Bitcoin Price Prediction As BTC Spikes Above $18,000 For First Time In 30 Days And Falls Back – Time To Buy The Dip?

In our Asian session Bitcoin price prediction, we predicted that BTC would fall further to complete a 61.8% Fibonacci retracement to $17,440 before rebounding. BTC has fallen to trade near $17,500; closing candles above this level can lead to a bullish bounce.

The aggressive FOMC and Fed decisions on interest rate hikes could be one of the main reasons for a bearish trend in Bitcoin.

After seeing inflation rise, the Federal Reserve raised interest rates again on Wednesday to 4.5%. The interest rate forecasts from the Fed may be more optimistic than expected. Almost everyone on the board agrees that an interest rate of just over 5% is reasonable for next year.

Although Powell has acknowledged that no one can predict when a recession will hit, the Federal Reserve has been more hawkish than many expected. The news from the Fed seemed to have a negative impact on markets and bitcoin. A hawkish Fed could lead to a temporary sell-off in the markets as things stand.

ECB follows Fed and raises interest rate to 2.50%

In addition to the Federal Reserve, the European Central Bank (ECB) decided to raise the key interest rate by just a quarter of a percentage point, from 1.5% to 2%, at its meeting on Thursday.

Starting in March 2023, the company plans to reduce its balance sheet by an average of €15 billion ($16 billion) each month until the end of the second quarter of 2023.

Cryptocurrency markets remain gloomy due to the FOMC’s hawkish stance, but there have been some positive developments that could boost prices.

Hong Kong Exchange Launches Bitcoin and Ether Futures ETFs Tomorrow

This coming Friday (December 16), the Hong Kong stock market will reportedly welcome the debut of two exchange-traded funds (ETFs) that track bitcoin futures contracts listed in the United States. These products will be Asia’s first exchange-traded fund (ETF) holding bitcoin and ether as underlying assets.

A Reuters report says the ETFs will mirror the performance of futures traded on the Chicago Mercantile Exchange. The CSOP Bitcoin Futures ETF and the CSOP Ether Futures ETF have raised $73.6 million, with the former accounting for $53.9 million of this total.

CSOP Asset Management’s Head of Quantitative Investments Yi Wang sees this move as proof that Hong Kong has stayed the course of its crypto journey.

Despite the recent liquidity problems that have plagued several cryptocurrency exchanges, Hong Kong continues to support the growth of virtual assets, as seen by the launch of two exchange-traded fund (ETF) products dedicated to cryptocurrencies.

Let’s take a look at the technical side of the market!

Bitcoin price

Bitcoin’s current price is $17,474, and its 24-hour trading volume is $25 billion. The BTC price has plunged over 3% since yesterday. Bitcoin is trading negative, despite breaking past a crucial resistance level at around $18,150. However, Bitcoin plunged below the $18,000 level following the announcement of the interest rate hikes by the Fed and the ECB. This suggests that the sales trend may continue.

Leading technical indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are currently positive, signaling that the price of Bitcoin may rise after completing the Fibonacci retracement to $17,440.

Bitcoin’s next major resistance level is at $18,125; a break above this level could lead to further gains and a price of $18,600.

On the downside, the price of Bitcoin may find support at $17,440. This level has previously acted as a barrier and is likely to keep BTC’s bullish trend intact.

On the other hand, a bearish crossover below this area could result in a decline in BTC price below $16,850.

Dash 2 Trade (D2T) – Final phase of pre-sale

The project said today that once token sales reach the $10 million mark, a countdown to its first listing on a controlled market will begin. If the $10 million goal is reached before the Stage 4 presale ends, Dash 2 Trade will launch DASH on CEX at the end of the presale.

Trevor Main, Community Manager for Dash 2 Trade, will be holding an AMA (Ask Me Anything) on the Coinsniper Telegram on Thursday, December 15 at 17:00 UTC.

Visit Dash 2 Shop Now

RobotEra (TARO)

Another Ethereum-based platform, RobotEra (TARO), is a Sandbox-style Metaverse that will allow players to play as robots and contribute to the construction of its virtual world. This covers the development of NFT-based lands, buildings, and other in-game assets, as well as the game’s goal of connecting players to other metaverses and creating an interoperable multiverse.

1 TARO is currently offered for 0.020 USDT (it can be purchased with USDT or ETH), but this price will increase to $0.025 in the second phase of the presale. It has already raised about $553,000.

Visit RobotEra now

FightOut Token (FGHT)

FightOut is an innovative M2E ecosystem that provides tailored and actionable health recommendations. Tokenized rewards are the primary way the FightOut initiative hopes to motivate members to stick with and improve their training routines.

Overpriced gym memberships, lack of social interaction and poorly designed training routines are just some of the problems that the FightOut team have identified as plaguing the fitness industry at large. To alleviate these problems, the FightOut team built and launched an app called FightOut, which has the added bonus of earning users money.

On December 12, a crypto presale began, with early buyers receiving 60% of the available tokens. FGHT has already started over 1.8 million tokens so far.

Visit FightOut Now

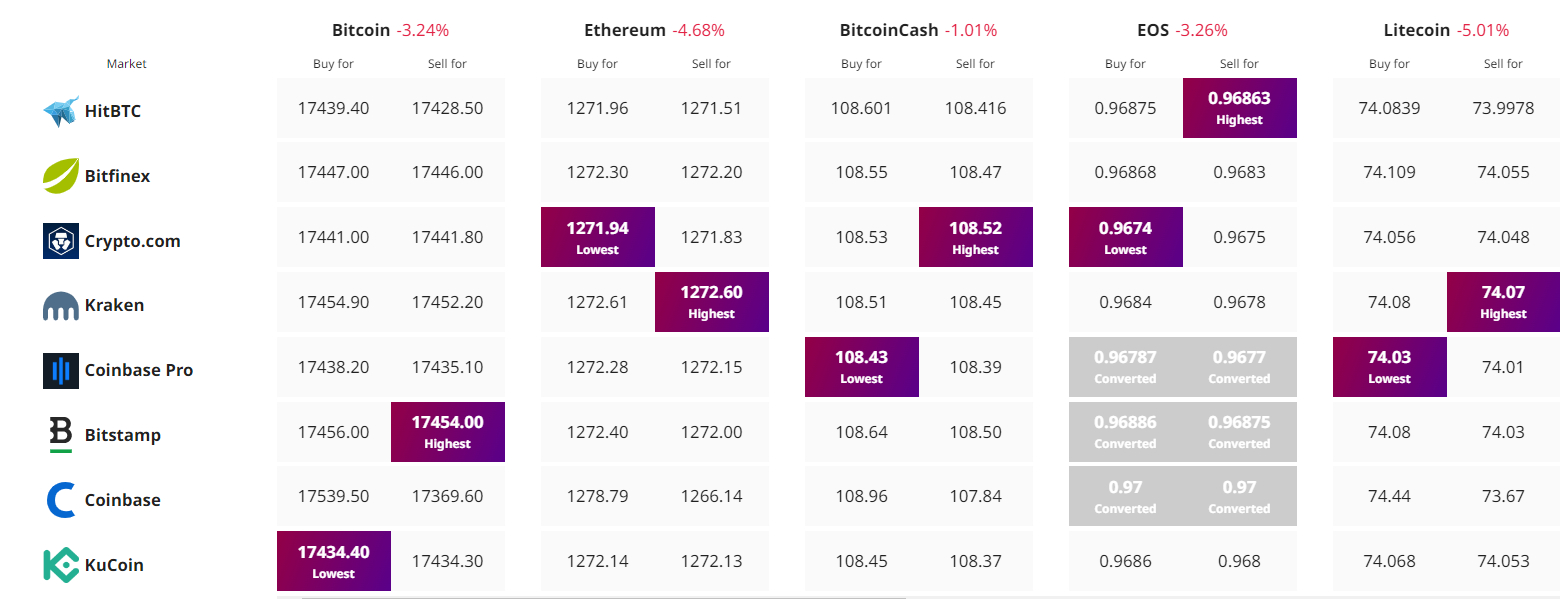

Find the best price to buy/sell cryptocurrency