Everyone wants to be a landlord, right? • TechCrunch

Welcome to The Interchange! If you received this in your inbox, thank you for signing up and your declaration of confidence. If you are reading this as a post on our site, please register here so that you can receive it directly in the future. Each week, I’ll take a look at the hottest fintech news from the previous week. This will include everything from funding rounds to trends to an analysis of a particular space to hot takes on a particular company or phenomenon. There’s a lot of fintech news out there, and it’s my job to stay on top of it—and make sense of it—so you can stay up to date. — Mary Ann

Hello and Happy New Year! It feels like it’s been a while since I sat down to write this newsletter. I have missed it!

Before I dive into the news, I wanted to say that I hope you all had a relaxing and fun holiday. Ours was super low-key, but that’s not a bad thing. Still, I’ll admit it took a while for my brain to switch back to work mode this week…so bear with me.

On Friday I published an article about Door chairits $21.5 million Series B raise. The story was among the most read on the site that day, further proof that people are actually interested in technology related to the property rental market, especially as it relates to investment. For its part, Doorstead says it’s more than a full-service property management company, in that it guarantees homeowners that it works with a minimum amount of rent. If it can’t get the amount it promises, it will cough up the difference. If it’s more, well, the owner gets the extra – not the company. Doorstead says it deliberately chose to only make money by charging an 8% management fee, so that its incentives are in line with the homeowners it works with. By being willing to pay the difference, the company says it is able to reduce the amount of time rental properties are vacant. So homeowners not only get a guaranteed rental income, but they also get their properties rented out faster and make more money that way, say the company’s founders, Ryan Waliany and Jennifer Bronzo. Notably, Doorstead also announced that it was picking up the Boston assets of another venture-backed proptech, Knox Financial, whose raise I had covered in 2021. I don’t have details of what led to the latter company going out of business, but I suspect that we are going to see more of this kind of thing in 2023. And by “kind of thing” I mean startups acquiring assets from other startups. To hear the Equity Podcast team’s thoughts on Doorstead’s model, go here.

During the break we published an interview that I had conducted with GGV CapitalHans Tung and Robin Li during the fourth quarter. For those unfamiliar, GGV is a venture capital firm with $9.2 billion in assets under management that invests in startups from seed to growth stages across a range of sectors, including consumer, internet, enterprise/cloud and fintech. Some highlights of the interview include Tung’s view that down rounds are not the end of the world. He told me that he would rather see a startup raise a down round than shut down, and that what matters in the end is the result. Refreshing! He also shared some of the advice he gives to his own portfolio companies, among other things. Meanwhile, Li gave his thoughts on why embedded fintech will remain hot.

While I’m sure there were already many downsides in 2022, Tung expects we’ll see even more in 2023 as startups that had raised in 2021 started to run low on cash. I agree with his view that there is no shame in raising a down round. Valuations were overinflated, and any downgrades announced this year in most cases reflect valuations that are more realistic and easier to defend.

Doorstead co-founders Ryan Waliany (CEO) and Jennifer Bronzo (COO) Image credit: Door chair

Weekly news

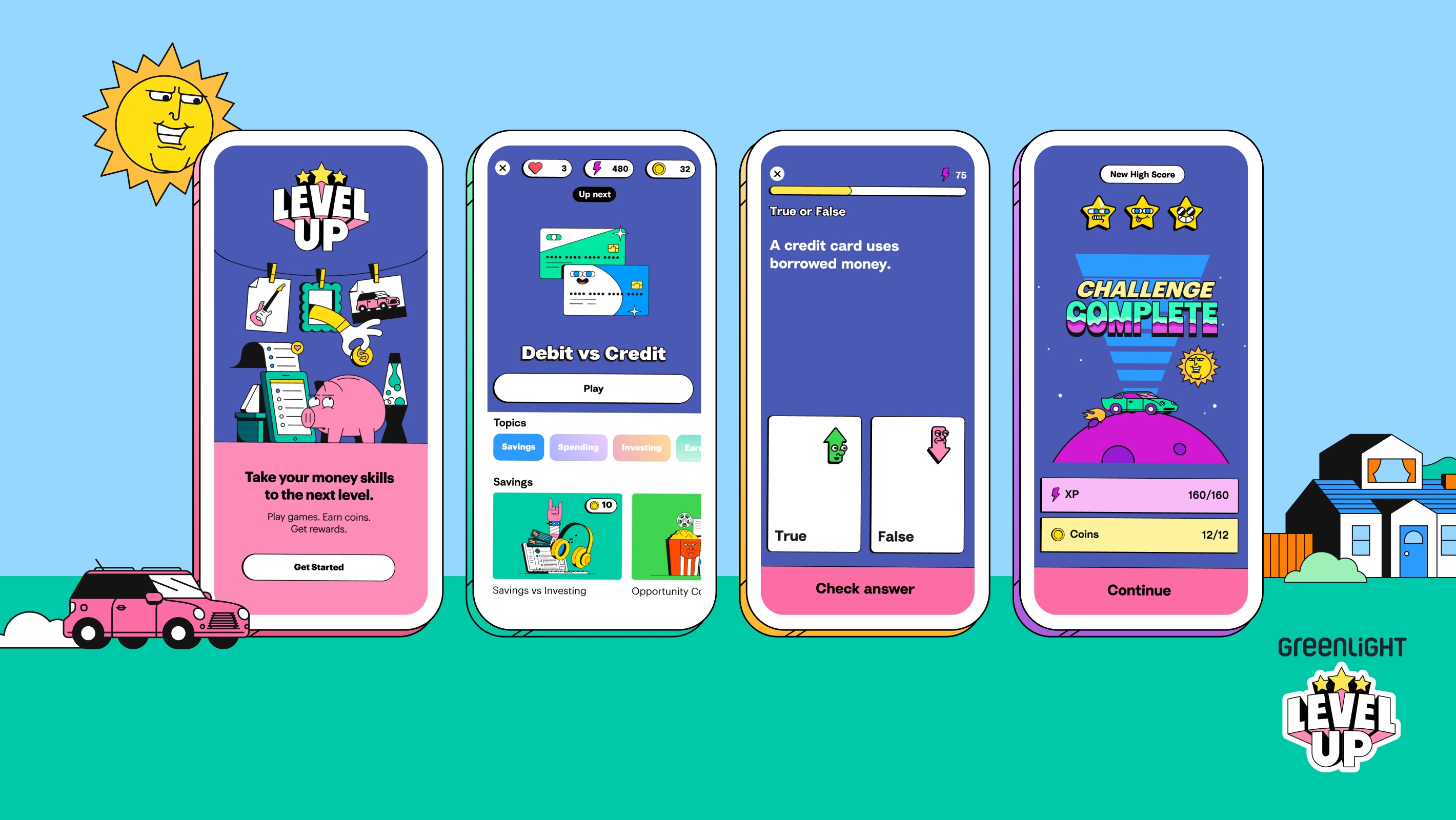

January 6 self-described family fintech Green light launched Greenlight Level Up, an interactive, curriculum-based financial literacy game. It’s clear that the company is trying to appeal to the younger generation’s love of playing games digitally, although one has to wonder what took them so long to include a game in the offering. Via email, a spokesperson told me: “Kids can earn virtual coins, experience points and engage in real-world money lessons through dynamic graphics, story-driven gameplay and animations on mobile phones or tablets – taking the principles of gamification and applying them to one of the essential the skills they will need throughout their lives.” Of course, the gamification of finance is not a new concept. Last year I wrote about Truist, one of the country’s largest financial institutions, acquiring fintech startup Long Game in its effort to appeal to a younger clientele.

BaaS startup Synctera said it merges with Wow (meaning “One” in Arabic), a digital Islamic investment platform that describes itself as the world’s first halal investment app. Synctera says it is providing the infrastructure for Wahed to make its services available to 3.5 million residents of the Muslim faith in the United States. Currently, Wahed has more than 200,000 customers in the UK and Malaysia and uses Synctera’s offering to build bank account products and rolling stock. out a debit card program linked to the app for Muslim Americans. Specifically, a Synctera spokesperson told TechCrunch that “Wahed currently offers halal investments, structured in accordance with established Islamic principles and standards, to US clients. With Synctera, Wahed will be able to provide its clients with bank accounts (making money transfers easier and smoother) and debit cards (for easy access to funds).” Synctera CEO/Founder Peter Hazlehurst wrote via email: “We are very excited to help Wahed launch banking products for its US customers… We expect to see a wave of mission-driven companies like Wahed embrace embedded banking to helping people light up their financial business. futures.” In recent years, we’ve seen more and more fintechs shape their offerings to cater to very specific demographics like Hispanics, blacks, Asian Americans, and immigrants in general. Only time will tell if that kind of niche focus will pay off.

In that Boston-based way Mendoza Ventures — which describes itself as “a female and Latinx-founded fintech, AI and cybersecurity venture capital firm” — announced that it has achieved a first close on its $100 million fund — its third. Unfortunately, the firm would not share how much it has raised so far, but said in a press release that the fund “will prioritize investing in early growth startups with a focus on diverse founding teams.” Hi, we are always here for any initiatives aimed at uplifting various founding teams. Notably, Bank of America led the first close, which included participation from Grasshopper Bank and other undisclosed investors.

To start the year, Felicis Ventures‘ CEO Victoria Treyger wrote a guest post for TechCrunch, giving her predictions and where she sees opportunities in the fintech space. Meanwhile, Bessemer Venture Partners’ Charles Birnbaum told us via email that he believes that “With FedNow finally scheduled to launch more broadly in mid-2023, all eyes will be on opportunities around faster payments. Although the introduction of the Clearinghouse’s RTP scheme has has been moderate to date, we expect FedNow’s use of the existing FedLine network to accelerate faster payment adoption starting in 2023. There will be many opportunities to build the enabling modern infrastructure for use cases such as payroll, insurance payments, vendor payments and more and at the application layer for more seamless b2b and consumer payment experiences.” He also remains bullish on the continued institutional use of blockchain technology in some major areas of financial services. For example, he predicts that SWIFT “will continue to experiment with central bank digital currencies (CBDCs) while more banks will join the USDF consortium to facilitate the compliant transfer of value across blockchains via bank-deposited tokenized deposit stable coins.”

Speaking of blockchain, Mercuryo, a crypto-focused startup that has built a cross-border payments network, has now launched a BaaS solution, which it claims “unlocks a unique feature – the ability to manage bank and crypto accounts within a single platform.” A spokesperson for the company told me via email that the goal is to make it easier for traditional banks to open crypto accounts for their users and to give crypto platforms a way to open bank accounts that allow their customers to store, transfer and pay via fiat. /crypto. I covered the company’s increase in June 2021.

It was cool to see a startup whose rise I covered last year be named a Time Best Invention of 2022. Altro raised $18 million last May to expand its offering, which aims to help people build credit through recurring payments like digital subscriptions to Netflix, Spotify and Hulu. Personally, I’m a fan of the startup’s inclusive credit-building efforts, which challenge the antiquated credit scoring model here in the US

Last week, Darrell Etherington and Becca Szkutak were joined by Brex co-founder and co-CEO Henrique Dubugras to chat about what made him and his co-founder, Pedro Franceschi, decide to launch the corporate card company and why the friends, who met online as teenagers, decided to co-manage directors, i.a. other.

According to payment transparency tracker Comprehensive.io, Stripe is not exactly that open about his salary. The fintech giant does not include salary ranges in its CA or NYC job postings. The tracker also found that a strategic account manager at fintech startup Bolt can do – are you ready for this? — $374,000 to $462,000 OTE/yr. (If you could see me, I’m doing Kevin’s “Home Alone” shocked face right now).

As reported by Manish Singh: “Suhail Sameer, CEO of BharatPe, will leave the top role later this week as the Indian fintech startup struggles to steer the ship after firing its founder last year for allegedly misusing company funds.” More here.

Image credit: Green light

Financing and M&A

While we don’t see many megarounds in the fintech space here in the US, TechCrunch’s Manish Singh reports that India has seen two significant increases in the fintech world in recent weeks:

Indian fintech Money View valued at $900 million in new funding

Indian fintech Kreditbee approaches valuation of $700 million in new funding

Meanwhile, in South Korea, fintech Toss boosted its valuation to a staggering $7 billion:

South Korean financial super app Toss closes $405M Series G as valuation rises 7%

Other funding deals reported on the TC website include:

Gynger launches in secret to lend companies money for software

Fintech Vint hopes to turn wine and spirits into a mainstream asset class

Early-stage Mexico fintech Aviva makes loans as easy as a video call

And elsewhere:

Saudi startup Manafa raises $28 million to fund expansion

And it’s a wrap. I’m not usually one for resolutions, but I can say that I am is trying to start this year on a more optimistic note. Last year was challenging in many ways, but it doesn’t help to be negative or doom. There is still so much good news and things to be thankful for. So my wish for 2023 is more resilience and optimism for all of us, because even though we can’t always control what happens, can control how we react. Thanks again for reading, and for your support. I’m always here for your feedback! Until next week…xoxoxo Mary Ann