With 39% ownership, Portage Fintech Acquisition Corporation (NASDAQ:PFTA) has piqued the interest of institutional investors

A look at the shareholders of Portage Fintech Acquisition Corporation (NASDAQ:PFTA) can tell us which group is the strongest. With a 39% stake, institutions have the maximum number of shares in the company. In other words, the group stands to gain the most (or lose the most) from its investment in the company.

Given the vast amount of money and research capacity at their disposal, institutional ownership tends to carry a lot of weight, especially with individual investors. As a result, a significant amount of institutional money invested in a firm is generally seen as a positive attribute.

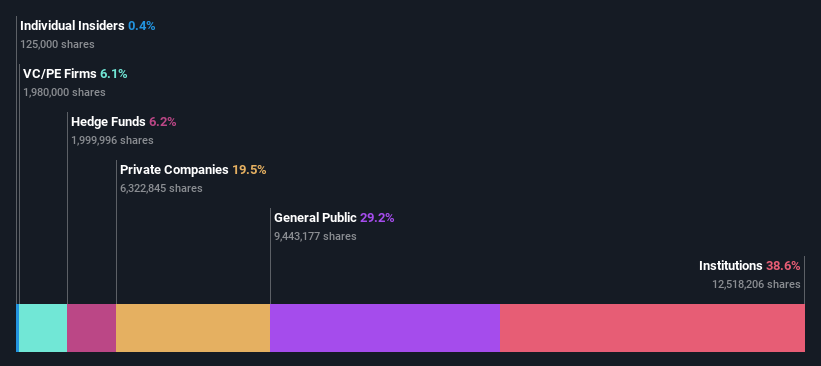

In the diagram below, we zoom in on the different ownership groups of the Portage Fintech Acquisition.

See our latest analysis for Portage Fintech Acquisition

What Does Institutional Ownership Tell Us About Portage Fintech Acquisition?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indexes.

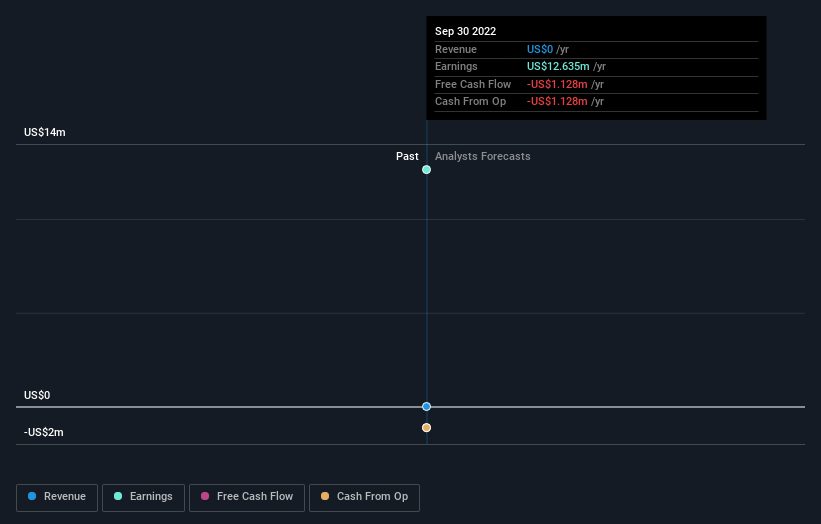

We can see that Portage Fintech Acquisition has institutional investors; and they have a good portion of the company’s shares. This may indicate that the company has a certain degree of credibility in the investment environment. However, it is best to be cautious about relying on the supposed validation that comes with institutional investors. They are also wrong sometimes. If several institutions change their view on a stock at the same time, you can see the stock price drop quickly. It is therefore worth looking at Portage Fintech Acquisition’s performance history below. Of course, the future is what really matters.

Our data indicates that hedge funds own 6.2% of Portage Fintech Acquisition. It catches my attention because hedge funds sometimes try to influence management, or bring about changes that will create short-term value for shareholders. Our data shows that PFTA I GP, Inc. is the largest shareholder with 20% of outstanding shares. In comparison, the second and third largest shareholders own around 6.2% and 6.1% of the stock.

We also observed that the top 10 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to some extent.

While studying institutional ownership of a company can add value to your research, it’s also good practice to examine analyst recommendations to gain a deeper understanding of a stock’s expected performance. We do not record any analyst coverage of the stock at this time, so the company is unlikely to become widespread.

Insider Ownership of Portage Fintech Acquisition

While the exact definition of an insider can be subjective, almost all directors consider themselves insiders. The company’s management runs the business, but the CEO will answer to the board, even if he or she is a member of it.

Most people consider insider ownership to be positive because it can indicate that the board is well aligned with other shareholders. But on some occasions too much power is concentrated in this group.

Our most recent data indicates that insiders own less than 1% of Portage Fintech Acquisition Corporation. But they may have an indirect interest through a company structure that we have not picked up. It appears that the board members have no more than USD 1.3 million in shares in the USD 326 million company. Many people tend to prefer to see a board with larger shareholdings. A good next step might be to take a look at this free summary of insider buying and selling.

General public ownership

The general public, which are typically individual investors, hold a 29% stake in Portage Fintech Acquisition. This size of ownership, although significant, may not be enough to change company policy if the decision is not in sync with other major shareholders.

Private Equity Ownership

Private equity firms have a 6.1% stake in Portage Fintech Acquisition. This suggests that they can have influence in important political decisions. Sometimes we see private equity staying for the long term, but generally they have a shorter investment horizon and – as the name suggests – they don’t invest much in public companies. After some time they may look to sell and redeploy capital elsewhere.

Private company ownership

Our data indicates that private companies own 20% of the company’s shares. Private companies can be related parties. Sometimes insiders have an interest in a public company through an ownership interest in a private company, rather than in their own capacity as an individual. Although it is difficult to draw any broad conclusions, it is worth noting as an area for further research.

Next steps:

It is always worth thinking about the different groups that own shares in a company. But to better understand the Portage Fintech Acquisition, we need to consider many other factors. For example, we have identified 3 Warning Signs for Portage Fintech Acquisition (2 should not be ignored) that you should be aware of.

Of course this may not be the best stock to buy. So take a look at this free free list of interesting companies.

NB: Figures in this article have been calculated using data from the last twelve months, which refers to the 12-month period ending on the last date of the month in which the accounts are dated. This may not be consistent with the annual report for the entire year.

Do you have feedback on this article? Worried about the content? Contact with us directly. Alternatively, you can email the editors (at) simplywallst.com.

This article by Simply Wall St is general. We provide commentary based on historical data and analyst forecasts only using an objective methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Join a paid user research session

You will receive one $30 Amazon Gift Card for 1 hour of your time while helping us build better investment tools for individual investors like yourself. sign up here