Lawmakers warn SBA to allow fintech borrowers into 7(a) program

In their first meeting since the Small Business Administration proposed opening its flagship 7(a) loan guarantee program to fintechs, Democrats and Republicans on the Senate Small Business Committee made clear that the agency must be prepared to effectively oversee any new lenders it admits. door.

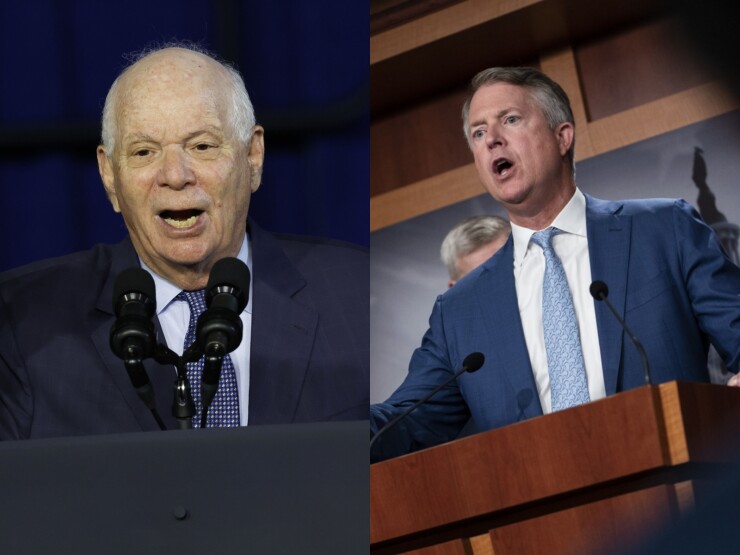

Sen. Ben Cardin, D-Md., the committee’s chairman, said he “wholeheartedly” supported the SBA’s efforts to increase access to capital for minority, women and veteran entrepreneurs — its stated reasons for pursuing the rule changes involving fintech — though he noted fintech lenders involvement in the Paycheck Protection Program was tainted by fraud concerns.

“I understand there are a lot of concerns about these proposed changes,” Cardin said during a hearing Wednesday on Capitol Hill. “While I fully support the goals and objectives in mind, I share some of these concerns. We must ensure that we address these disparities and better serve small business owners without undermining important guardrails. Guardrails are critical. They protect borrowers, lenders and the integrity of program.”

Sen. Roger Marshall, R-Kan., said Congress should examine the proposed regulation carefully “before the SBA implements these very significant changes.”

“It is troubling that the current administration is changing significant lending policies without input from Congress,” Marshall said. “It is also concerning that SBA may not be able to provide adequate oversight and vetting of new lenders through the Office of Credit Risk Management.”

Vice President Kamala Harris originally signaled SBA’s intent to allow fintech borrowers to participate in the flagship 7(a) program in October, during an appearance at the annual Freedman’s Bank Forum in Washington. The agency followed up last monthreleasing a proposed regulation that would eliminate a 40-year moratorium that limited 7(a) participation to banks, credit unions and a handful of non-custodial small business lending companies, known as SBLCs.

The SBA envisions two new classes of SBLCs, mission-based lenders that would focus on underserved markets or demographics, along with for-profits — including fintechs — that would operate much like the 14 existing SBLCs.

While the SBA made clear, as Cardin noted, that its intent is to expand access to capital for disadvantaged borrower groups, the proposed rule has become the subject of growing controversy, particularly since the release of a House Select Subcommittee report on the coronavirus crisis attributed a large proportion of PPP fraud to fintech borrowers.

Nick Schwellenbach, a senior investigator at the Washington-based Project on Government Oversight, reiterated that point in testimony Wednesday. “It appears that the government did not do enough to ensure that all non-traditional lenders participating in PPPs had adequate anti-fraud controls either internally or through their service providers.”

Trade groups representing banks, credit unions and the existing SBLCs have all declared their opposition to adding new lender groups to 7(a).

In testimony Wednesday, Annemarie Murphy, president of SBA lending at the $481 million First Bank of the Lake in Osage Beach, Missouri, said lenders are already having remarkable success getting capital to minority borrowers under 7(a)’s current framework.

“One third of all loans [during SBA’s 2022 fiscal year] went to minority borrowers, a number that has been steadily rising,” Murphy said, adding that the trend has continued into fiscal year 2023, with loans to African-American and Hispanic borrowers sharply up.

Murphy’s testimony underscored comments made Tuesday by SBA Administrator Isabella Casillas Guzman, who said in a news release that her agency had “increased funding to women-owned, minority-owned and veteran-owned small businesses by 29%” during Fiscal Year 2022, which ended Sept. 30 .

According to SBA statistics, approximately 32% of fiscal year 2022 7(a) lending, totaling $8.3 billion, went to minority borrowers. So far in the financial year 2023, minorities’ share of 7(a) lending has risen to 35%.

Murphy, who urged the SBA to “pause these rules,” said offering existing 7(a) lenders incentives to make even more loans to underserved borrowers would have a bigger impact than opening the door to fintechs.

“Especially, as a lender, what would help is to codify small dollar loans,” Murphy said. “Keep these at no charge to our borrowers. That’s powerful, especially for underserved borrowers.”

In its proposed regulation, the SBA indicated that it initially plans to limit the number of new for-profit SBLCs to three as it builds insurance capacity. However, Cardin noted that the rule contains no limit on how many it can ultimately approve.

“Yes, these regulations target a limited number of new lenders, but the regulation as written does not limit it to just a few new lenders,” Cardin said. “This could be a model going forward for competition, so we need to make sure it’s done right.”