The Swiss financial industry has successfully traded and settled tokenized investment products

-

Credit Suisse, Pictet and Vontobel have completed a proof of concept to issue tokenized investment products registered on a public blockchain and traded on BX Swiss, the Swiss regulated exchange

-

The three processes of the proof of concept – issuance, trading and settlement – took place within hours, whereas in a traditional financial environment they take days

-

The Capital Markets and Technology Association’s (CMTA) token standard and Taurus’ tokenization technology have been used to issue tokenized investment products

-

Transactions with tokenized securities are settled in fiat currency – Swiss francs – through a smart contract and targen’s payment bridge DLT2Pay

-

The financial industry utilizes blockchain technology to increase security and efficiency and reduce complexity

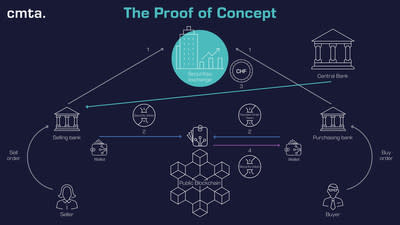

GENEVA, 13 December 2022 /PRNewswire/ — For the first time, key players in the Swiss financial industry developed and tested a new settlement mechanism for tokenized investment products on a public blockchain testnet infrastructure. A smart contract, developed by the Capital Markets and Technology Association (CMTA), allows streamlined processes, reduces complexity, increases security and eliminates counterparty risk from trades. CMTA’s proof of concept marks a milestone for the Swiss financial industry.

The proof of concept involves:

-

issuance of tokenized investment products registered on a Ethereum test blockchain,

-

trading in these products in Swiss francs on a regulated Swiss stock exchange, and

-

settlement of trades through a smart contract developed by CMTA.

These three distinct operations – issuance, trading and settlement – all happened within hours, when it takes days to unfold in a traditional financial environment.

“We are very proud to have developed this ground-breaking mechanism with a number of partners from the financial and technology industries,” says Jacques Iffland, Chairman of the CMTA. “It will enable the industry to increase efficiency, simplify cross-border settlements and improve the quality of services. And customers will benefit from the efficiency gains.”

Vontobel and Pictet each issued an actively managed equity certificate representing a basket of shares, while Credit Suisse issued a structured note, which was associated with digital tokens registered on a Ethereum test blockchain, a process often referred to as “tokenization”. These securities were then traded on the platform of BX Swiss, a FINMA-regulated Swiss stock exchange. The trades were settled bilaterally on the blockchain. To do this, the participants used a chain mechanism that secures the parties’ obligations. The settlement in fiat currency (Swiss francs) was made possible by an application called DLT2Pay, a product of targens, which connects the blockchain with the Swiss Interbank Clearing (SIC), the Swiss real-time gross settlement (RTGS) payment system. National Bank. The proof of concept leveraged CMTA’s standard token format and smart contract (CMTAT), and another smart contract that replicates the delivery-vs-payment functionality of traditional settlement systems. The creation, security aspects and technical operation of the smart contracts were carried out under the leadership of Taurus, whose technology was used to issue and manage the structured products throughout their lifecycle.

The proof of concept was developed and executed under the auspices of CMTA, with support from representatives from BX Swiss, Credit Suisse, Homburger, Lenz & Staehelin, METACO, Pictet, targens, Taurus, UBS and Vontobel.

proof of concept lays the foundation for an alternative Swiss post-trade infrastructure that operates without central parties (central counterparty and central securities depository) and enables participating banks to benefit from cost advantages along the entire value chain of securities transactions (issuance, settlement and custody).

Daniel GorreraHead Digital Assets at Credit Suisse, said: “The transactions carried out today clearly state that products tokenized on a public blockchain can be traded on regulated trading platforms and that settlement of transactions on tokenized products can be carried out in fiat currencies without creating any counterparty risk. The successful proof of concept is a crucial first step in unlocking the benefits of tokenization in the future.“

Steve Blanchethead of Group Tech Strategy and Innovation at Pictet said: “Tokenization is an important strategic element for the future of asset management. It enables issuers to streamline the processes that govern the creation of investment products in a way that is not currently achievable with traditional infrastructure, and drastically reduce time-to-market. With the solutions we tested in the proof of concept, processes that currently take days can be reduced to a few hours, and finally down to minutes or less.“

Anna-Naomi Bandi-LangStructuring – Credit Solutions at UBS Investment Bank said: “Tokenization has many uses, but for it to become an established feature of modern financial markets, the ability to trade tokenized products in major currencies and through regulated trading venues is key. CMTA’s proof of concept shows that there is a way to achieve this goal.“

Marco Hegglinchief of staff Structured Solutions & Treasury at Vontobel, said: “This proof of concept is only a first step on the way to defining a new standard for structured products in the form of a smart contract. Structured products are not only innovative products, they are also predestined for state-of-the-art technology. With a fully automated smart contract covering the entire lifecycle, the possibilities that can be expressed in pure code language are almost limitless, and blockchain technology can help design new generations of financial products.”

Matthias Müller, Head of Marketing at BX Swiss, said: “First of its kind, this proof of concept showed that trades executed on exchanges can be settled on a public blockchain directly between participants. It is no longer necessary for the parties to secure a transaction by transferring tokens or cash to the exchange before trading. This is a significant advantage in terms of speed, cost and risk management. The smart contract used for the settlement eliminates the counterparty risk that would exist if the cash part and the asset part of the transactions were carried out independently of each other. The new regulatory regime for DLT-based trading platforms will allow BX Swiss to take full advantage of these developments.“

Jean-Philippe Aumasson, co-founder of Taurus SA and Chair of CMTA’s Technology Committee, said: “We are pleased to see consensus building around the use of open standards for DLT-based market infrastructures and to see CMTA’s smart contracts being recognized as reliable technology in this regard. Using collaboratively developed open source smart contracts reduces development and due diligence costs for participants and contributes to the reliability and efficiency of the Swiss fintech ecosystem.“

Samuel Bisigbusiness development and product manager at targens GmbH i Stuttgartso: “targens’ DLT2Pay solution provides the missing link between a DLT/blockchain and a payment transaction protocol (here: the central banks’ clearing systems) for cash settlement of securities transactions. As long as central banks’ digital currencies (CBDCs) are not available, such a “trigger solution” is the key if digital assets are to be traded in a different way than in private cryptocurrencies.“

Further information on proof of concept (paper, video, animated graphics):

https://cmta.ch/news-articles/trading-and-settlement-in-digital-securities

For further information, please contact:

Pascal IhleCohabitant

furrerhugi.ag

Telephone: +41 44 251 01 43

Email: [email protected]

About the Capital Markets and Technology Association

The Capital Markets and Technology Association (CMTA) is a non-profit organization based in Geneva, Switzerland, which brings together experts from the financial, technological and legal sectors to promote the use of new technologies in the capital markets. The association offers a platform for creating open industry standards around the issuance, distribution and trading of securities in the form of digital tokens using distributed ledger technology. Created in 2018 by Lenz & Staehelin, Swissquote and Temenos with the support of EPFL, it currently has over 40 members representing the Swiss and international financial industry.

www.cmta.ch

Image – https://mma.prnewswire.com/media/1966701/cmta_proof.jpg

Logo – https://mma.prnewswire.com/media/1965639/CMTA_Logo.jpg

View original content to download multimedia: https://www.prnewswire.com/news-releases/the-swiss-financial-industry-has-successfully-traded-and-settled-tokenized-investment-products-301700554.html

SOURCE Capital Markets and Technology Association (CMTA)