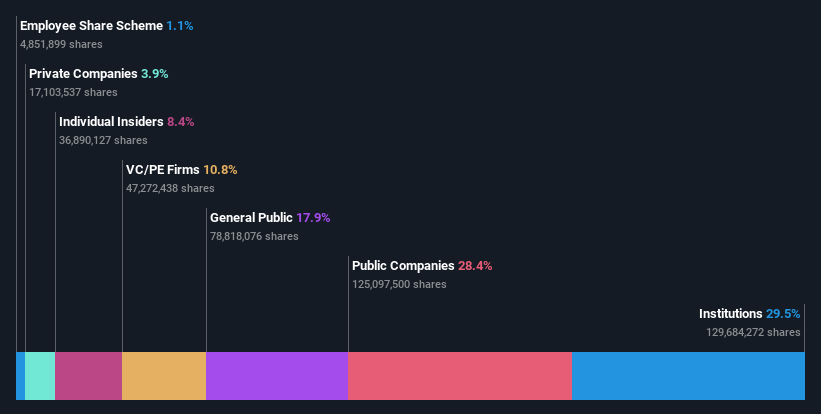

Institutional owners, who own 29% shares, appear interested in PB Fintech Limited (NSE: POLICYBZR),

To get a sense of who is really in control of PB Fintech Limited (NSE:POLICYBZR), it is important to understand the ownership structure of the business. With a 29% stake, institutions have the maximum number of shares in the company. In other words, the group stands to gain the most (or lose the most) from its investment in the company.

Given the vast amount of money and research capacity at their disposal, institutional ownership tends to carry a lot of weight, especially with individual investors. Therefore, a good chunk of institutional money invested in the company is usually a big vote of confidence about the future.

Let’s dive deeper into each type of owner of PB Fintech, starting with the chart below.

Check out our latest analysis for PB Fintech

What does institutional ownership tell us about PB Fintech?

Institutional investors typically compare their own returns to the returns of a commonly followed index. So they generally consider buying larger companies that are included in the relevant benchmark.

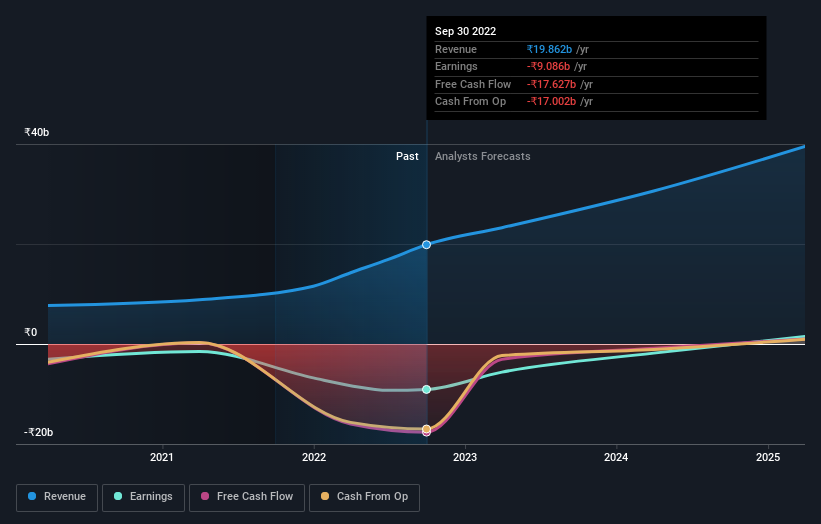

PB Fintech already has institutions in the share register. They actually own a respectable stake in the company. This may indicate that the company has a certain degree of credibility in the investment environment. However, it is best to be cautious about relying on the supposed validation that comes with institutional investors. They are also wrong sometimes. It is not unusual to see a large share price drop if two large institutional investors try to sell out of a stock at the same time. So it’s worth checking the past earnings trajectory of PB Fintech, (below). Remember, of course, that there are other factors to consider as well.

PB Fintech is not owned by hedge funds. Info Edge (India) Limited is today the company’s largest shareholder with 20% of the shares outstanding. For context, the second largest shareholder owns approximately 8.6% of outstanding shares, followed by a 5.6% stake in the third largest shareholder. Additionally, we found that Yashish Dahiya, the CEO has 4.7% of the shares allocated to their name.

We dug a little more and found that 8 of the top shareholders account for about 51% of the register, which suggests that along with larger shareholders there are a few smaller shareholders, thus balancing each other’s interests somewhat.

While studying institutional ownership of a company can add value to your research, it’s also good practice to examine analyst recommendations to gain a deeper understanding of a stock’s expected performance. There are many analysts who cover the stock, so it may be worth seeing what they predict as well.

Insider ownership of PB Fintech

The definition of company insiders can be subjective and varies between jurisdictions. Our data reflects individual insiders, capturing at least board members. Management ultimately answers to the board. However, it is not uncommon for executives to be board members, especially if they are a founder or CEO.

Most people consider insider ownership to be positive because it can indicate that the board is well aligned with other shareholders. But on some occasions too much power is concentrated in this group.

We can see that insiders own shares in PB Fintech Limited. It’s a pretty big company, so it’s generally positive to see a potentially meaningful adaptation. In this case, they own shares worth INR 17 billion (at current prices). Most would say that this shows a alignment of interests between the shareholders and the board. Nevertheless, it may be worth checking whether these insiders have sold.

General public ownership

The general public – including retail investors – own 18% of the company, and therefore cannot be easily ignored. This size of ownership, although significant, may not be enough to change company policy if the decision is not in sync with other major shareholders.

Private Equity Ownership

With an ownership of 11%, private equity companies are in a position to play a role in shaping the company’s strategy with a focus on value creation. Some may like this, because private equity is sometimes activists who hold management accountable. But other times, private equity sells out, after taking the company public.

Private company ownership

We can see that Private Companies own 3.9% of the shares that have been issued. It may be worth looking into this. If related parties, for example insiders, have an interest in one of these private companies, this should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Public ownership

Public companies appear to own 28% of PB Fintech. This may be a strategic interest and the two companies may have related business interests. It could be that they have merged. This holding is probably worth investigating further.

Next steps:

It is always worth thinking about the different groups that own shares in a company. But to understand PB Fintech better, we need to consider many other factors.

I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow, free of charge.

But in the end it is the future, not the past, that will determine how well the owners of this business will do. That’s why we think it’s advisable to take a look at this free report that shows whether analysts are predicting a brighter future.

NB: Figures in this article have been calculated using data from the last twelve months, which refers to the 12-month period ending on the last date of the month in which the accounts are dated. This may not be consistent with the annual report for the entire year.

Valuation is complex, but we help make it simple.

Find out about PB Fintech is potentially over- or under-rated by checking out our extensive analysis, which includes fair value estimates, risks and warnings, dividends, insider trading and financial health.

See the free analysis

Do you have feedback on this article? Worried about the content? Contact with us directly. Alternatively, you can email the editors (at) simplywallst.com.

This article by Simply Wall St is general. We provide commentary based on historical data and analyst forecasts only using an objective methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.