Here’s how Binance’s Bitcoin and Stablecoin reserves compare to pre-collapse FTXs: Quant Analyst

The CEO of on-chain insights platform CryptoQuant says that despite the current rumors surrounding Binance, the exchange’s stablecoin reserves still look quite different than FTX did before the collapse.

Ki Young Ju is responding to a Reuters story that broke earlier this week reporting that Binance and its CEO Changpeng Zhao are under federal investigation for potential money laundering violations.

The news appeared to have a ripple effect on the exchange’s crypto reserves: Zhao acknowledged that the exchange saw about $1.14 billion in net withdrawals on Tuesday, but he maintained it was “business as usual” for Binance.

“Things seem to have stabilized. Yesterday was not the highest withdrawal we processed, not even top 5. We processed several during LUNA or FTX crashes. Now the deposits are coming in again.”

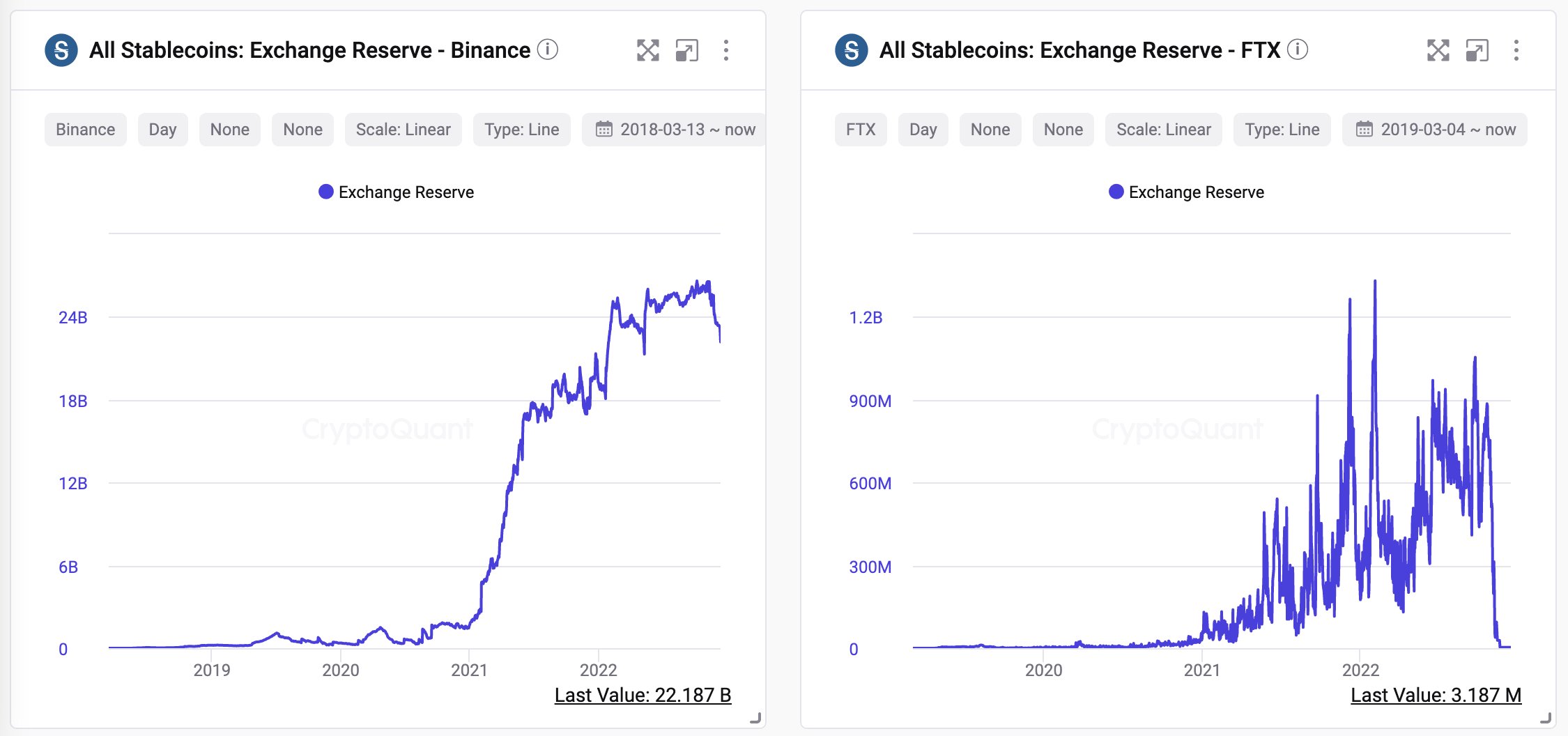

Ki Young Ju says Binance’s stablecoin reserves look fundamentally different than FTX’s did in November.

“FTX reserve doesn’t look organic with a lot of in/outflows related to non-FTX wallets and the reserve dropped -93% already, a few days before the bank run.”

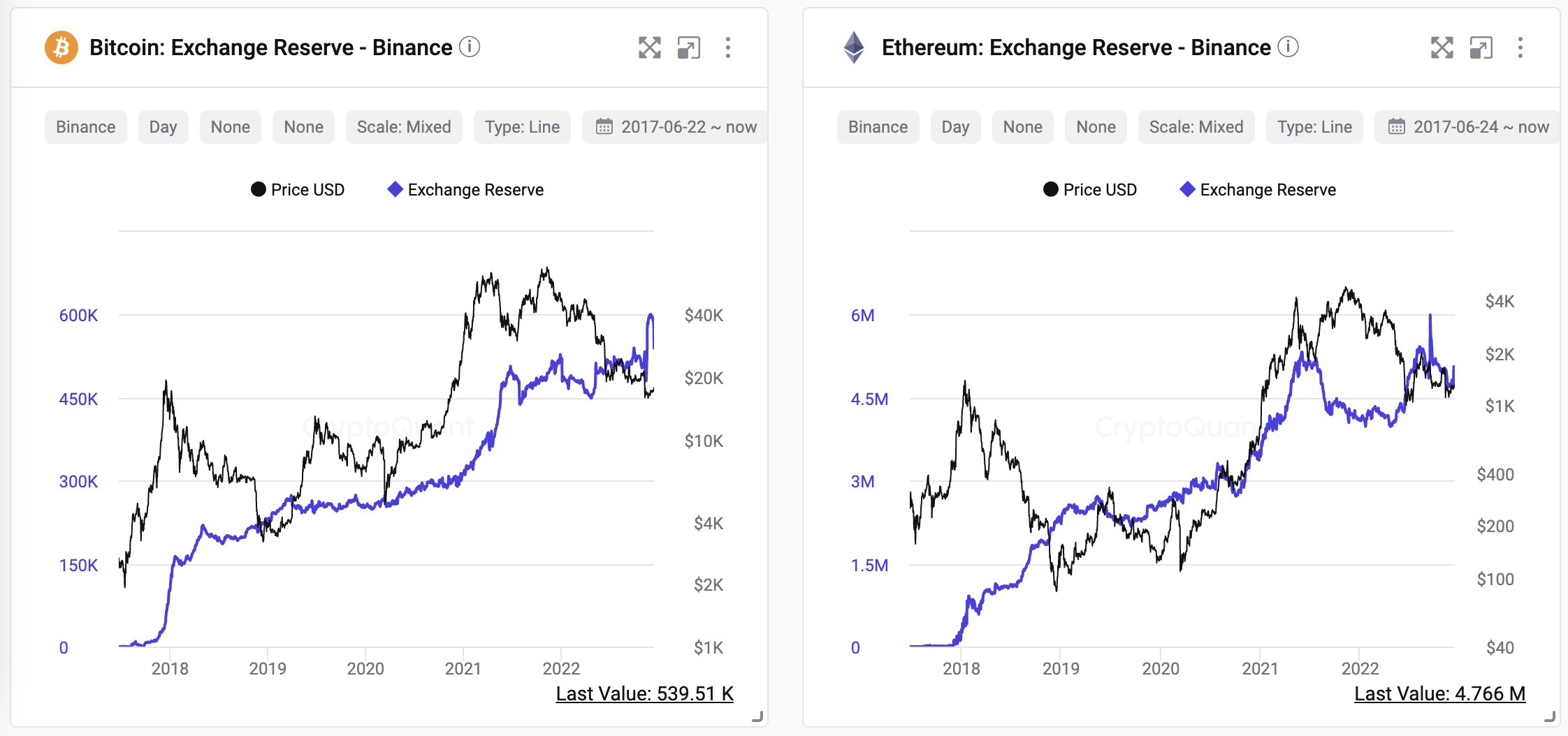

Young Joo says Binance’s Bitcoin (BTC) and Ethereum (ETH) reserves also look normal.

“People ask me if Binance is doing well. Their BTC reserve fell -8% in the last two days, but up +24% during the FTX bank run last month. There may be things that need to be clarified for regulation, but I don’t see any shady activities on the chain for now.”

Cryptoanalysis firm Santiment notes that Binance rumors dominate social media conversations.

“24% of all crypto platform conversations revolve around the swirling R&D [fear, uncertainty, and doubt] rumors on Binance. AP ArchPublic has reported that executives are allegedly “citizens” and that there are fears of money laundering. Read our take on how audiences are reacting.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/DigitalAssetArt