Three reasons why the Bitcoin price may be witnessing a big short squeeze

- As open interest in Bitcoin is on the rise and funding rates are increasingly negative, analysts predict a textbook briefly squeezing the asset.

- Analysts have identified aggressive buyers moving into Bitcoin and believe it is a clear sign of redistribution.

- $ 20,000 is considered an important psychological level for the Bitcoin price; a weak rally can result in levels below $ 20,000.

Analysts have identified an upcoming short squeeze in Bitcoin where short sellers will be forced to cover to feed a bullish narrative for the big crypto. Bitcoin price has witnessed positive momentum; however, it remains limited. Whether the global economy slips into a recession or not will be a key factor influencing investors considering taking action in the crypto market.

Also read: Bloomberg says the Bitcoin price is tied to a bullish breakout under one condition

Analysts predict a short squeeze in Bitcoin

Will Clemente, a Lead Insights analyst at Blockware, compared the Bitcoin price trend to the 200-day moving average and noted that BTC had been so far below the 200-day moving average a handful of times (<2%). Buying Bitcoin looked daunting in each of these cases; However, Clemente advises investors to acquire BTC since it has risen every time it has been in this position before.

Bitcoin 200-day trend

Clemente claims that Bitcoin is witnessing a card squeeze in the textbook. Open interest in Bitcoin is growing with increasingly negative financing rates and an increase in the asset. Meanwhile, a key indicator is rising, the Cumulative Volume Delta (CVD), which measures liquid volume inflows for assets. An increase in CVD indicates that buyers dominate the Bitcoin market.

Textbook short squeeze $ BTC

Open interest rates rise with increasingly negative financing rates as the price rises. (Shorts)

Meanwhile, CVD is rising, indicating spot bids. pic.twitter.com/ARI27bvpCU

– Will Clemente (@WClementeIII) July 16, 2022

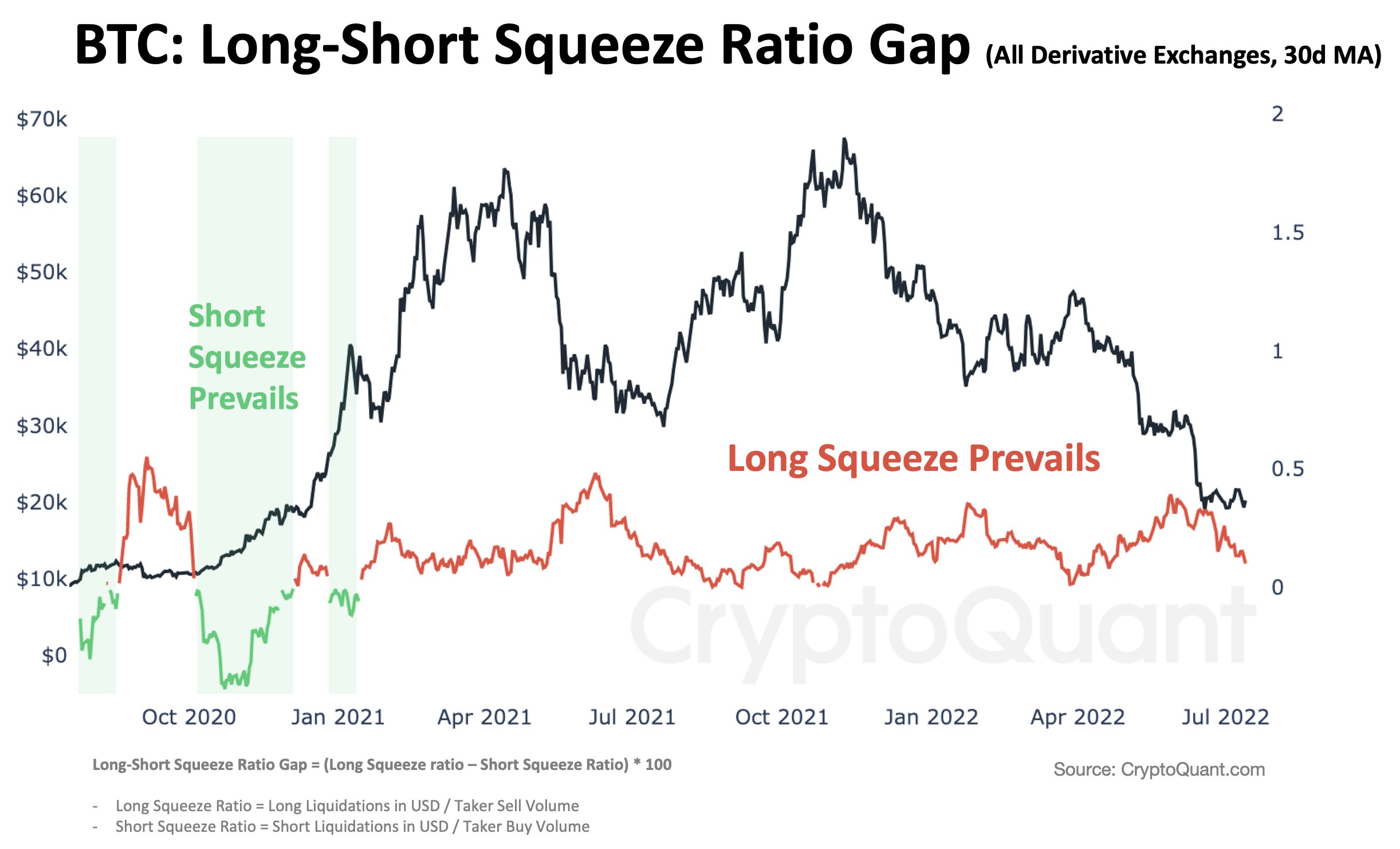

Ki Young Juit CEO of CryptoQuant claimed that at the end of 2020, short positions in Bitcoin were liquidated in the range of $ 10,000 to $ 20,000 ahead of the parabolic bull run. 10% of the hourly market orders were from short liquidations. At present, this figure is 1%. The CryptoQuant boss therefore concluded that Bitcoin could soon witness a major card squeeze.

Bitcoin: Long-Short Squeeze Gap

Ki Young Ju told its followers on Twitter that the Bitcoin price is closer to the bottom, and BTC may witness a trend reversal after the upcoming short squeeze.

$ 20,000 is Bitcoin’s key psychological level

Rekt Capital, a pseudonymous cryptanalyst, notes that The $ 20,000 level is key support for the Bitcoin price trend and plays an important role in determining where the asset is heading. In the event of a slight rise in the Bitcoin price, the analyst expects that the Bitcoin price will fall to the level below $ 20,000.

The #BTC traits that are currently unfolding will be very important to show how strong or weak the psychological level of $ 20,000 is as support

If a weak rally takes place, it would make sense to expect levels below $ 20,000 in the future$ BTC #Crypto #Bitcoin

– Rekt Capital (@rektcapital) July 17, 2022

Analysts at FXStreet warn that a Bitcoin price drop to the $ 17,600 level is possible under these conditions. For pricing and more information, watch this video: