Bitcoin is up 40% in 2023; Here’s Where It Goes Next (BTC-USD)

da-cock

Two months ago we announced that we are buying Bitcoin (BTC-USD) in the analysis: “Bitcoin is going to rally again, here’s what you need to know.”

Here’s what we said on December 9:

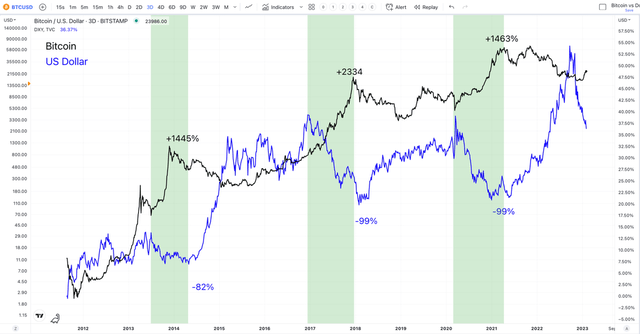

Although we are in 4th bear cycle in Bitcoin’s history, the previous three cycles suggest where we are is a rare buying opportunity. There is plenty of evidence to support the $15,500 level is either a major low or very close to a major low. Both the technical and chain analysis support this.

Due to technical analysis combined with the chain analysis provided by WealthUmbrella, it became clear that we were at a major low and we notified our followers about this important moment. Since then, Bitcoin has gained 40% and we see the next correction as potentially another moment when we can increase our position.

Below, we update the new developments in Bitcoin’s price patterns, as well as the on-chain metrics that we tend to see around historic lows. We will also take a look at the fundamental thesis surrounding Bitcoin’s utility, and why a globally indebted economy combined with structural inflation will only benefit from Bitcoin.

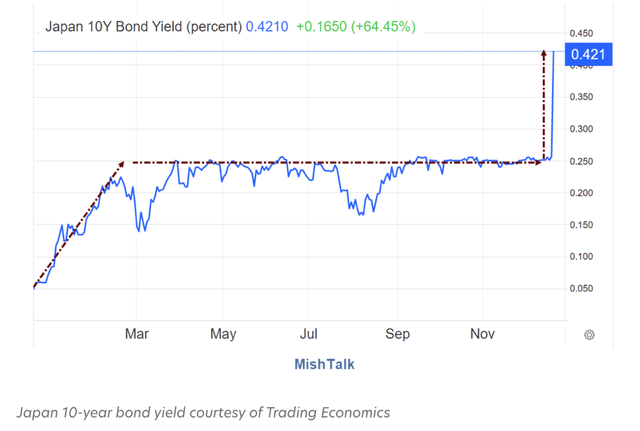

Our first sign of this problem occurred when the Bank of England abandoned the fight against inflation to support the currency. This was followed recently when we saw signs that the Bank of Japan could potentially lose control of the bond market as it began to bow to inflationary pressures. It appears that central banks are being put into a wingless corner where they must choose between fighting inflation or causing a fiscal spiral in their economies. As these issues grow, Bitcoin’s alternative to centralized fiat system will become more attractive, which I think will show in the price action.

Bank of Japan, Inflation and Bitcoin

Last month, the Bank of Japan (BoJ) surprised markets by widening its 10-year government bond from 0.25% to 0.50%. This may seem small, but this move plunged markets and sent ripple effects across asset classes globally. The reason why the change in bond yields had a strong effect is that Japan has excessive public debt, and the concern is that it will cost Japan more until now. service this debt.

Most countries have high debt levels due to a decade of negative to zero interest rates. However, Japan’s debt is one of the worst globally with a debt ratio of 262.5%. Like most central banks emerging from the Great Financial Crisis, the Bank of Japan embarked on a series of programs to combat deflationary forces. Unlike most economies, Japan’s rapidly declining population, among other factors, had its central banks fighting deflationary forces that most of the world did not have to deal with.

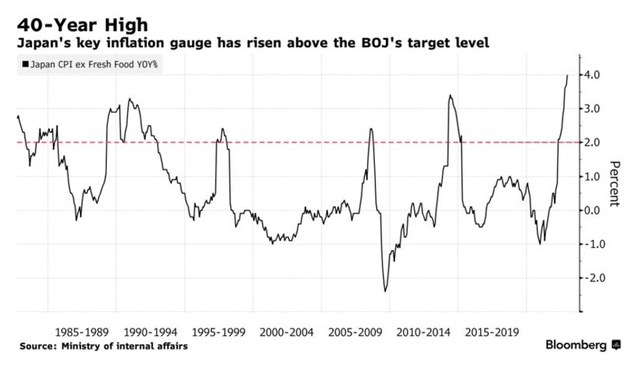

As a result, Japan decided to take central banking engineering one step further. They set a goal of achieving a 2% CPI at all costs. So they announced a new yield curve control policy. In order to maintain a yield below where the market would naturally price it, the BoJ had to sacrifice its balance sheet to achieve this goal. In short, any bond that traded above their target, they bought.

Mistalk

One of the by-products of artificially low interest rates in countries that issued public debt in their own currency was a very high public debt to GDP ratio. With interest rates at persistently low levels, governments were encouraged to borrow under the assumption that inflation was likely to always be under control.

What this means is that Japan, as well as other countries with high debt-to-GDP ratios, cannot tolerate higher yields. The higher the yield, the more it will cost the Japanese government to service this debt. If they go too high, the Japanese government risks defaulting on their loans.

This is not a problem as long as inflation is subdued. However, like the rest of the world, Japan now has a high CPI around 3.7%, which is much higher than their target.

Bloomberg

So now they seem to be approaching the playoff scenario. They must fight inflation by raising interest rates, but if they raise too high, the bond market will lose confidence in Japanese debt. This is what happened in England last year when the new administration announced a sweeping spending bill combined with tax credits in the face of a growing energy problem. In short, the bond market stopped playing ball. As the debt was sold and yields rose, this left the Bank of England with no choice but to once again become the buyer of last resort, while having to deal with high inflation.

If 3rd largest economy in the world, and the second most important currency loses control of the bond market, the Bank of Japan could be one of the biggest stories of 2023. How does this relate to Bitcoin? Bitcoin is seen as an alternative to the centralized fiat money system. Because it is not centralized, it is not subject to the results of monetary manipulation and corruption. Bitcoin is an easy and safe way out of a country’s fiat system, for better or for worse.

Whether you agree or not is irrelevant. The perception that Bitcoin is an alternative is what matters, just as the perception that gold is an alternative is also important. The more problems that unfold with the inevitable collapse of the global fiat money system in the face of systemic inflation, the more a country is likely to adopt it.

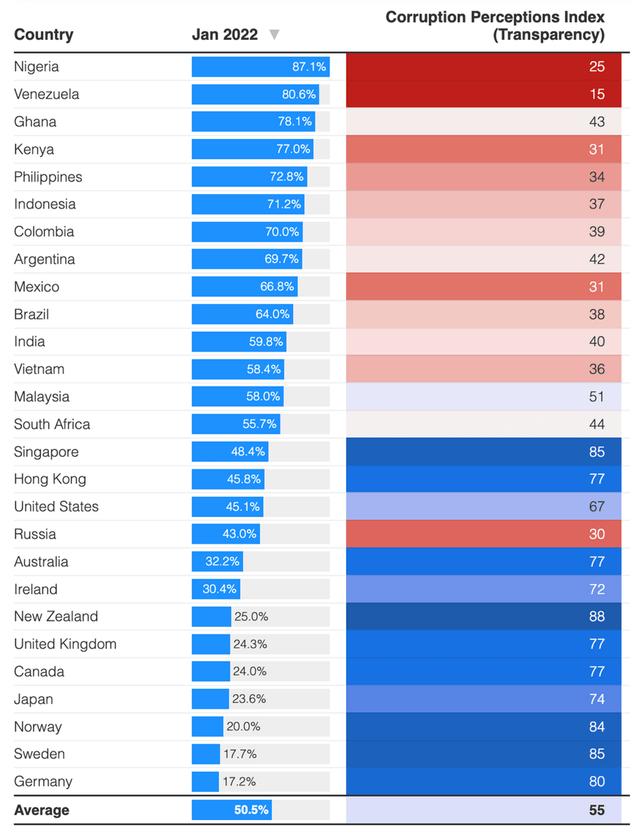

We see a clear connection between corruption and crypto adoption. This is a relationship that has persisted for years.

Trust nodes

The reason for this connection is because with systemic corruption comes economic difficulties, increased inflation and in some cases hyperinflation. Before Bitcoin, citizens have historically had no practical way out of their country’s currency, so they have been trapped.

Not all economic difficulties are the result of corruption. We have seen global central banks embark on the biggest monetary experiment in human history, marked by countless policy mistakes and questionable decisions. In the United States, we see a clear connection between the strength of the US Dollar and Bitcoin.

I/O fund

When the dollar is weak, or we see the FOMC back down in light of having to tighten, Bitcoin takes a bid. So, clear correlations and tools are being developed with Bitcoin that are in line with the monetary issues that are unfolding. We only expect this relationship to strengthen into 2023 and beyond. Structural inflation is likely here to stay, meaning global central banks will inevitably follow Japan in Yield Curve Control programs to prevent a fiscal spiral. There is simply too much debt in the system, and not enough buyers of new issues. This will only enhance Bitcoin’s attractiveness.

Analysis of the chain

Bitcoin does not have income reports. You cannot do classic fundamental analysis on this asset to determine the underlying strength. For this reason, crypto has relied mainly on technical analysis, until recently. Some researchers have revealed that Bitcoin offers its own unique form of fundamental data found on the public blockchain. This data, called on-chain data, allows us to track multiple patterns that can provide clues to major turning points. The following data was provided by Vincent Duchaine of WealthUmbrella, whose company has developed an automated algorithm to help retail investors navigate risk-on and risk-off environments.

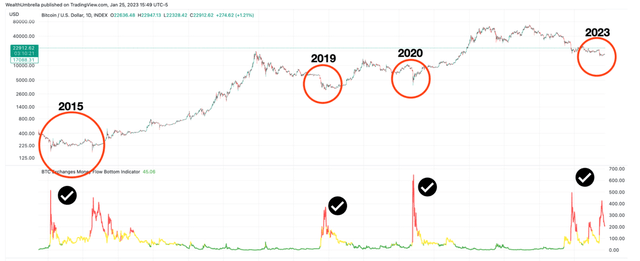

In the previous article, we noted that various indicators on the chain indicated that a bottom was likely:

Overall, most on-chain metrics from all layers of the Bitcoin ecosystem provide infrequent readings that tend to flash around major bottoms.

Specifically, the indicators tracking money flow in and out of exchanges saw a peak in June 2022, which was the third highest recorded in Bitcoin’s history. Despite the FTX (FTT-USD) event in November, this indicator formed a lower high, suggesting that fears are fading.

Wealth Umbrella

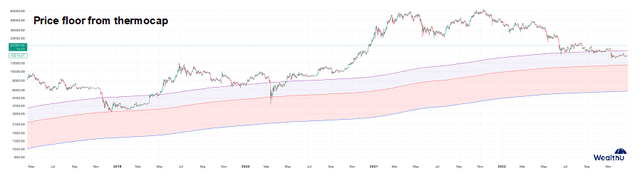

In addition, Bitcoin’s price was in a range that we rarely see, and has historically marked major lows. What the area below measures is the ratio of Bitcoin’s market capitalization (price x number of coins in existence) to the thermocap (the price of each coin when it was last purchased x number of coins in existence). Bitcoin’s price was in the middle of our “value zone” that has marked major turning points in the past.

Wealth Umbrella

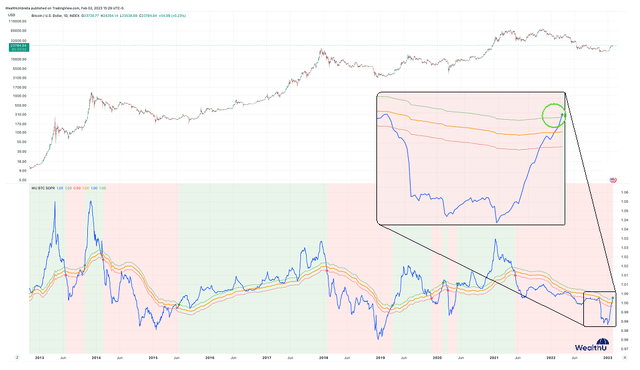

Further evidence that a new bull cycle is developing can be seen with the Spent Output Profit Ratio (SOPR). This is calculated by examining all daily transactions on the Bitcoin blockchain and determining whether the coins were traded at a profit or loss based on the price of the last time they moved. A ratio of 1 indicates that all Bitcoins moved on a given day were sold at the same price as they were bought. A ratio above 1 means that people, on average, sold at a profit, and below 1 means at a loss.

The SOPR signal can be noisy from day to day, but when properly filtered, it can be a good indicator of the current market phase. It may prematurely signal a peak and may hang on to signal a new uptrend. As of last week, this signal turned positive, and it is worth noting that it has not given any false signals throughout the history of Bitcoin, despite sometimes being late in calling an event.

Wealth Umbrella

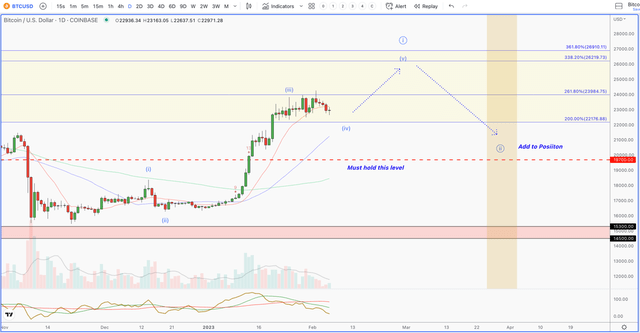

The analysis above is just a handful of metrics used to improve our odds of catching another bull cycle. The final evidence will come from the developing price pattern from the 2022 low. So far we have only 3 waves up from the recent low. We need this to get to one more high to complete the long awaited 5 wave pattern which tends to mark a major trend reversal. If we get the last push higher, the following pullback will be where we add to our position.

I/O fund

In conclusion, our multifaceted analysis of Bitcoin supports the likelihood of a major trend reversal. This is not confirmed from our end until we see that prices will stay high in the coming weeks towards the $25,600 region. Interestingly, this new bull cycle coincides with a weakening of the US dollar. It is also accompanied by more central banks being put into inevitable corners. Structural inflation is probably here to stay, and it will not be easy for indebted countries to control this.

This would only lend support to Bitcoin’s original thesis that there is no need for the trusted intermediary in a peer-to-peer transaction. Centralization of our monetary system allows for corruption and political mistakes that can, and do, lead to 2008-style events. The deeper we go into the central bank’s monetary experiment, the clearer it is that this idea has become 15 years later.