16 Million ETH Staking: Another Milestone of the Ethereum Blockchain

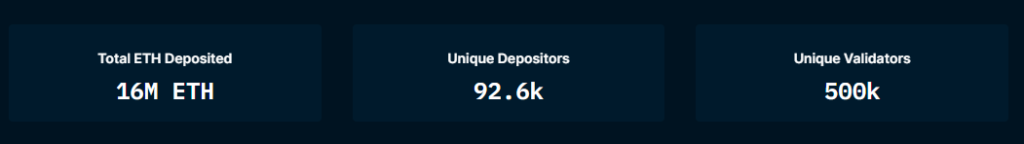

Four months have passed since the successful transition of Ethereum from proof-of-work to proof-of-stake. Now Ethereum – the second largest blockchain – passed another big milestone. Over 16 million of its native token, Ether (ETH) has been deposited into its Beacon Chain staking contract, data from Etherescam shows.

Here, 16 Million ETH has more than 13.28% of the total Ether supply, which also indicates about $22.98 billion at the current trading price. This comes almost two years after Ethereum’s contract of stake went live in 2020 and its proof-of-stake Beacon Chain was first introduced.

The validators – who help run the Ethereum network, stake ETH just for a chance to write and authenticate the transactions to the Ethereum ledger. After this, the staked funds are unlocked in the network and accrue interest. However, it will not yet be possible to withdraw until the Ethereum network’s Shanghai Update, which is slated for March 2023.

The Ethereum network’s Shanghai upgrade will implement EIP (Ethereum Improvement Proposal) 4895. It will enable consensus layer mining for the first time since December 2020.

Meanwhile, the increasing number of ETH staked could be a positive signal for Ethereum security and adoption. And in addition, it may put some pressure on Ethereum’s core developers to speed up their work to enable withdrawals.

Staked Ether, or stETH, is a cryptocurrency token. It represents an equivalent amount of Ether (ETH) that has been staked. Staked tokens are unlocked for a longer period to provide liquidity to the staked ether.

ETH2

According to data obtained from Nansen, the number of unique stake depositors indicates approximately 92.6k. The number of unique validators is approximately 500,000.

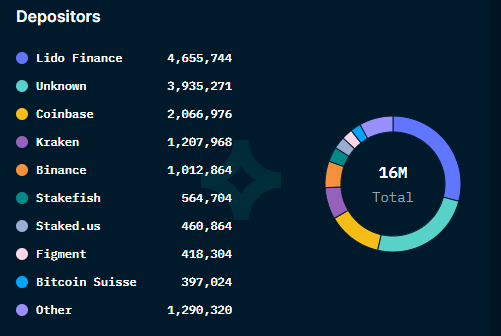

It should be noted that a larger amount of staked ETH should theoretically make the stake harder for an individual actor to sabotage the Ethereum chain. At the moment, the majority of Ethereum’s ownership belongs to a handful of large players – raising concerns that control of the chain could become too centralized.

The table above, taken from Nansen, showed that of the 16 million ETH staked, approximately 4.65 million have been staked through Lido Finance – a kind of community-driven validator collective.

In addition, the amount of ETH staked has increased by around 16.68% since the so-called Ethereum Merger took place in September 2022. The Merger completely transferred the Ethereum blockchain to a proof-of-stake consensus mechanism.