Fantom outperformed Bitcoin during the December 14 trading session, here’s how

- FTM ranked number one altcoin on LunarCrush’s AltRank.

- Bullish momentum is waning, showing that buyers may be exhausted.

Phantom [FTM] took first place in the ranking of altcoins that surpassed Bitcoin [BTC] on December 14, data from LunarCrush knew.

The cryptocurrency social analytics platform has an AltRank feature that tracks the social and market activity of 4,047 coins and how they are outperforming leading BTC coins.

Read Phantoms [FTM] Price prediction 2023-24

Logging its position as the altcoin that surpassed BTC in terms of social activity the most, out of all 4,047 tracked altcoins, FTM’s social volume ranked 67th and recorded a social score of 27th.

With leading social + market activity, #Phantom has hit AltRank™ 🥇 among the top 4047 coins.

LunarCrush AltRank™ looks for coins that perform better #Bitcoin. Upgrade your account to access our exclusive AltRank™ insights.

More $ftm attractions: pic.twitter.com/HUvb3FNxHp

— LunarCrush (@LunarCrush) 14 December 2022

FTM for the win

Per data from CoinMarketCap, FTM was exchanging hands at $0.2384 at press time. While the rest of the market suffered a decline following FTX’s unexpected demise, FTM disconnected from the rest of the market to log gains.

In the last month, its value has grown by 28%. Within that period, Alt’s market value also jumped from $480 million to $660 million.

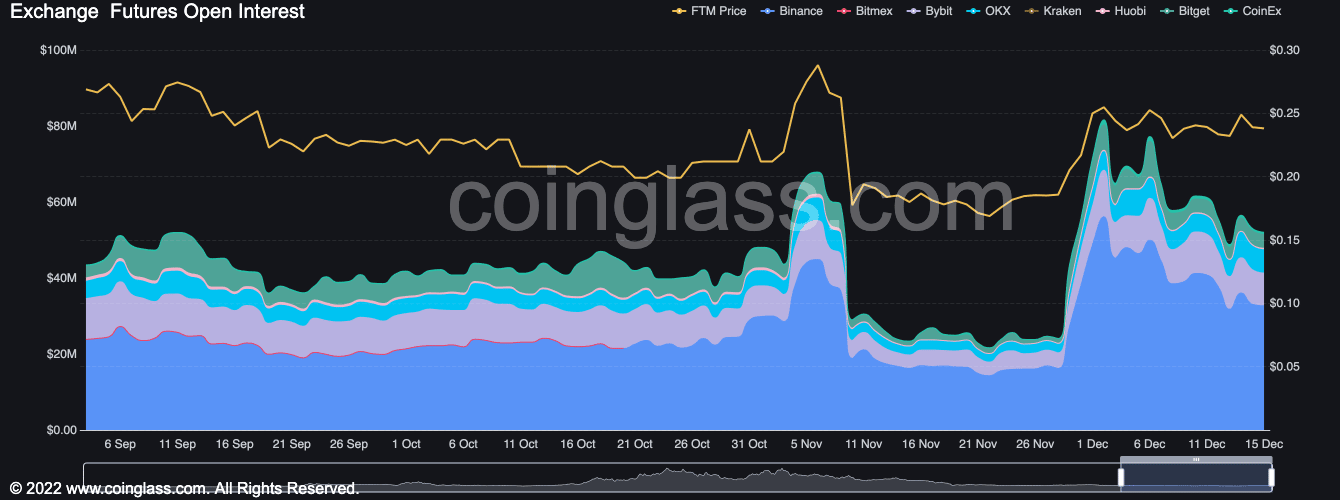

Furthermore, an assessment of FTM’s open interest since the FTX debacle revealed a rally since November 10. Per data from Coinglass, this was $52.04 million at press time, having grown by 79% since November 10.

This showed that a strong bullish conviction was behind the price rally, which remained unaffected by FTX’s collapse.

Source: Coinglass

Here is a caveat

While FTM’s price may have risen over the past month, an assessment of its performance on a daily chart showed that everything has been trading in a tight range since the beginning of the month.

As a result, while key indicators remained bullish, they had weakened over the past two weeks. Moreover, the price has shown a pattern of lower highs, which makes the recent decline in momentum understandable.

The Relative Strength Index (RSI) was at 54.91 at press time. Below its neutral 50 region, the decline in bullish momentum saw FTM’s Money Flow Index (MFI) observed at 40.25, still in a downtrend.

Furthermore, Chaikin Money Flow (CMF) and On-Balance Volume (OBV) have been flat since the beginning of the month. Although these indicators remained bullish, their flatness since December indicated that buyers may be exhausting and a market takeover by sellers was imminent.

Source: TradingView

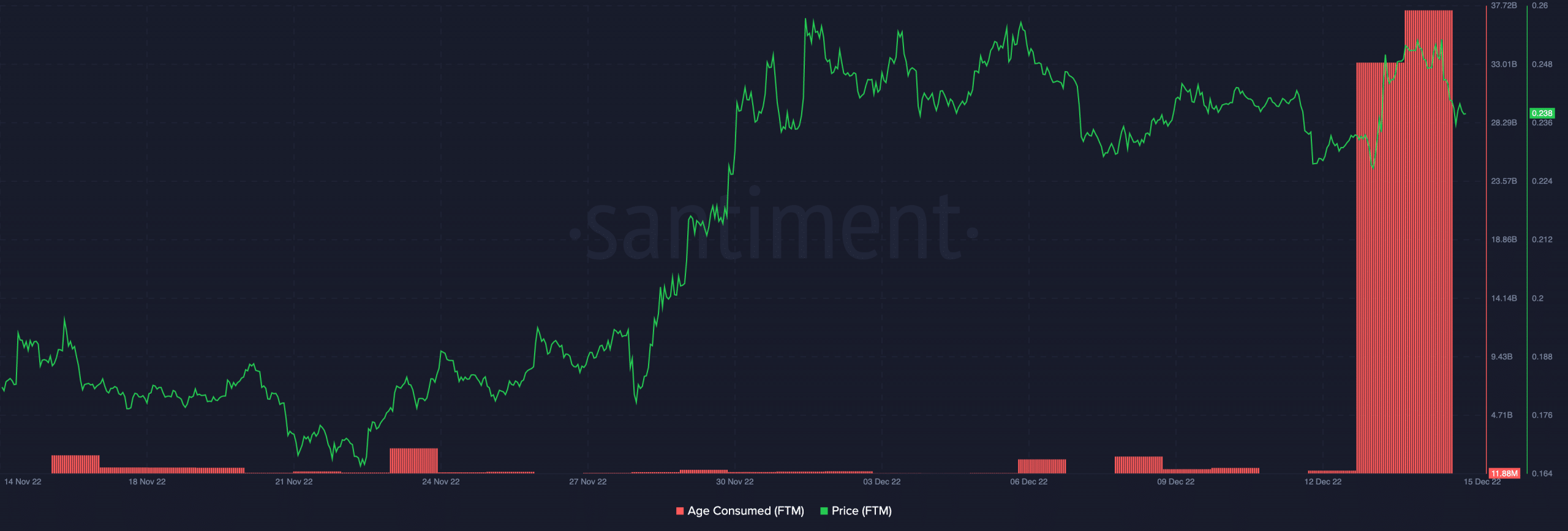

A look at FTM’s Age Consumed calculation confirmed this. This metric tracks the activity of previously dormant coins on the blockchain.

An increase in age consumption indicates that a large number of previously inactive tokens are now being moved between addresses, potentially indicating a sudden change in the behavior of long-term holders.

Per data from Santiment, FTM saw an increase in its aged consumption, and a price drop followed this. This indicated that a local bottom had been reached and a negative price reversal was on the way.

Source: Sentiment