November 2022 NFT report – Coin stud

Despite the crash in token prices caused by macro conditions and the collapse of FTX, the NFT market continued to decline steadily instead of experiencing any significant shock in November.

While overall activity and trading decreased, the number of investment rounds increased and the blue chip collections increased trading.

The total market

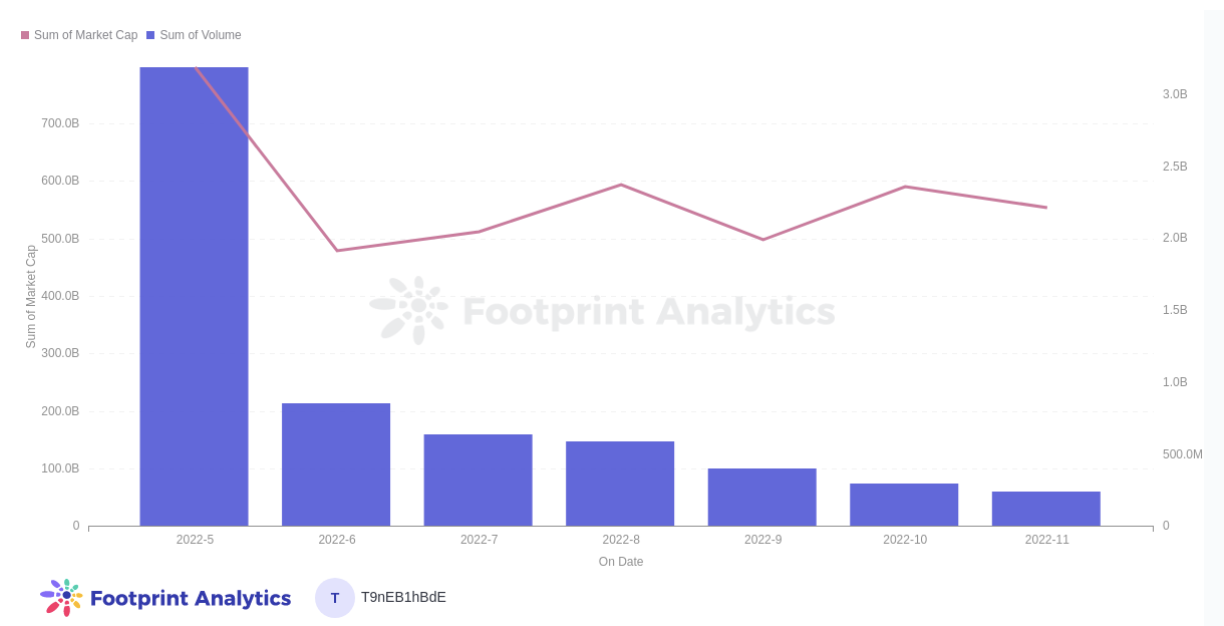

- The total market capitalization of the NFT sector fell 6.3% from $590.9 billion to $553.1 billion.

- Across all measures, activity in the NFT industry has decreased. The total volume of NFT transactions went from 297.5B to 242.4B.

- While the number of NFT holders jumped from 16.7 million at the end of October to 21.6 million at the end of November, buyers and sellers remained steady.

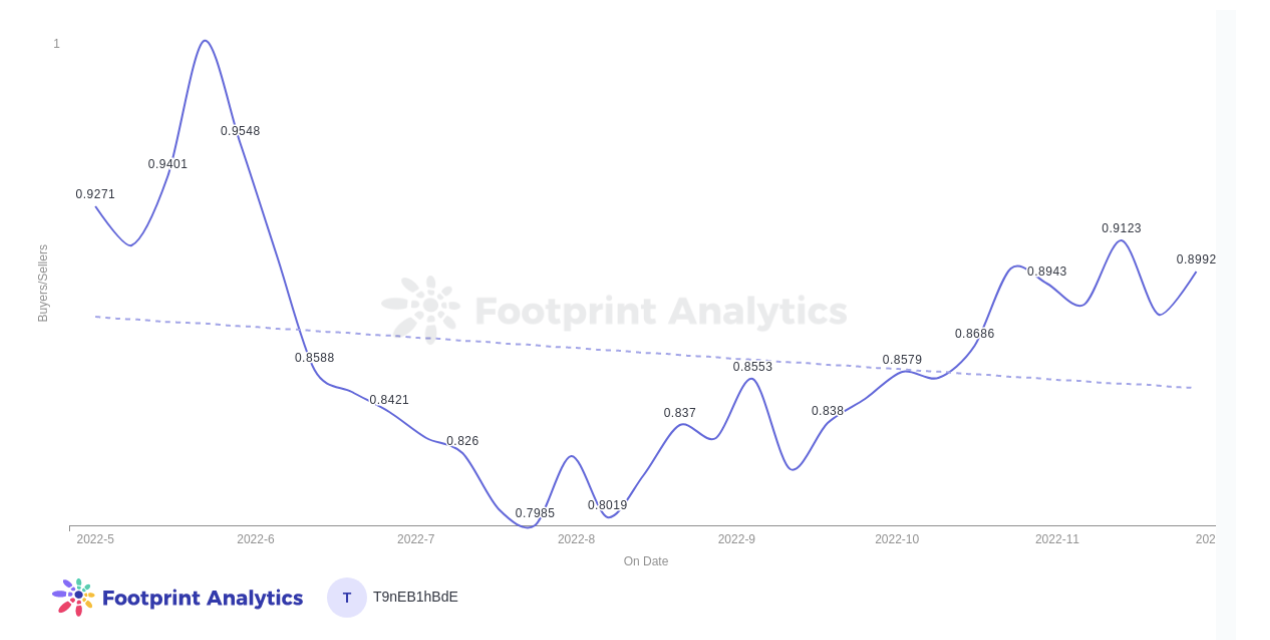

- The buyer-to-seller ratio increased in November, peaking at 0.94 (91 buyers for every 100 sellers).

- The last time there were more buyers than sellers was in June, when there were 487,064 buyers and 485,095 sellers.

- Volume on NFT marketplaces fell 26% MoM.

Financing and investment

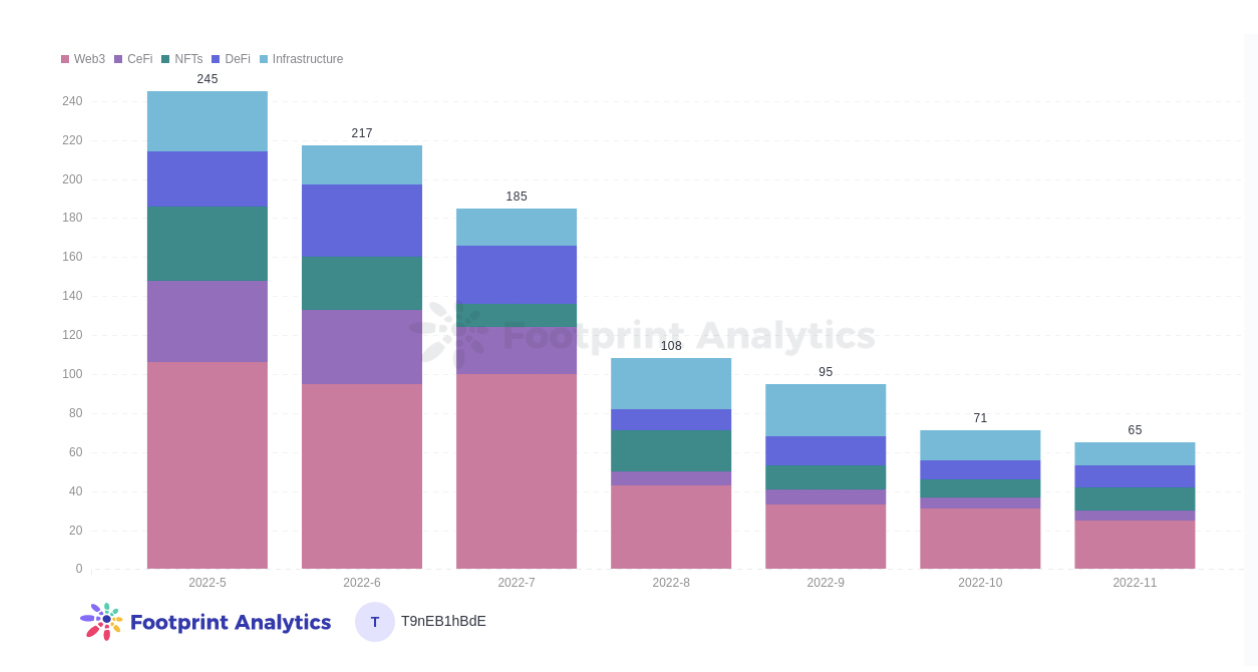

- The number of funding rounds in the NFT category increased from 9 to 11, while the number of rounds in the blockchain space overall decreased by 8.4% MoM (from 71 to 65)

- Almost all the rounds in November were relatively small seed rounds – all were under $10 million

- Two of November’s largest rounds, including the largest, went to NFT marketplace projects. Joepegs, an NFT marketplace on the Avalanche blockchain, raised $5 million led by FTX Ventures — money the project founders claim has been transferred from FTX since its collapse — and the Avalanche Foundation. Courtyard closed its biggest round of the month at $7 million and hopes to let people monetize their real-world collectibles by turning them into digital assets.

Marketplaces and chains

- According to Footprint’s laundering detection, laundering plays a much smaller role in the NFT market than it used to, likely due to the reduced profitability of the overall NFT sector.

- In November, the filter found that only about 37% of the total volume on major marketplaces was traded.

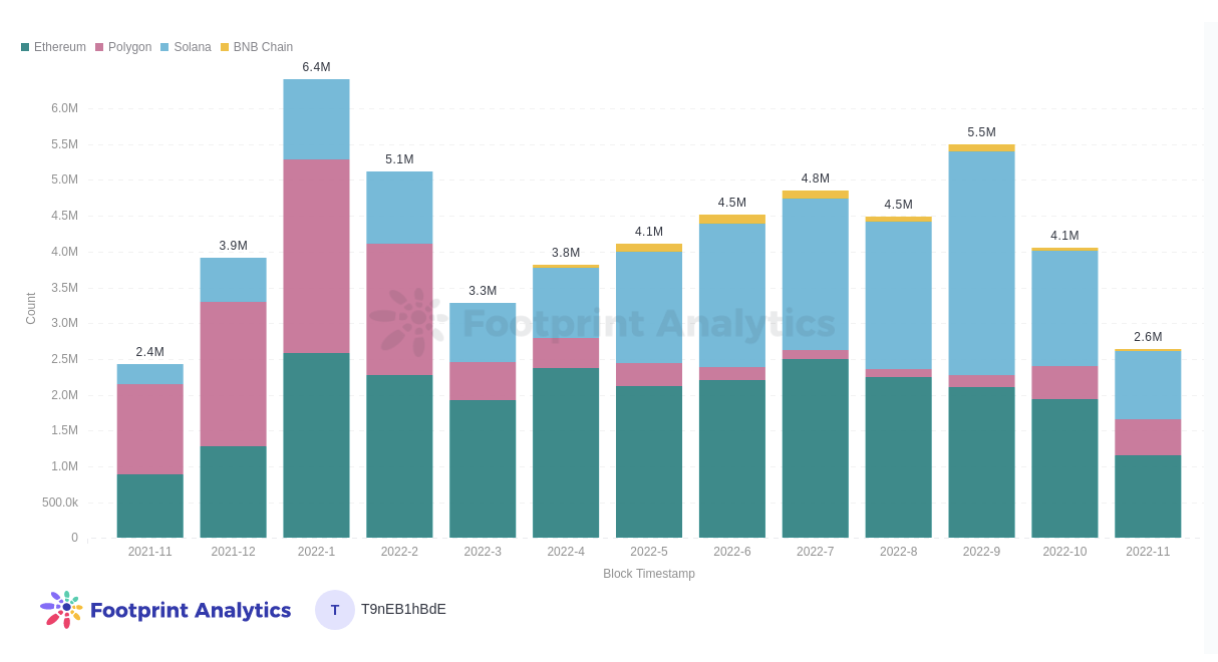

- Ethereum still accounts for the majority of NFT transactions, with Solana a close second and Polygon in third.

Collections Overview

- Blue Chip NFT pools BAYC and CyptoPunks saw a significant increase in trading in November

- Transactions of BAYC NFTs almost doubled MoM from 232 in October to 441 in November

- Transactions of CryptoPunk’s NFTs increased from 150 to 203

NFT Market Overview

In November, volume in the NFT sector fell along with transactions and market value. However, the data indicates that the market cap is holding steady between the $500B and $600B band despite the fluctuations.

NFT market value and volume (November report)

The ratio of buyers to sellers is used to measure supply and demand in the NFT market, which affects the price. In November, it has rebalanced to a steady level in the high 0.80s. In the summer, the ratio strongly favored buyers, driving down the prices of NFTs, but this started to balance out again in September and continued up into October.

Buyer/seller relationship November report

Investment and collection

While the number of fundraising rounds in the blockchain industry decreased, the NFT sector had more in November than October, with 11 small (under $10 million), mostly seed-stage rounds.

Investment by category (NFT report Nov.)

In light of the seemingly bleak conditions, it is useful to compare these figures with the wider market, where investment rounds also fell on an annual basis according to research from S&P Global, but to a lesser decree. The crypto market was clearly hit earlier and harder by macro conditions. While the above research may use other tools to track investment rounds than Footprint Analytics, it is also interesting to see that blockchain had about 5% of total global VC funding rounds (which the report estimates at 1,289) when we compare the data side by side. -page.

Marketplaces and chains

Wash trading is a form of fraudulent activity where trades are made to artificially inflate the amount of activity in a pool or marketplace, or for the trader to reap reward incentives for trading in a market.

However, with reduced profitability throughout the crypto space, the prominence of wash trading in the NFT industry has diminished. In other words, tokens like $LOOKS simply don’t hold value like they used to, and there aren’t enough real buyers to justify the effort of laundering trades. Although laundry trade may still occupy 30-40% of the total market volume.

The top three chains for NFT transactions are Ethereum, Solana, and Polygon, in that order.

NFT Tnx off chain

Collections

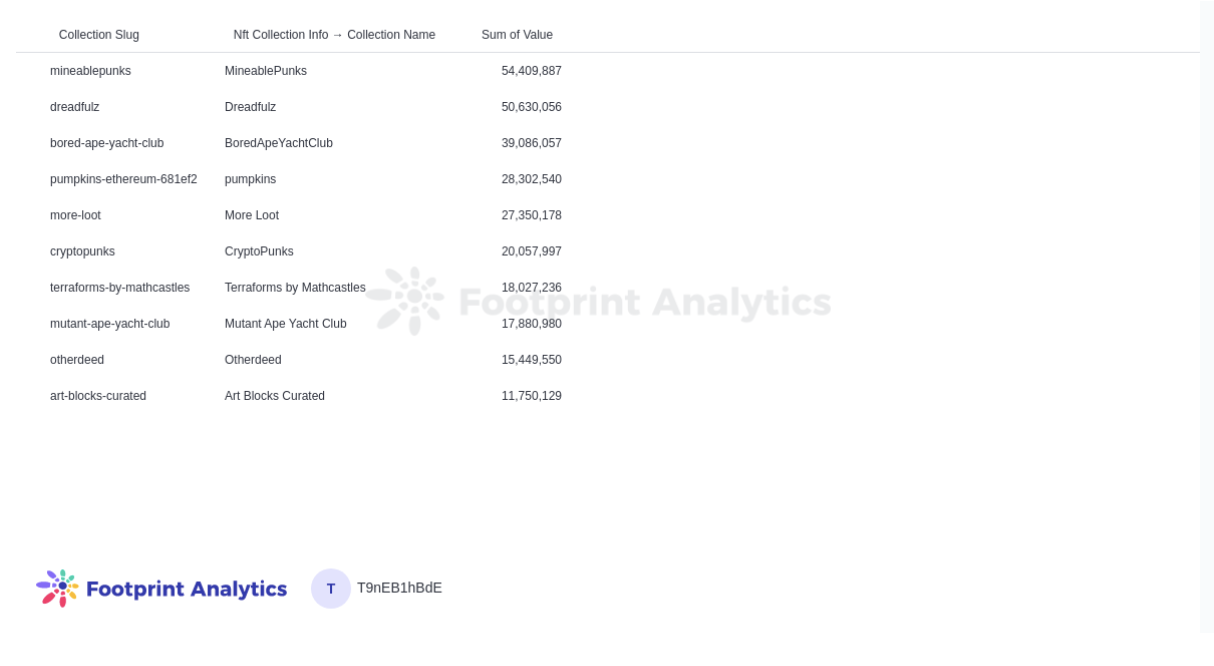

The top 3 compilations by volume in November were MineablePunks, Dreadfulz and Bored Ape Yacht Club. In the past, Dreadfulz has seen a lot of wash trade, while data is unclear on MineablePunks.

Top 10 collections by volume (November report)

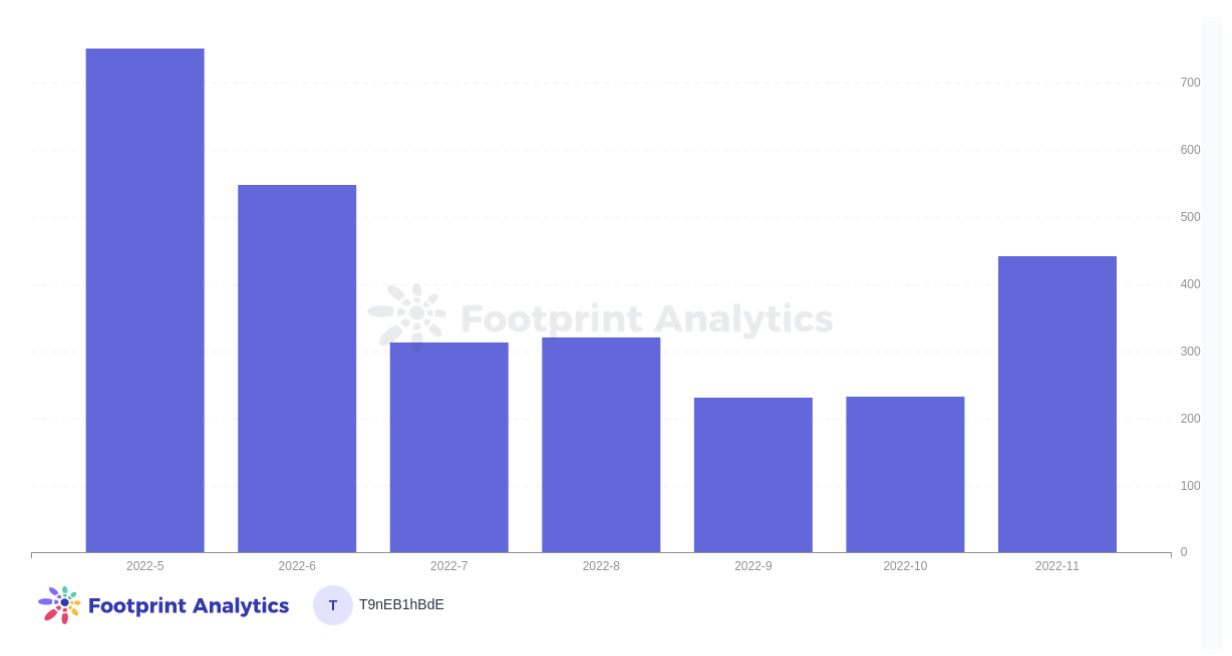

Blue chip collection activity was a slight anomaly in November, picking up significantly. This was particularly true of BAYC, where trading almost doubled.

BAYC: NFT transactions (Nov. report)

Several publications have taken notice, and AmberCrypto even published an article on December 5 titled, BAYC overcomes the “judge month” of November, but can APE refuse to follow suit, which began:

“BAYC recorded a massive increase in performance in November, excluding the crypto market crash.”

However, this type of article ignores that activity includes both buying and selling. A huge increase in activity during turbulent times can indicate a sale as well as an increase in demand.

This piece is contributed by Footprint Analytics society.

Footprint Community is a place where data and crypto enthusiasts around the world help each other to understand and gain insights about Web3, the metaverse, DeFi, GameFi or any other area of the new world of blockchain. Here you will find active, diverse voices that support each other and drive society forward.

Footprint website:

Disagreement:

Data source: November 2022 NFT report (ENG)

Disclaimer: Views and opinions expressed by the author should not be considered financial advice. We do not provide advice on financial products.