Bitcoin has a bullish stance, but that warrants a buyer interest in BTC

Disclaimer: The findings in the following analysis are the sole opinions of the author and should not be considered investment advice

- Bitcoin is seeing large outflows from exchanges to suggest an accumulation phase

- A revisit to the month-long lows could present traders with an opportunity

Tether dominance has slowly increased throughout 2022. This meant that over the course of the year the stablecoin occupied more and more of the entire cryptosphere’s market cap. This metric’s gains since June highlighted how investors fled from holding crypto to holding in fiat.

Bitcoin itself has been in a downward trend from $67ki last year. This downward trend was not about to end just yet.

Read Bitcoins [BTC] Price prediction 2023-2024

Speculation that Bitcoin was nearing bottom in the markets was seen on social media. Others felt that the sins of FTX could see the entire industry bleed for years. In December, Bitcoin hovered precariously above $17k, but it may be time for another move down.

Bitcoin is showing bearish momentum on the daily chart with support at $15.6k

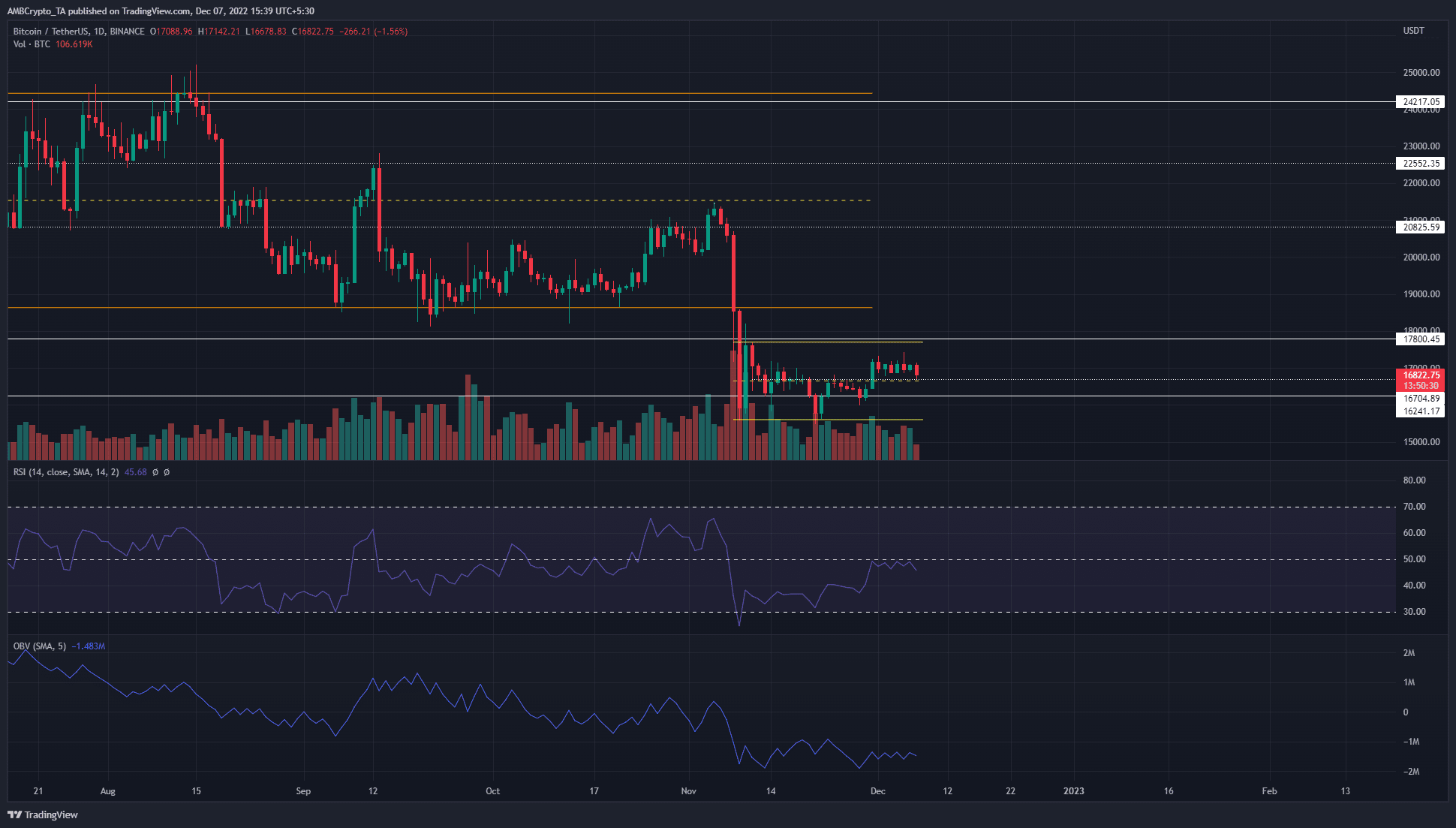

Source: BTC/USDT on TradingView

Over the past month, BTC has traded within a range (yellow) from $15.6k to $17.7k. The midpoint was at $16.6k and has acted as an important level over the past month. At press time, the Relative Strength Index (RSI) was below neutral 50 while the On-Balance Volume (OBV) had no recent trend. Since August, OBV has been in a downward trend and has shown significant sales volume.

From a technical point of view, BTC has a bullish market structure. It has risen above the previous low of $16.6k, testing the same as support. Still, that doesn’t indicate that buyers might be interested.

The mid-range was a place where lower time frame traders might look to bid. For better chances of success, risk-averse traders can wait for a transition to the lowest levels before buying. They could also look for a sweep into the $15.2k-$15.4k range and a retracement of $15.6k, to trade a swing failure pattern.

The latest bloodshed saw investors bet on Bitcoin, could a rally begin soon?

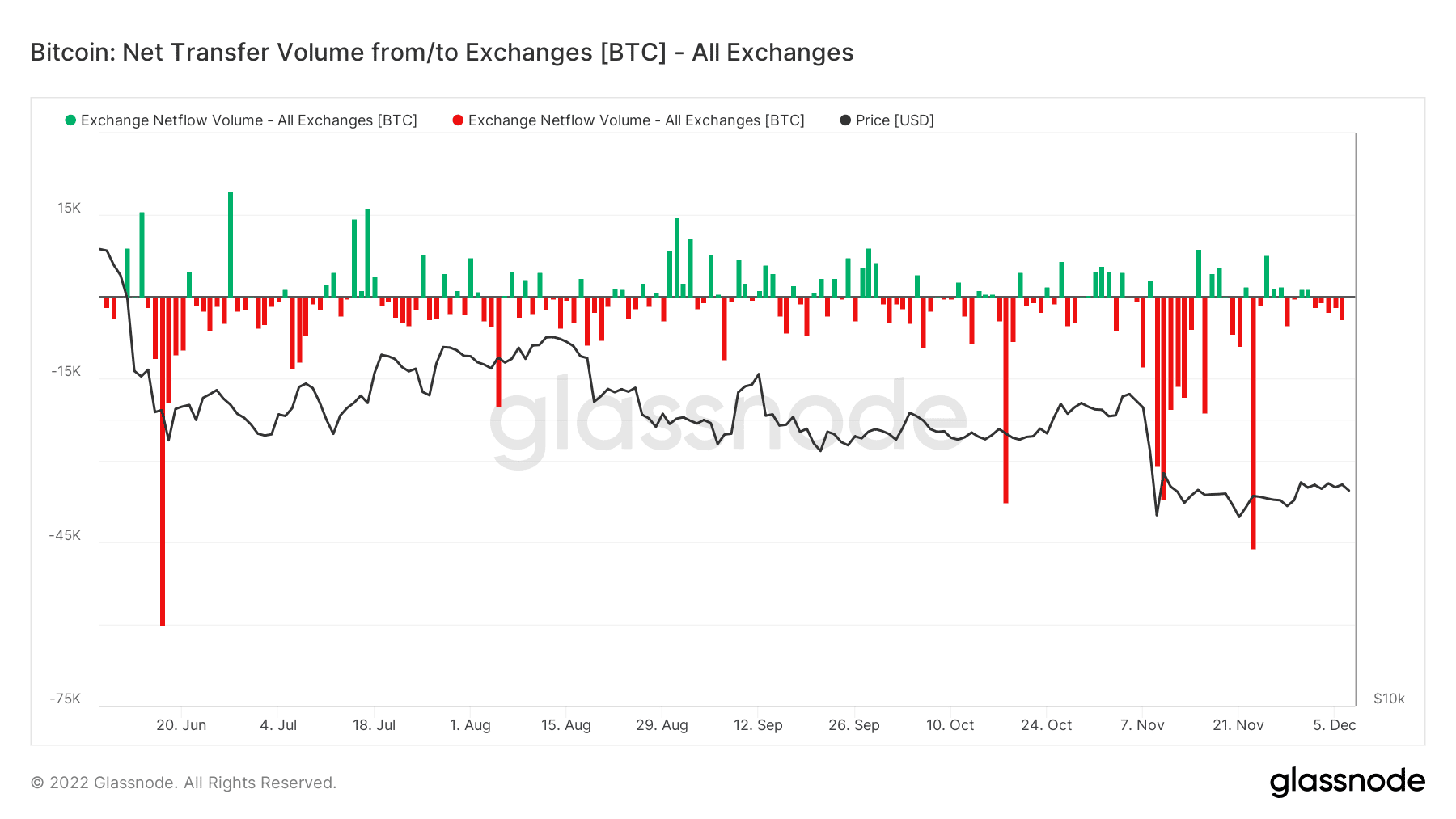

Source: Glassnode

Glassnode data showed that Bitcoin leaving exchanges has been a dominant trend since November. This suggested that investors were moving their BTC out of exchanges and likely into cold storage. It could be a response to the FTX crash, but it could also be an indication that buyers saw these prices as lucrative.

This data alone does not support the idea of a rally. Another drop below $15.6k remained a possibility. Still, despite all the fear in the market, Bitcoin has been able to hold on to the $16k range. Derivatives traders expecting further losses on Bitcoin have had their hands scalded.

Traders can stick to the aforementioned range, while investors need to exercise patience. Bitcoin may be close to bottoming out in terms of price, but it may be very far from bottoming out in terms of time.