Toncoin: The Telegram Blockchain (TON-USD)

stockcam/iStock not released via Getty Images

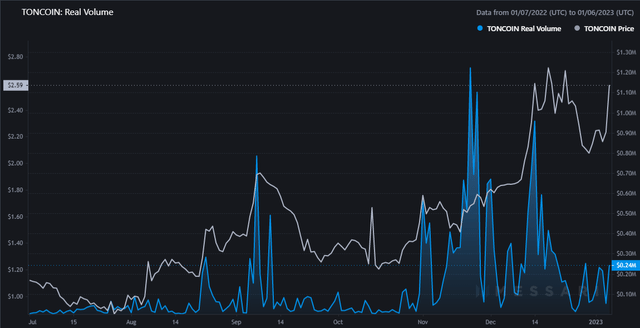

While most of the crypto market has been down quite a bit since the collapse of FTX (FTT-USD), there are some coins that have shown overall strength relatively. No coin with a top 100 market cap has done better than Toncoin (TONS-USD) during the last 60 days. TON is up over 34% in that time period compared to Bitcoin (BTC-USD) and Ethereum (ETH-USD) which are both down around 20% at publication.

Toncoin weekly chart (CoinMarketCap)

After the FTX fall in November, many of the coins that have outperformed the rest of the market have since focused on decentralization in one way or another. Self-custodial wallet tokens such as Trust Wallet Token (TWT-USD) and non-custodial DEX dYdX (DYDX-USD) have performed very well. Toncoin is another example of a public blockchain marketed as a decentralized network. The rally in TON combined with the relative underperformance of the rest of the crypto market has propelled TON all the way to a top 25 market cap according to CryptoMarketCap.com:

- Market value: 25

- Circulating market cap: $2.6 billion

- Fully diluted market cap: $10.9 billion

- Circulating coin supply: 24%

History of Toncoin

Toncoin is the native currency of “The Open Network.” The Open Network has one of the more bizarre histories of the best public blockchains. The network was originally developed and launched by the founders of Telegram.

Previous history (The Open Network)

One of the main issues with The Open Network from launch was the $1.7 billion private sale in 2018. It was such a large token offering that the SEC stepped in with a lawsuit:

The US Securities and Exchange Commission is suing Telegram, accusing it of conducting an unregistered securities offering. Telegram claims the SEC’s allegations were baseless, but agrees to delay the launch of TON until legal issues are resolved.

Despite disagreement with the SEC’s position, Telegram eventually stopped the development of TON, paid a fine and returned funds to the original investors in 2020. Because there was already a community interested in developing on the chain, there was enough excitement and valuable code from the original project that a group of independent developers took over TON and has brought it back to the wild without any ICOs.

Structurally, The Open Network is a proof-of-stake blockchain that is sharding-enabled for fast blocks, near-instant finality, and very high TPS projections. According to the TON Foundation’s own analysis of the blockchain, the network is ideal for gaming and social interaction.

New development?

The development group behind this new version of The Open Network is the TON Foundation. As described on ton.org:

TON Foundation is a decentralized community started by Anatoliy Makosov and Kirill Emelyanenko after Telegram walked away from the project. A community of open source developers has supported the development of TON ever since, with the goal of staying true to the network design described in the original white paper.

After Telegram’s exit from TON, there were several competing development teams trying to gain control of the project. It led by Makosov formally requested the ton.org domain. This request granted by Telegram and the TON Foundation was later given the seal of approval by Telegram CEO Pavel Durov:

Unlike the original TON, Toncoin is independent of Telegram. But I wish their team the same success. Coupled with the right go-to-market strategy, they have everything they need to build something epic

Fedor Skuratov is a former community leader with TON labs, an entity associated with the first Telegram-led version of TON. In an old CoinDesk article, Skuratov seems to indicate that Makosov was chosen to take over because his development team planned to follow Telegram’s original plan for the network:

As for why Durov chose to back Toncoin instead of Everscale, Skuratov said he believes it’s because Toncoin’s team “doesn’t position itself as independent and ‘follows Telegram’s legacy’ without any leadership ambitions of its own, and Durov likes that.” Everscale made a point of cutting all ties with Telegram to avoid a “toxic” association with the project targeted by the US regulator, Skuratov said.

I think this raises some questions about how independent TON really is from Telegram, but that’s speculation on my part at this point. TON Foundation is in control of quite a lot of money as $250 million was raised through investments from Kucoin and Huobi. An additional $90 million was raised by a handful of other crypto investment entities separately from 176 independent donors who backed the network with over 527 million TON back in April 2022 – that TON is now valued at over $1.3 billion.

Network activity and roadmap

So far, the community has launched a number of applications built on The Open Network – most of these apps are aimed at NFTs and games in one form or another. Although there are some block explorers like TON API. According to that site, there are over 1.8 million accounts on The Open Network. The volume of daily transactions in the chain is very volatile, and there is not much that happens at peaks, as the daily transaction volume is generally well below $1 million.

TON Real Volume (Messiri)

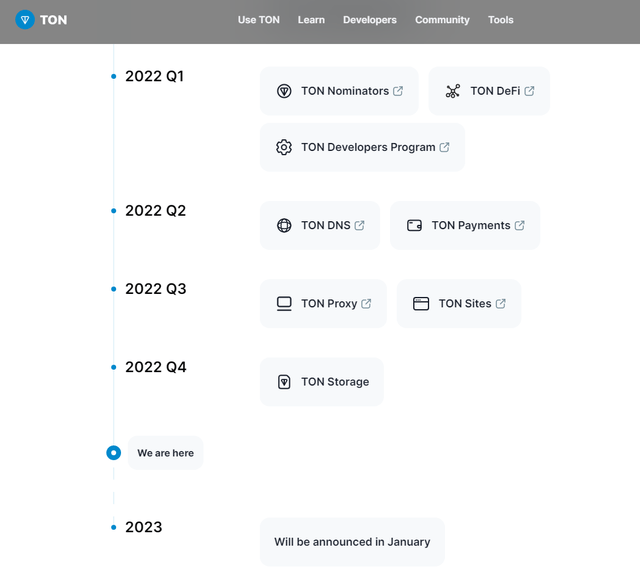

The biggest success from this blockchain so far seems to be through Telegram’s sale of usernames and virtual phone numbers on a TON-based marketplace called Fragment. The road map for the network is ambitious to say the least:

Road map (ton.org)

TON Foundation ultimately wants to have a footprint in DeFi, stablecoins, file storage, domains and websites. Essentially, it tries to be everything in one blockchain network. So far, adoption seems fast, but still very small compared to other Layer 1 chains.

Risks

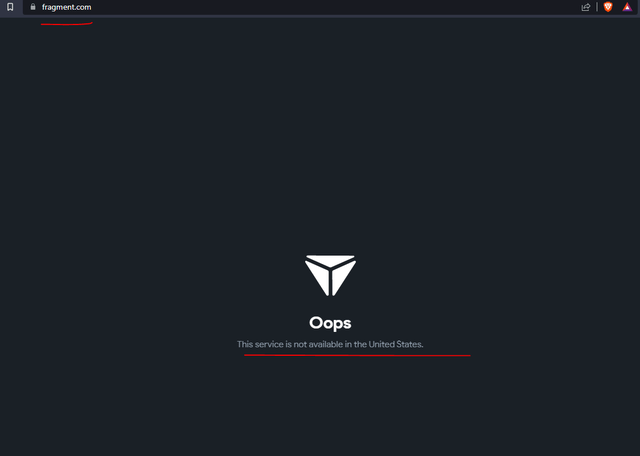

Jurisdiction risk seems like the obvious one for Toncoin. I think there are pretty big concerns about how the SEC will look at this project given that the new team’s roadmap still seems to be very much tied to implementation with Telegram. The project’s official Twitter handle has been suspended and one of the leading apps on the blockchain, Fragment, is blocked in the US:

TON Domain Marketplace (Fragment.com)

This is in addition to all the normal risks that come with any cryptocurrency. These risks include macro headwinds as well as loss of confidence in the future of public blockchain from individual investors. It is also important to remember that this is an industry that is filled with fraud and scams.

Summary

There isn’t much network data available, and the roadmap seems very tied to a specific social messaging app for onboarding users, namely Telegram. Telegram seems to be the only company doing anything meaningful with the blockchain itself, and there is plenty of competition in the Web3 space. Furthermore, I find it problematic that major US-based exchanges such as Coinbase (COIN), Kraken and Gemini have not listed the token. I would probably avoid this one for now even with DEX purchases.