Can BTC and ETH bounce off the 38.2% Fibonacci retracement?

Bitcoin continues its downward trend and has now slipped below $22,000, while the global cryptocurrency market capitalization is on the verge of falling below $1 trillion. Most cryptocurrencies, including Bitcoin and Ethereum, have seen falls in recent days.

These declines were triggered by US-based crypto exchange Kraken’s decision to suspend its betting service and pay a $30 million penalty to the SEC for failing to register the business. As a result, the cryptocurrency market has been negatively affected, leading to the loss of BTC.

On a positive note, the upbeat comments from several notable figures on Bitcoin prices are seen as a key factor in preventing further losses for BTC. Pantera Capital CEO Dan Morehead, for example, believes that despite some market pessimism, Bitcoin has already started its next bull market cycle.

Meanwhile, Adam Back, the co-founder of Blockstream, is optimistic that Bitcoin (BTC) will rise in value to $10 million in the next nine years, increasing its market size to over $200 trillion. In addition, Bitcoin mining companies such as Core Scientific, Riot and CleanSpark experienced an increase in their cryptocurrency production in January. This is seen as another critical factor that can help limit BTC price losses.

In this post, we will examine the possibility of Bitcoin and Ethereum bouncing off the 38.2% Fibonacci retracement and the potential implications for their prices.

Risk-off crypto market

The global cryptocurrency market has experienced a significant sell-off, and there is a possibility of it falling below $1 trillion. Bitcoin (BTC) failed to surpass the $22,000 mark over the weekend and is currently trading well below that level. Other popular cryptocurrencies such as Dogecoin (DOGE), Ripple (XRP), Solana (SOL) and Litecoin (LTC) have also suffered losses.

However, the declines were caused by US-based cryptocurrency exchange Kraken’s decision to stop its betting service and pay a $30 million fine to the SEC for failing to register the business.

According to a recent report, the SEC and cryptocurrency exchange Kraken have reached a settlement that clarified that staking as a technical service will continue in the US, but with more transparency around tokens entering the staking pool to prevent misuse of funds. This development resulted in an increase in the price of floating staking tokens.

Two macroeconomic factors that have caused price swings across the cryptocurrency market are regulatory uncertainty and higher-than-expected consumer prices in December.

Blockstream co-founder Adam Back predicts that Bitcoin’s market cap will reach $200 trillion

Blockstream co-founder Adam Back believes that Bitcoin (BTC) could reach a market cap of over $200 trillion and rise to $10 million in value over the next nine years.

Adam stated in a Twitter thread on February 12 that this price can be achieved if BTC continues to grow at a 2X rate over the next nine years. However, the news has not had a significant impact on BTC prices.

Pantera Capital CEO Insights on Bitcoin’s Bullish Momentum

Pantera Capital CEO Dan Morehead has recently stated that Bitcoin has entered its next bull market cycle. According to Morehead, investors should not be deterred by the cryptocurrency market’s post-FTX decline, as Bitcoin is now in its seventh bull cycle.

In the company’s Blockchain Letter, he predicted that 2023 would be a year of regained confidence in the cryptocurrency sector and acknowledged that it had bottomed out during this cycle.

It is worth noting that the news that Bitcoin is entering its next bull market cycle, as stated by Pantera Capital CEO Dan Morehead, could have a significant impact on BTC prices and could help limit further losses.

The strong US dollar: effects and implications

The strength of the US dollar is another factor weighing on cryptocurrencies. On Monday, the broad US dollar index rebounded to hit a five-week high, driven by expectations of more Federal Reserve policy tightening ahead of critical consumer price data due the next day.

The broad US dollar index has held close to its five-week high against major rivals.

The US dollar has been strongly supported since the release of significantly stronger-than-expected US jobs data earlier this month, and recent comments from the Federal Reserve have tended to be more hawkish, further adding to the currency’s strength.

Bitcoin Hash Rate Shows Significant Growth

According to a new Hashrate Index survey, the first production report for 2022 from listed Bitcoin mining firms indicates a continuous increase in hash rate and a sharp increase in BTC production compared to the previous month. This may be due to better weather conditions and steady electricity prices.

In January, the majority of Bitcoin miners increased their output, with CleanSpark increasing its output by 50% and setting a new monthly record of 697 Bitcoins. Riot, the second largest producer, mined 740 Bitcoins in January, while Core Scientific remained the top BTC producer, having produced 1,527 coins.

As a result, this development can be seen as a positive factor that can help prevent further declines in BTC prices.

Bitcoin price

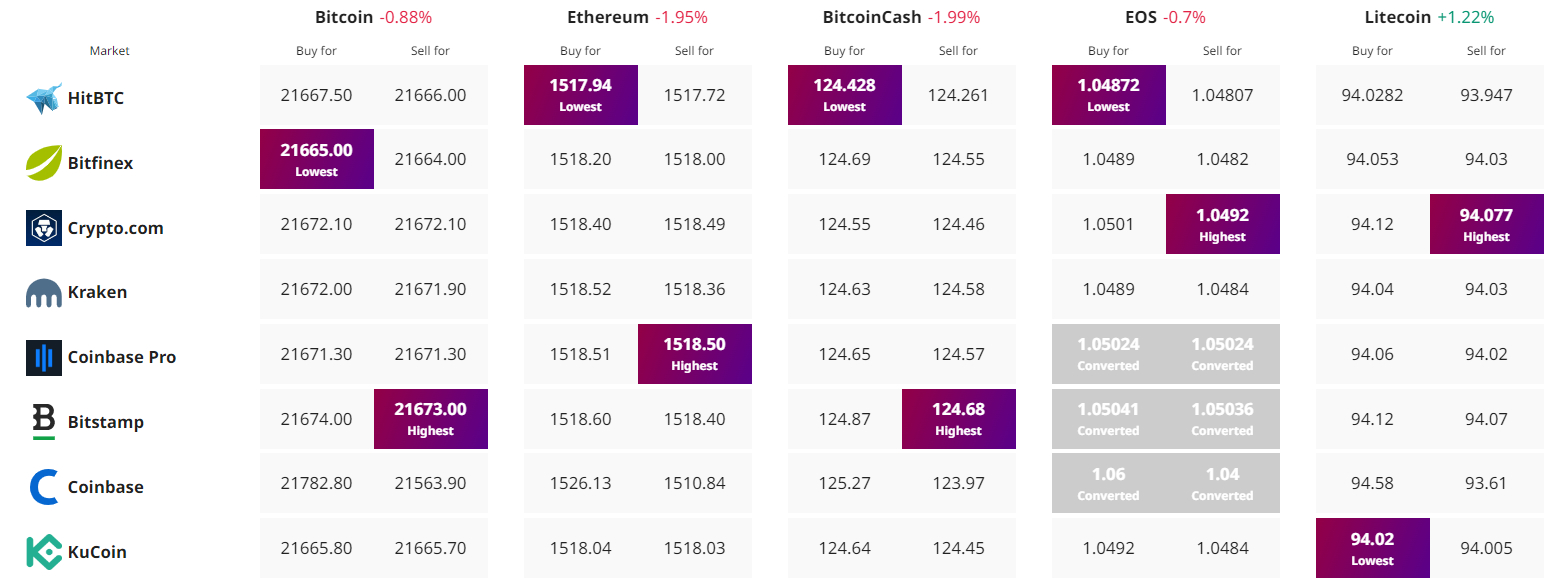

The current value of Bitcoin stands at $21,898 as of today, with a trading volume of $19 billion in the last 24 hours. Over the past 24 hours, Bitcoin has decreased by less than 0.50%.

According to CoinMarketCap, it is currently ranked #1 with a market cap of $422 billion. The circulating supply of Bitcoin is 19,289,343 BTC coins, while its maximum supply is 21,000,000 BTC coins.

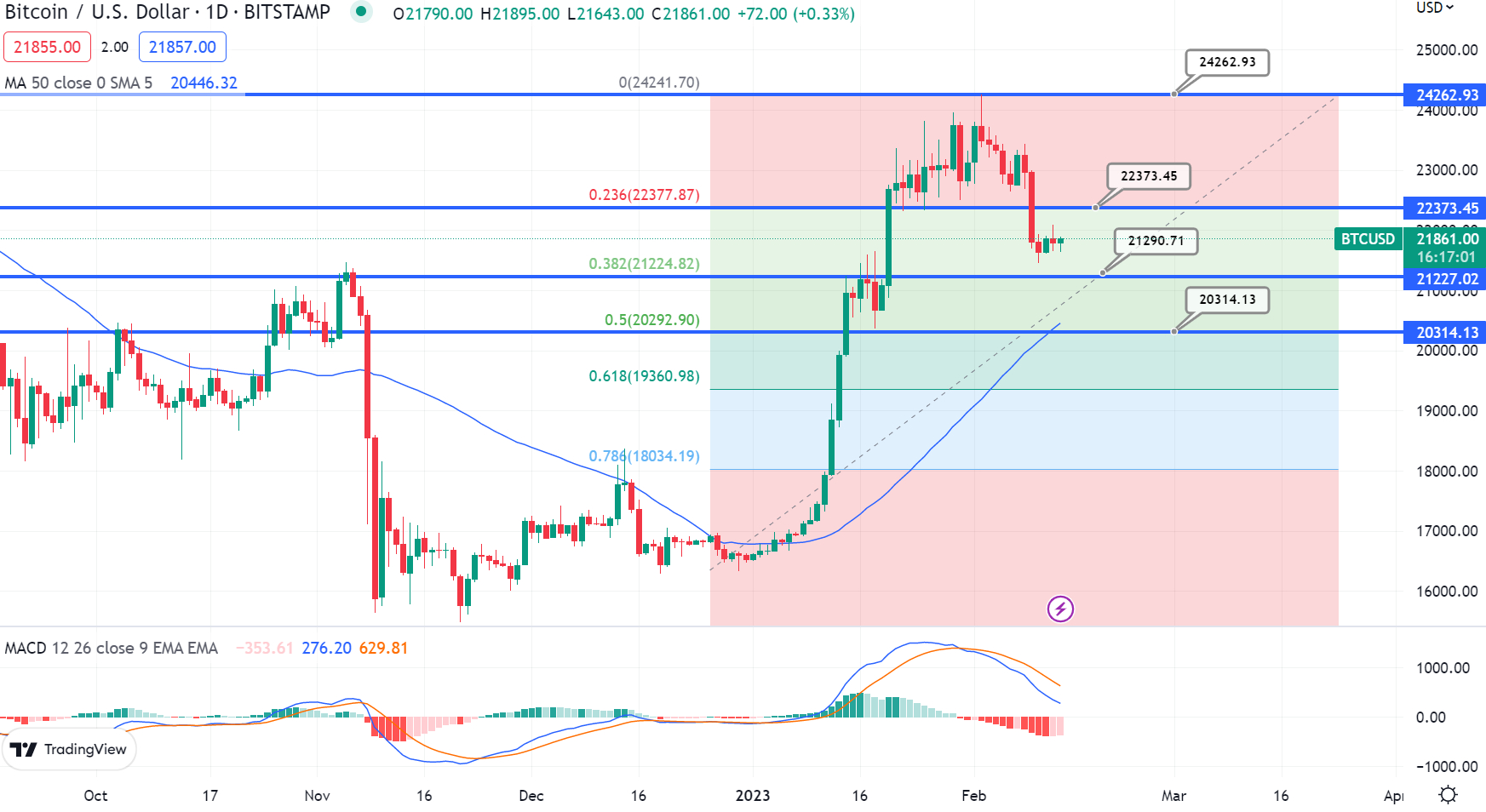

On the technical front, Bitcoin is now approaching a 38.6% retracement at the $21,290 level. A breach of this level could open up more room for selling, potentially leading to a drop to the $20,300 level.

However, if the candle closes above the $21,300 level, there is potential for a bullish bounce, with the possibility of reaching the $22,375 level. An increase in buying pressure could further propel the price of BTC towards the next resistance level of $24,260.

Buy BTC now

Ethereum price

The current Ethereum price is $1.524 with a 24-hour trading volume of $6,301,002,828 ETH. The crypto’s loss of 0.50% in the last 24 hours makes it the #2 spot on CoinMarketCap and has a market cap of roughly $186 billion.

On the technical front, Ethereum is trading just above the 38.2% Fibonacci retracement level at $1,500, which also serves as a double-bottom support level. Close candles above $1,500 have the potential to drive an uptrend to the $1,560 level.

This resistance level is driven by an ascending channel that was previously broken on Friday. The break above $1,560 could expose BTC to the $1,600 or $1,680 level.

If you can break above $1,560, ETH prices will stay up and ETH traders will have better opportunities to make money. If not, ETH prices are predicted to fall and reach the $1435 level.

Buy ETH now

Bitcoin and Ethereum alternatives

We have recently identified the top 15 cryptocurrencies of 2023 that are set to be the biggest in terms of market cap. If you want to invest in something more promising, there are many other options to consider.

Cryptocurrencies and ICOs are becoming more prevalent, with a new one being offered every week.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

Find the best price to buy/sell cryptocurrency