Crypto.com (CRO) Price drop may be followed by increase

Crypto.com (CRO) price is showing signs of near-term weakness, which could lead to an initial retracement before the uptrend continues.

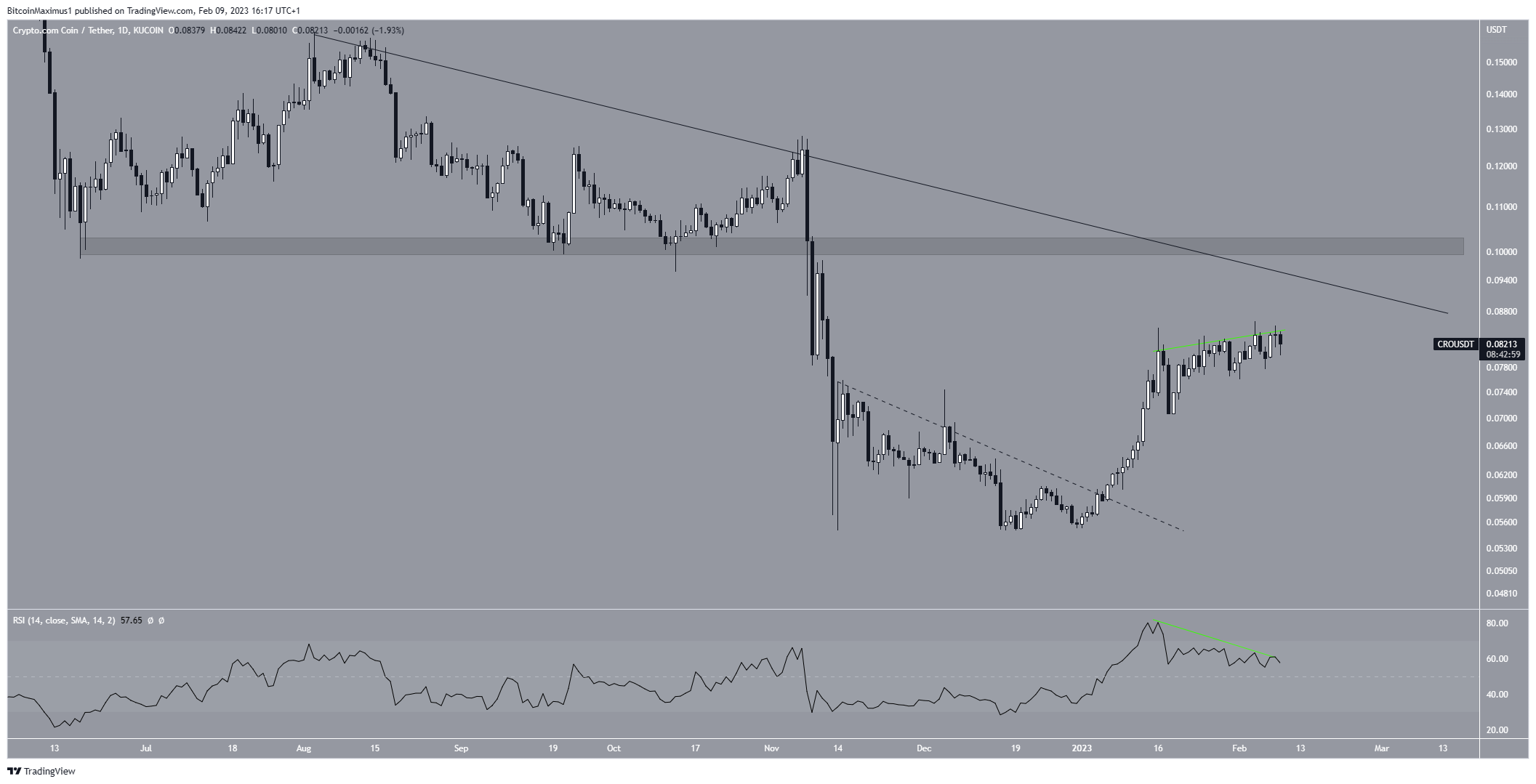

CRO is the native token of Crypto.com’s cryptocurrency exchange. On January 6, CRO price broke through a short-term descending resistance line (dashed). It then rose rapidly, reaching a high of $0.085 on January 19. After a short fall, the price returned to the same level on 6 February. Since then it has been trading a little below.

In addition to a potential double top pattern, the daily RSI has generated bearish divergence. Divergences of this type often precede downward movements. Furthermorethe trend in January has been characterized by long upper weeks, signs of selling pressure.

The main resistance area is between $0.090-$0.101, created by a descending resistance line and a horizontal resistance area. Only when the price breaks out of this confluence of resistance levels can the Crypto.com price trend be considered bullish.

The technical analysis of the short-term six-hour chart indicates that the CRO token price is most likely in wave four of a five-wave uptrend (black). The number of sub-waves is highlighted in red, indicating that wave three was extended.

If the count is correct, the CRO coin price will fall towards the 0.382-0.5 Fib retracement support level of $0.071-$0.074. This may happen within the next 24 hours. After that, the upward trend may continue.

The previously mentioned confluence of resistance levels suggests that the top of the upside move could be near $0.101. However, a more accurate estimate can be provided once wave four is completed.

This bullish CRO price forecast would be null and void if the price fell below the $0.060 high of wave one (red line).

To conclude, the most likely CRO price forecast is a decline towards $0.071-$0.074 before the upward move continues towards $0.100. A decline below $0.0601 would indicate that the trend is bearish. If so, the price may fall below $0.050.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use this information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.