Assessing Binance Reserves and Liabilities – Bitcoin Magazine

Below is an excerpt from a recent issue of Bitcoin Magazine Pro, Bitcoin Magazine premium market’s newsletter. To be among the first to receive this insight and other market analysis on the bitcoin chain straight to your inbox, Subscribe now.

Binance: FUD or Legit Question?

By far one of the biggest winners in the wake of the FTX collapse has appeared – on the surface – to be Binance. After only having a 7.82% market share of bitcoin supply on exchanges in 2018, their share is now 27.50% despite a much broader trend of bitcoin supply leaving exchanges. The Bitcoin balance on Binance now stands at 595,864 BTC, which is 3.1% of the outstanding supply, worth $10.58 billion. This bitcoin belongs to their customers and reflects an increasing trend in market share in recent years that has made Binance the largest bitcoin and cryptocurrency exchange in the world.

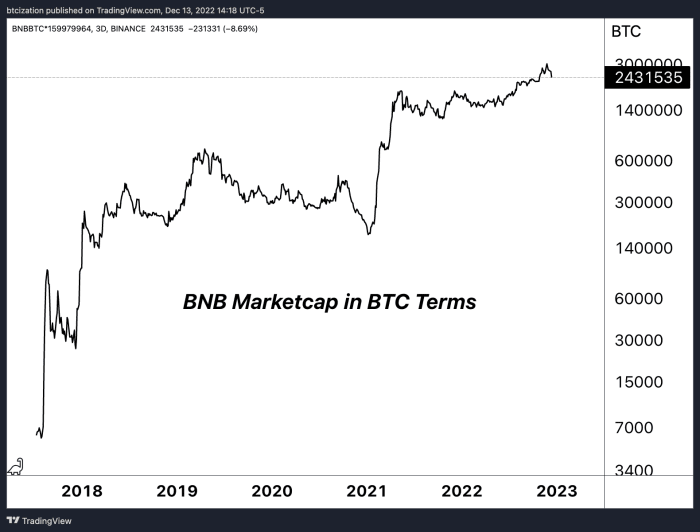

Binance now controls approximately 60% of spot and derivatives volume in the entire market. It’s hard to see how any exchange in the area can be a “winner” in the current market conditions, but a case can be made for Binance, with the exchange’s growing strength in a decimated industry. On top of that, Binance’s BNB token, the native currency of Binance’s own Ethereum-competing Layer 1 blockchain, remains one of the better performing tokens when valued in bitcoin terms this year.

Still, is this recent “strength” all it seems, or is it a facade? We’ve learned over the past month that no company is safe in this industry right now (especially exchanges), and questions are growing about Binance’s practices, solvency, BNB token value, and the overall state of their business in recent weeks. Is it FUD or legit? Let’s try to break some of that down, and address the concerns through an objective and skeptical lens.

Binance is floating

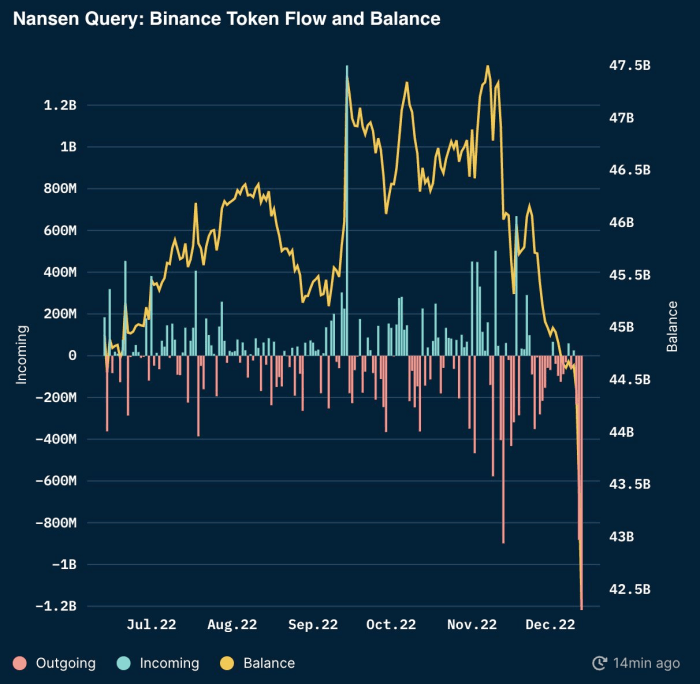

We have seen significant outflows from Binance across various different tokens and bitcoin when looking at both Nansen and Glassnode tracking. Across ETH and ERC20 tokens, Binance saw 3 billion dollars leaving the exchange with its largest single-day outflow since June. Across Nansen total wallet tracking, all Binance balances are estimated at $62.5 billion with around 50% of those balances in stablecoins across BUSD and USDT.

Source: Nansen

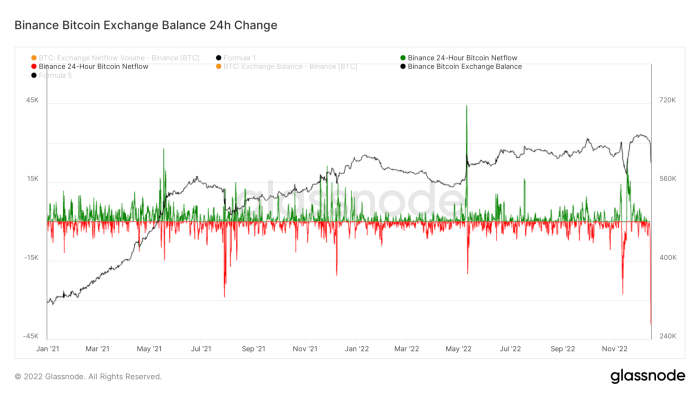

According to Glassnode, the total bitcoin exchange balance on Binance is down around 6-7% in the last day, after reaching a peak on December 1st. Although balances remain above 500,000 bitcoin and Binance has shown an upward trend of bitcoin balances on the platform this year, this is a significant move for outflows in just 24 hours. As a general comparison, the trend of bitcoin exchange balances was a much different story for FTX, whose balances had fallen sharply since June. Binance outflows over the past couple of days are a bit alarming and raise questions: Is this a one-off and just business as usual, or is this the start of something more?

Readers can track the chain addresses provided by Binance for free here.

The main cause of concern is not whether Binance has any bitcoin/crypto or not. We can openly see that the firm controls tens of billions worth of crypto assets. What is not entirely clear, like FTX, is whether the firm has commingled user funds or whether the firm has outstanding obligations against user assets.

Binance CEO Changpeng Zhao (CZ) has said that the firm has no commitments with any other firms, but as the past few months have shown, words don’t mean much. While we do not claim that CZ is lying to the public about the state of Binance finances, we have no way of proving otherwise.

CZ’s response to whether the company should revise user asset liabilities was: “Yes, but liabilities are more difficult. We don’t owe anyone a loan. You can ask around.”

Unfortunately, “ask around” isn’t a satisfying enough answer for an ecosystem supposedly built around the ethos of “don’t trust, verify.”

While there is no doubt that Binance is an industry giant in the crypto derivatives industry, how do we know that the firm is not doing similar things to previous players when it comes to trading against clients using user funds and/or proprietary data. Things like the former Chief Legal Officer of Coinbase left Binance USA last summer after just three months as the CEO leaves one with many questions.

Adding to our skepticism, the price of Binance exchange token BNB is near all-time highs in bitcoin terms, appreciating an astonishing 828% against bitcoin over the past 785 calendar days.

The coming weeks will be full of headlines surrounding the state of global crypto regulation in a post-FTX world. In a 48-hour period, Reuters published news stating that the US Justice Dept is divided over charging Binance, Binance withdrawals for bitcoin and overall stablecoin pairs have hit all-time highs and the BNB exchange token has fallen 10% vs. bitcoin.

Out of an abundance of caution, we will continue to encourage readers operating on any centralized exchange – of which Binance is certainly included – to look into self-storage solutions. There have been far too many cases of incompetence and/or misconduct from exchanges.

It’s not that we don’t trust CZ or Binance, it’s the fact that we don’t trust anyone.

The whole point of bitcoin is that we now have an asset that is really nobody’s liability. Verify ownership of an open distributed network with cryptography; do not rely on permitted IOUs. With the mix of regulatory concerns about the global crypto derivatives industry, a questionable exchange token with incredible relative performance over the past two years, and a shaky proof-of-reserve certificate — which was falsely claimed to be an audit and raised eyebrows among industry executives — We find the need to encourage our readers to assess their counterparty risk.

Relevant previous articles: