Bitcoin: A New War Begins (BTC-USD)

Burak Fatsa

Bitcoin (BTC-USD) may be headed for another civil war. It wouldn’t be the first time the Bitcoin community has engaged in an internal conflict, but this one could be just as impactful. In many ways it has given The idea of Bitcoin trust is the belief that it is a monetary system without censorship or permission to use.

But every couple of years the Bitcoin community faces an internal challenge, and I think we now have a new one that could eventually turn into a much deeper conversation about what Bitcoin is and what the future is going to look like. In this article, we’ll dive into what Ordinals are, why Ordinals exist, why Ordinals are controversial for Bitcoiners, and we’ll consider what impact a battle over Ordinals might have on the price of Bitcoin afterward.

What are Ordinals?

Simply put, Ordinals is an NFT project on Bitcoin. It works by creating a numbering system for each satoshi that is mined as new blocks are created. A satoshi, or sat, is the smallest unit of division for an entire Bitcoin. Each one is worth a fraction of a penny to $24K BTC. These sat identifiers make it so that some sats have more unique or rare numerical characteristics than others – you can probably think of it in the same way that paper notes can be collected based on rare serial numbers.

Through Ordinals, Bitcoin’s block space is now used to create NFTs through inscription on this new satoshi numbering system. Ordinals was created by Casey Rodarmor, a software developer who saw a need for NFTs stored on blockchains themselves rather than off-chain. Casey explained that problem well in his blog post on Inscription with the Ordinals Project:

For an NFT to be a digital artifact, it must be decentralized, immutable, on-chain and unlimited. The vast majority of NFTs are not digital artifacts. Their content is stored off-chain and can be lost, they are on centralized chains, and they have backdoor admin keys.

This is a legitimate concern, and it’s something I’ve also explored in Blockchain Reaction. While I think there’s a perfectly viable solution to the off-chain data problem that doesn’t require Bitcoin’s block space to be used to monkey-jpeg files, I’m actually not opposed to Bitcoin being adopted in other ways that are a bit more interesting than just “stable rate and hope the price goes up.”

Some important Bitcoin voices don’t like this

Ordinals have created a debate in the Bitcoin community about how the chain’s block space should be utilized and what type of transactions benefit. For the purists, Ordinals are essentially sacrilege and against what Bitcoin’s founder Satoshi Nakamoto would have wanted. There is some merit in that argument. Back in late 2010, Satoshi Nakamoto was not on board with an idea to create a DNS-like service through Bitcoin because of the scalability issues that would come with trying to collect too much data in a small block space. This is what Nakamoto said in the Bitcoin Talk forum at the time:

Bitcoin and BitDNS can be used separately. Users should not have to download both parts to use one or the other. BitDNS users may not want to download everything the next unrelated network decides to collect either.

The idea that Bitcoin should be protected from potential blockspace spamming has even led some Bitcoin developers entertaining idea that miners could censor transactions associated with Ordinals; which would be a very big deal if it were to happen, as it could be argued that censoring what happens on the chain is very much against the original ethos of Bitcoin. However, if it were to actually happen, censoring transactions on the chain would not be the first time Bitcoin has failed to live up to its original intent.

The last civil war

The original goal of Bitcoin was to be a peer-to-peer payment network, and that simply hasn’t been the case. In fact, it could be argued that the HODL approach to Bitcoin actually works against develop real utility through use. In my view, a big reason why some in the Bitcoin community have adopted a HODL approach to Bitcoin is precisely because using the network for peer-to-peer transactions at the base layer is not actually feasible at scale. This is why the “Bitcoin is digital gold” narrative took over the “Bitcoin is digital cash” narrative.

Bitcoin’s inability to scale at the base layer is why the Lightning Network exists. And the scaling problem is also why Bitcoin Cash (BCH-USD) exists. BCH is the product of the last Bitcoin civil war several years ago which consisted of two camps; “big blockers” and “small blockers.” When BTC was originally constructed, there was a 1 megabyte block size limit at launch. This is very small and only allows approx. 7 transactions per second on the base chain.

In the years leading up to the 2016 halving, there was discussion among the core developers about increasing the block size from 1MB to 20MB. This move was contested, and the “small blocks” eventually won. The “big blocks” hard-forked BTC and created BCH, a chain with a block size limit of 8MB. And that brings us to the possibility of another Bitcoin fork. Are Ordinals a controversial enough topic to cause Bitcoin to fork again? I don’t think I’ll get that far yet. But this argument about block space can conceivably escalate in another way.

A tariff war is more likely

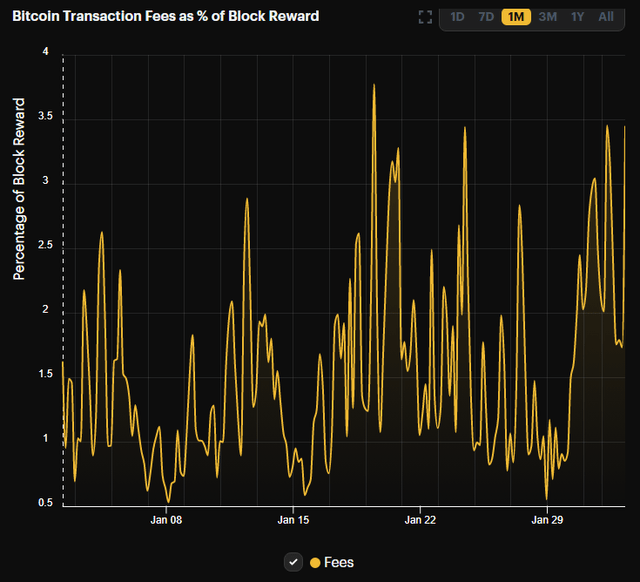

When a user wants to create an Ordinals NFT, they have to pay a higher transaction fee to enter the data into a Bitcoin block. If Ordinals is successful, we are going to see an increase in the transaction fees paid to Bitcoin miners. These fees are generally a very low percentage of the total block reward, but we’re starting to see that percentage tick up since Ordinals launched in late January:

Transaction fees as % of BTC Block Reward (Hashrate Index)

If Bitcoiners who don’t like the Ordinals project want to stop what they see as network spam with a true free market solution, they need to start using the base chain more and be willing to pay transaction fees large enough to incentivize miners to choose their transactions as priority.

The risk of a fee war will be transaction fees that become so burdensome that only very large value transactions can take place on the chain. Which could theoretically hinder the opening of Lightning Network channels enough to actually slow adoption of the chain’s scaling layer.

Main takeaways

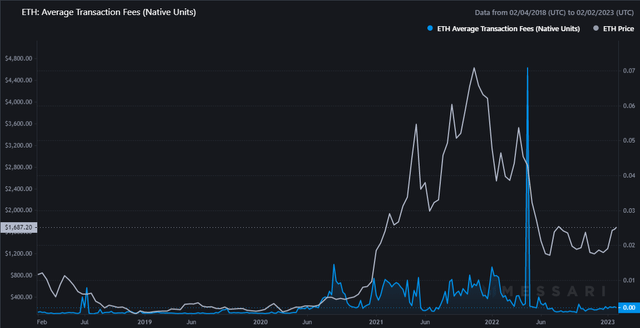

I don’t think Ordinals are a flash in the pan. We saw what the NFT craze of 2021 did to Ethereum’s (ETH-USD) transaction fees:

ETH Native Unit Transaction Fees (Messiri)

Ordinals are at the beginning of what it will be and we are already seeing NFTs globally starting to catch a bid again. Unlike the previous bull market in NFTs, Bitcoin will not hold this one out. Ordinals are now a major talking point in the Bitcoin community. How the opponents of that block placement usage deal with it remains to be seen. However, if there is a competition for block space, fees will likely have to increase significantly. This will be very good for Bitcoin miners and probably Bitcoin’s nominal dollar price as well. It may not be good for actually using Bitcoin for payments. But the HODLers don’t seem to be using it for that anyway.