Coinbase Buyers Drive Bitcoin Higher Or Did They?

Bitcoin (BTC) has gained nearly 28% this month, hitting its highest since early November. The popular tale on Crypto Twitter is that traders from Coinbase (COIN) have driven the cryptocurrency higher. However, the Nasdaq-listed exchange has not been the only source of bullish pressure for the cryptocurrency.

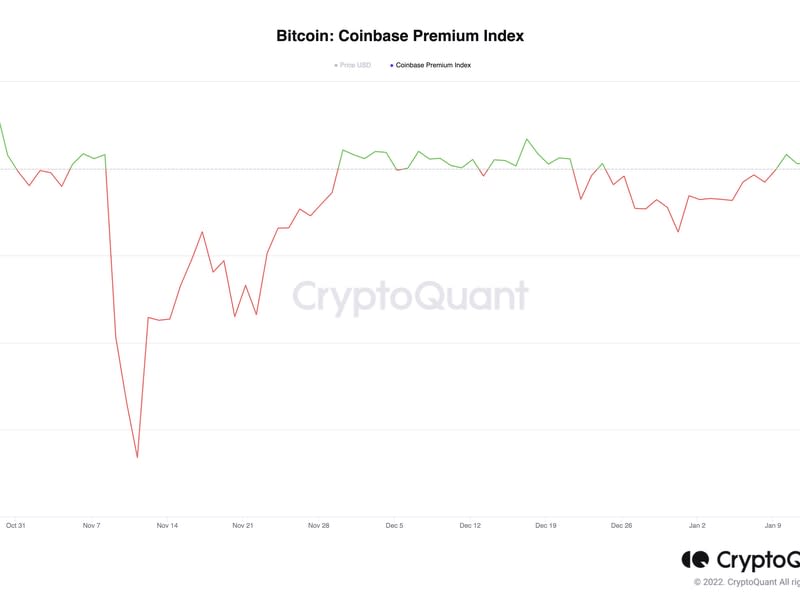

The Coinbase Premium Index, which measures the spread between Coinbase’s BTC/USD pair (USD) and Binance’s BTC/USDT pair involving the tether stablecoin, turned positive last week and rose to 0.039 over the weekend, the highest since late October, per data sourced from blockchain analytics firm CryptoQuant.

In other words, the indicator suggests that the buying pressure on Coinbase has been relatively stronger.

“The price premium between Bitcoins traded on Coinbase relative to those traded on Binance (the Coinbase-Binance premium) continued to be positive throughout the week, indicating increased buying interest from institutional investors relative to retail investors,” André Dragosch, head of Deutsche Digital Assets, wrote in a note to clients.

Institutions prefer publicly traded and regulated Coinbase over offshore entities such as Binance, which are considered a proxy for private investor participation. Binance is now taking steps to establish itself as an institution-focused platform.

However, another indicator called the cumulative volume delta (CVD), which measures net capital inflows into the market, suggests that the rally began with Binance-based entities bidding for bitcoin with BUSD, a fiat-backed stablecoin issued by Binance and Paxos, in the perpetual futures market . And buyers from Coinbase and other exchanges joined the fray later.

A rising CVD means that more buyers are in action, while a negatively sloping line suggests that there are more sellers.

The chart sourced from Coinalyze.net and tweeted by pseudonymous analyst exitpump (@exitpumpBTC) compares the Cumulative Volume Delta (CVD) of the BTC/BUSD pair listed on Binance (yellow line) with the CVD of the BTC/USD and BTC/USDT pairs listed on other exchanges and Binance.

The yellow line has been going up since January 11, while the green line started rising three days later. In other words, bitcoin’s initial rise from $17,000 was mainly driven by solid bidding in Binance’s BTC/BUSD market while buyers from other exchanges, including Coinbase, stepped in later.

“From my observations, it was pretty much one unit [from Binance] bids and absorbs selling pressure and tries to create a market that buys and constantly eats the selling walls without signs of exhaustion, leading to short squeezes that pump the price.” exitpump tweeted.

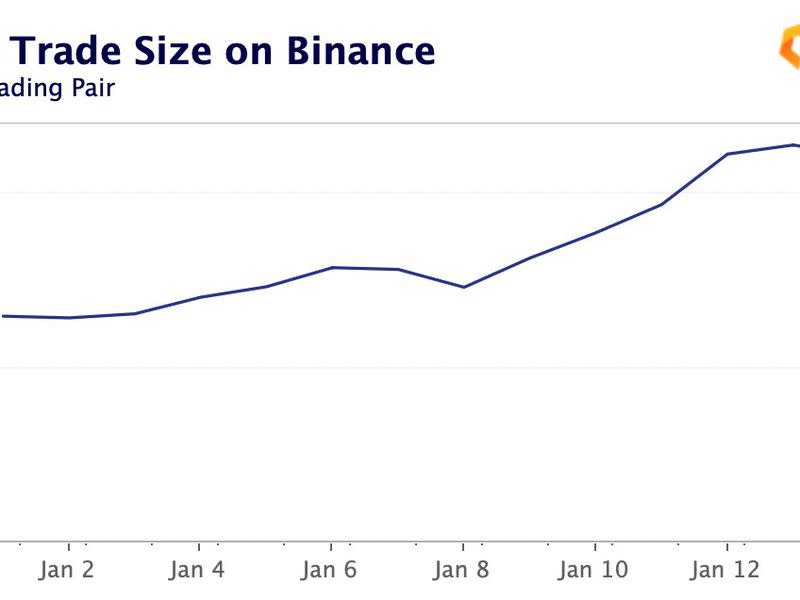

Meanwhile, other metrics, such as average trade size, suggest an absence of clear leadership and a general increase in whale activity.

“In terms of average trade size, there has been a noticeable increase on Bitstamp, Kraken, Bitfinex and LMAX Digital and a slight increase on most other exchanges, including Binance, suggesting more whale-driven price action,” Clara Medalie, research director at Den Paris- based crypto data provider Kaiko told CoinDesk in an email.

The average trade size on Binance has increased from $700 to $1100 since January 8th.

Bitcoin changed hands at around $21,150 at press time, after rising nearly 22% last week. The rally stemmed from the belief that worse macroeconomic risks may be behind us.

“It’s not just the acceptance that peak inflation is behind us and that interest rates probably don’t have much more to rise. It’s also that most sellers have been washed out of the market,” Noelle Acheson, author of the popular “Crypto Is Macro Now” newsletter, said in this weekend’s edition of the newsletter, explaining the price increase.