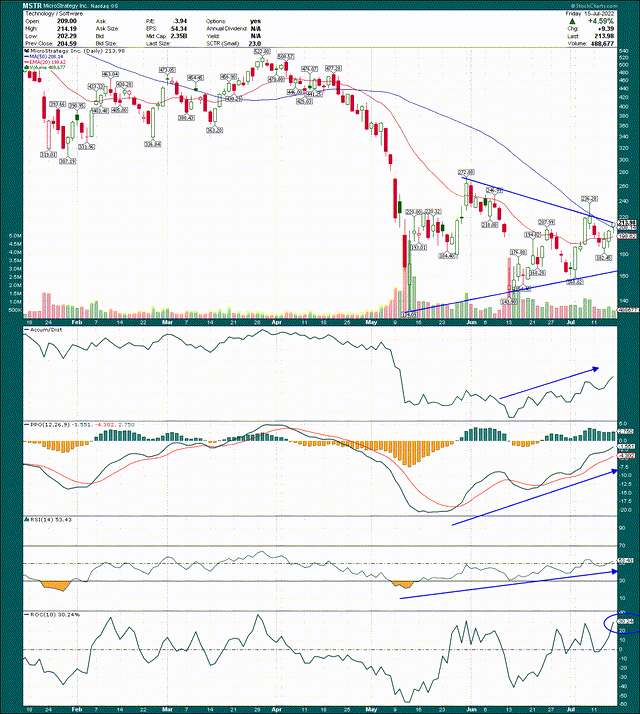

Now that we have some context, let’s start with a daily chart.

Stock charts

MicroStrategy has produced some very bullish price promotions in recent weeks, which is hardly surprising given the 40% + gain. However, this builds a more bullish case for me, instead of it looking like the move is over. Is the simple money already earned? Certainly. Are we done? I do not think so.

I have drawn a symmetrical triangle on the price chart with higher slopes and lower heights. That triangle converges with itself, so we get resolution one way or another soon, probably in less than two weeks. The direction this triangle breaks will determine the next major movement of the stock, so follow it closely. You can obviously see which way I am leaning.

Also note that the stock has closed above the 20-day exponential moving average several times, indicating the start of a new uptrend. In addition, the 20-day EMA is crossing the 50-day simple moving average in a bullish way, which is another indicator that the worst is behind us. The next step after the transition will be to get the 50-day SMA to turn higher, something I expect will happen in the next few weeks.

Then the accumulation / distribution line moves up for the first time in months, which means that big money buys falls instead of selling scratches. The A / D line itself is never a reason to buy or sell, but in the context of what else we can see, there is another reason to be bullish.

PPO looks very bullish at this point in time, having created what should be a significant bottom, and almost returned to the center line from -20 at this rally. When we retire next time, I expect a much higher low on PPO, which in turn suggests a sustainable bottom.

The 14-day RSI makes similar moves as the PPO, showing improved momentum as the stock rises.

A note about the 10-day change rate in the bottom panel is that we are up ~ 30% in two weeks, so do not be surprised to see some consolidation and / or sales to avoid this. This stock is moving in huge sizes all the time, so such rallies are happening. Sales of similar sizes are also happening, so I just wanted to point out that we are overbought in very short time frames. It favors another shot inside the triangle before the last push-out, but we’ll see. Just something to keep in mind.

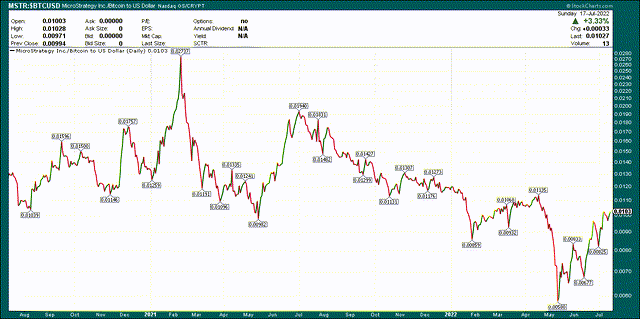

Let’s now take a look at the price of MicroStrategy in relation to Bitcoin itself. This is a measure of relative value, which is very relevant given that MicroStrategy is simply a proxy for Bitcoin at this time. The chart below improves the relative value of MicroStrategy to Bitcoin as the line moves down, and deteriorates (or becomes more expensive) as the line moves up. This is a two-year chart, roughly equivalent to when the company began storing Bitcoin.

Stock charts

We can see here that the value of MicroStrategy in relation to Bitcoin was extremely strong two months ago. It was still pretty good a month ago, and even today it is well towards the bottom of the historic area. I do not suggest that we will see a return to the staggering heights when MicroStrategy’s stock price was 6X what it is today, but on a relative basis the stock is still very cheap in relation to the asset it shares its fate with. This means that when / if Bitcoin accumulates, we can get a double tailwind on MicroStrategy of 1) rising underlying Bitcoin value and 2) more extensions back to historical levels.

Other considerations

While I paint a bullish picture, of course, there are huge risks involved in owning cryptocurrencies or related stocks. MicroStrategy has put massive efforts into the future price action of Bitcoin, and if that does not work, the company may be forced to liquidate at very low prices, destroying huge amounts of money in the process. It’s a risk, and something you want to keep in mind if you decide to take a stand. This is about as far from a buy-and-forget stock as I can imagine.

The first half of 2022 has been a strong reminder to all of us of how quickly things can be resolved in the world of risk assets, and we have no guarantee that Bitcoin has actually bottomed out. I can not count how many forecasts I have seen in recent weeks about how Bitcoin is judged and goes to $ 10k or $ 12k before it bottoms out. It’s the kind of emotion I love because it means the pessimism is very high. It’s hard to buy in the face of a constant drum of negative news, but it’s exactly the time you want to buy. Another reason I love technical analysis is that it removes all that noise and only focuses on facts about price action. Let others generate fear and groan while focusing instead on making money.

The mistakes we have seen in the crypto world have been alarming, but remember that any industry that goes through a downturn sees errors. How many banks went under during the financial crisis? How many consumer companies fail during recessions? The list goes on, but those industries are not dying out; we simply lose the weakest players. As long as you do not spend your capital on the weakest players, the risk of a total explosion should be manageable. It’s a choice every investor must make for themselves, but crypto haters trumpeting a handful of errors indicating that crypto is a doomed venture are ridiculous.

I will mention again something I talked about in my last piece about MicroStrategy, and that is the risk of a margin call. The $ 21k level of Bitcoin was said to be critical for the loans the company has taken out to buy Bitcoin. This is one of the additional risks of MicroStrategy; The company is leveraged by spending ~ $ 2.4 billion in long-term debt for some of its Bitcoin purchases. However, the company had over 90,000 unencumbered Bitcoin last month as well, which means that it would simply contribute more Bitcoin to the security of the debt, thus avoiding a margin call. The margin call ended up being fear for no reason, given the price of Bitcoin went well below $ 21ki in a short period of time. If Bitcoin falls below $ 21,000 again, just remember that the company owns nearly $ 2 billion worth of unencumbered Bitcoin.

One last point I want to make is that MicroStrategy’s short interest is up to 38%, according to Seeking Alpha. When two out of five stocks are shorting, volatility tends to be huge, but there is another important thing to keep in mind. Short hugs are a real phenomenon, but remember that they are very rare. Certain conditions must be met, including a very high percentage of the float that is short-circuited, but we also need a high-volume trigger. If I’m right about the current consolidation resolving higher, we could see a short hug. To be clear, I’m not saying we need a short hug for the bull thing to work, but I’m saying it’s a possibility. When the price reaches a point where the majority of the shorts are under water, that is when the panic purchase can set in. It is impossible to know the exact point because we do not know when the 38% of the float was shorted. However, high volume outbreaks tend to produce clamps if they are to occur. We’ll see.

Last thoughts

I have not seen anything in the last month or so that has put me out of the bull case for Bitcoin. That’s the key to the micro case for MicroStrategy, and I’m certainly still bullish. The movement of 40% + we have seen since the previous article was very nice, but I also think there is a lot more left on this one in the coming months. Volatility will remain epic on this one, so if you are risk averse, this is not for you. But by using technical analysis, we can remove the fear and emotions and put the odds in our favor. The bottom line is that I think MicroStrategy’s current consolidation will resolve higher in the coming weeks, and if you’re bullish on Bitcoin, this is one to keep on your watch list.