Bitcoin: FTX, BlockFi and What’s Next for Crypto (BTC-USD)

salarko

BlockFi is the latest domino to fall in the FTX (FTT-USD) contagion saga with its recent Chapter 11 filing. How far will this contagion go and is the crypto market dead? The purpose of this article is to cut through noise and provide an analysis of how this happened and where the industry goes from here.

To begin with, the crypto market tends to validate one’s assumptions about the industry. The truth is somewhere between “everything is a scam” and “this is why we need decentralized finance (DeFi).” If you bought $100 Bitcoin (BTC-USD) for every crypto obituary published in the mainstream financial media, you would be rich enough not to care what is written here. However, let’s also not forget that the collapse of the algorithmic stablecoin ecosystem of Terra Luna (LUNC-USD), with a market capitalization of $34.8 billion and a total value locked of over $20 billion across multiple decentralized product offerings, triggered the events we see. Today.

Centralized economy is broken

Centralized Finance, or CeFi, is the business model for using traditional banking practices with crypto assets. The most common practice involves lending customers’ crypto deposits to generate returns for the finance provider and the depositor.

BlockFi, FTX, Voyager (OTCPK:VYGVQ), Celsius (CEL-USD), Babel Finance, and Three Arrows Capital all filed for bankruptcy this year. These collapses highlighted the incestuous relationship between yield-bearing CeFi providers, firms that borrowed from them to trade with leverage, and even exchanges that leveraged a functionally similar asset in the case of FTX and its token, FTT. Apart from Three Arrows Capital, it appears that all other bankrupt institutions above may have lent customer deposits.

Any asset that regularly trades with volatility levels above eighty percent should not be leveraged or lent. For reference, the S&P 500’s volatility historically fluctuates between ten and twenty percent. If this structure was built around real-time priced equity in early-stage startups, the result would be the same. Unfortunately, foreclosures and dire emotions prior to the Chapter 11 process have been a drag on crypto prices.

What about Bitcoin and Ethereum?

Digital assets were created to not have to rely on institutions like BlockFi and individuals like Sam Bankman-Fried. Despite the collapse of the surrounding architecture mentioned above, Bitcoin still produces blocks every ten minutes. Ethereum-based (ETH-USD) smart contracts still work the same way they did when they were deployed. People are still spending $1 million on Bored Ape Yacht Club NFTs to party with celebrities at next year’s Apefest. Protocols and self-service wallets work just fine.

If you have to generate a return, do it on the chain without a counterparty. For most people, it should be sufficient to keep the carrier’s assets or the settlement layer. If you don’t trust their ability to self-deposit crypto assets, use transparent exchanges like Coinbase (COIN) or preferably one with proof of reserves like Kraken. Many are throwing the baby out with the bathwater by treating FTX and Bitcoin as the same. I consider it a buying opportunity.

Does crypto even have persistence?

This is what you basically have to believe to buy BTC and ETH at these levels. To answer the question, let’s separate the technological use case from the investment case. On the technology front, I believe that billions of dollars in trading volume is proof enough of product market fit to solve societal needs for decentralized money, decentralized financial architecture, and P2P creative expression through Non Fungible Tokens. I also believe that blockchain will serve as the backend of an immersive, ownable and interoperable metaverse within the next ten years.

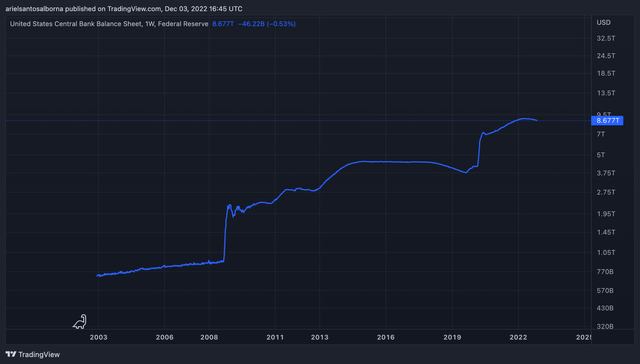

On the investment front, a picture is worth a thousand words. Have we entered a new paradigm for monetary and financial discipline? I think the answer is no. The current liquidity crisis is a blip in the history of the never-ending expansion of the Fed balance sheet, and the money printer go brrr is the only play in the Fed’s playbook to stave off economic recessions until The central bank’s digital currencies allow targeted stimulus or unless Jerome Powell is okay with boosting the global economy with a Great Depression-like restart. Owning scarce assets is what matters in this context. No counterparty risk is also a plus.

Nice balance (tradingview.com)

Conclusion

If crypto does indeed have staying power, market overreactions to the demise of flawed business models built around these assets are buying opportunities. Bitcoin didn’t budge on the announcement of the BlockFi bankruptcy and is actually now trading 4.5% higher. I believe that the worst has priced in and now is the time to consider opening or adding a position. Unleveraged, blue chip cryptoassets still have a role to play in a diversified portfolio.