Bitcoin investor cohorts now have a close cost basis, what does that say about the market?

Data shows that the various Bitcoin investor groups now have their cost basis packed together in a tight range. Here’s what this can tell us about the current market.

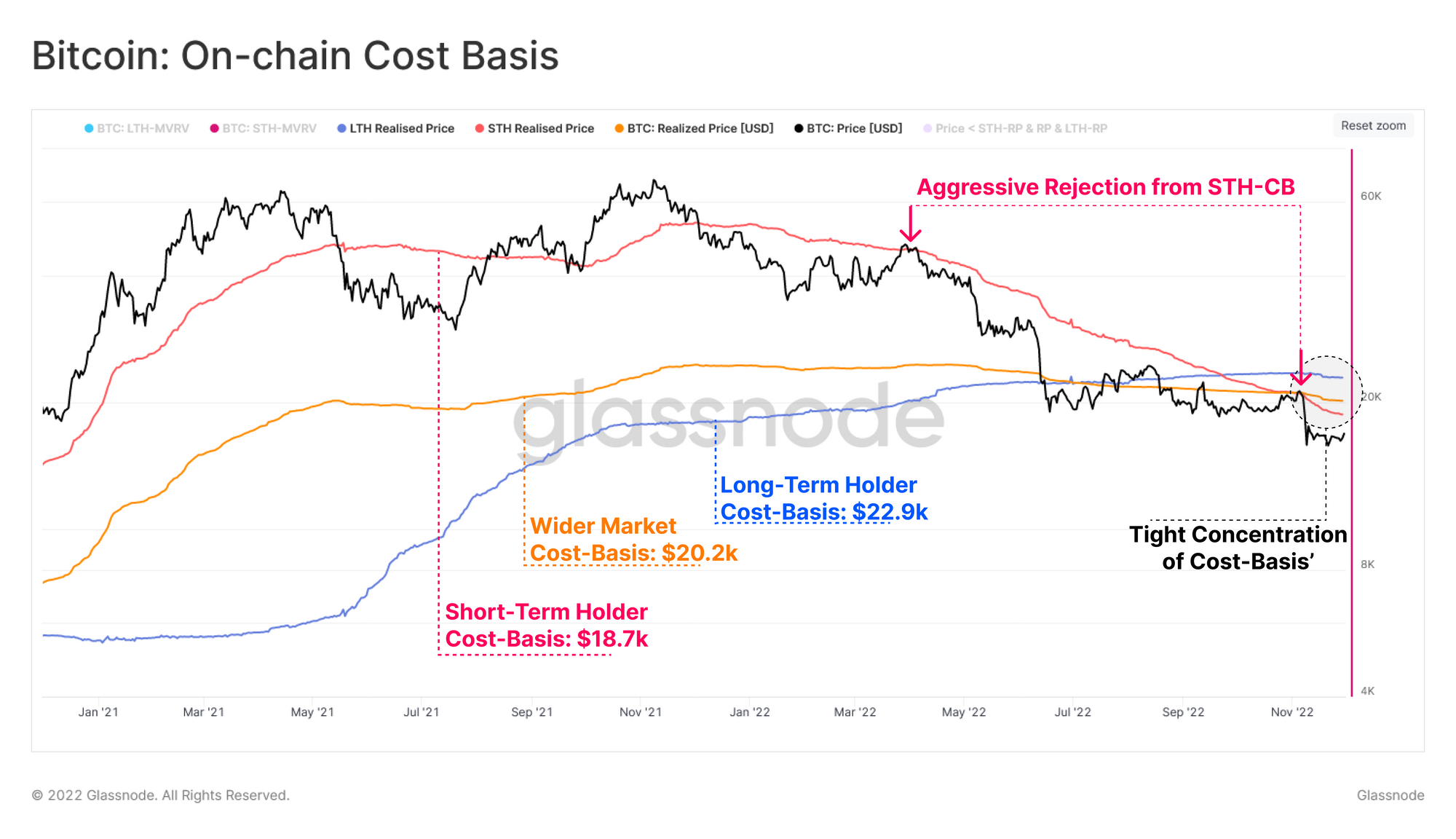

All Bitcoin investor groups have cost bases between $18.7k and $22.9k

According to the latest weekly report from Glassnode, the cost base for the broader BTC market is currently around $20.2k.

Here, the “cost base” refers to the price at which the average investor in the Bitcoin market bought their coins.

The entire market can be divided into two main investor cohorts, “short-term holders” (STHs) and “long-term holders” (LTHs).

The STH group includes all investors who have purchased their coins in the last 155 days. The LTHs, on the other hand, consist of holders who have held onto their coins since more than 155 days ago.

Statistically, the LTH group is the group least likely to sell their coins at any time, since the longer investors hold the coins, the less likely they are to break hibernation.

The cost base for one of these two groups is the price at which the average investor belonging to said cohort bought their coins.

Now, here’s a chart showing the trend in the cost basis for both LTHs and STHs, as well as the broader Bitcoin market:

Looks like the price was rejected by the STH cost-basis not too long ago | Source: Glassnode's The Week Onchain - Week 49, 2022

As you can see in the graph above, the cost basis of the Bitcoin STHs has fallen as the bear market has progressed, which makes sense since this cohort only includes investors who recently bought. Naturally, the “recent” prices during the bear have been lower and lower.

The LTH cost base has increased somewhat as investors who bought below the higher prices are now part of this group. Currently, this metric has a value of $22.9k.

This is not too far from the $18.7k cost base for the STHs and the $20.2k cost base for the wider market. This means that the various investor groups in today’s market have acquired their coins at equal prices.

The implication of this is that the perceived risk and opportunity among all holders, whether short-term or long-term, is the same. “As such, it is more likely that the overall market will begin to behave in a more coherent manner in response to volatility,” the report notes.

BTC price

At the time of writing, Bitcoin’s price is hovering around $17k, up 3% in the last week.

BTC continues to hold still around the $17k mark | Source: BTCUSD on TradingView

Featured image from iStock.com, charts from TradingView.com, Glassnode.com