Getty pictures

The amount of cryptocurrency flowing into privacy-enhancing mixer services has reached a record high this year as funds from wallets belonging to government-sanctioned groups and criminal activity nearly doubled, researchers reported on Thursday.

Mixers, also known as tumblers, obscure cryptocurrency transactions by creating a disconnect between the funds a user deposits and the funds the user withdraws. To do this, mixers collect funds put in by a large number of users and mix them at random. Each user can withdraw the entire amount deposited, minus a cut for the mixer, but because the coins come from this cluttered pool, it is more difficult for blockchain investigators to track exactly where the money went.

Significant money laundering risk

Some mixers provide extra concealment by allowing users to withdraw money in different amounts sent to different wallet addresses. Others try to hide the mixing activity completely by changing the fee for each transaction or varying the type of deposit address used.

Using a mixer is not automatically illegal or unethical. Given how easy it is to track the flow of Bitcoin and some other types of cryptocurrencies, there are legitimate privacy reasons that someone might want to use one. But given the widespread use of cryptocurrency in cybercrime, mixers have evolved as a tool that must be used for criminals who want to withdraw money without being caught by the authorities.

“Mixers present a difficult question for regulators and members of the cryptocurrency community,” wrote researchers from the cryptocurrency analysis firm Chainalysis in a report linking the increase to increased volumes deposited by sanctioned and criminal groups. “Almost everyone wants to acknowledge that financial privacy is valuable, and that in a vacuum there is no reason why services such as mixers should not be able to offer it. However, the data show that mixers currently pose a significant risk of money laundering, with 25 percent of funds coming from illegal addresses, and that cybercriminals associated with hostile authorities exploit. “

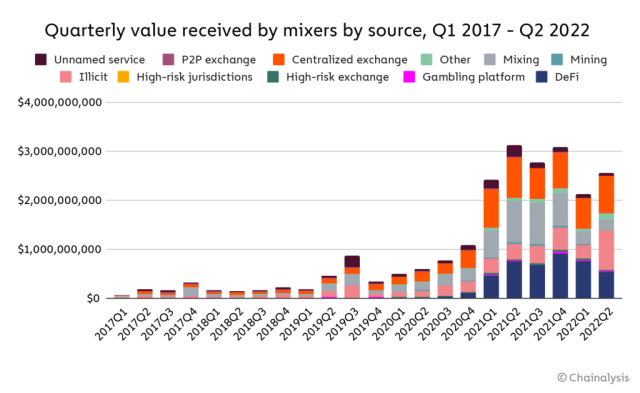

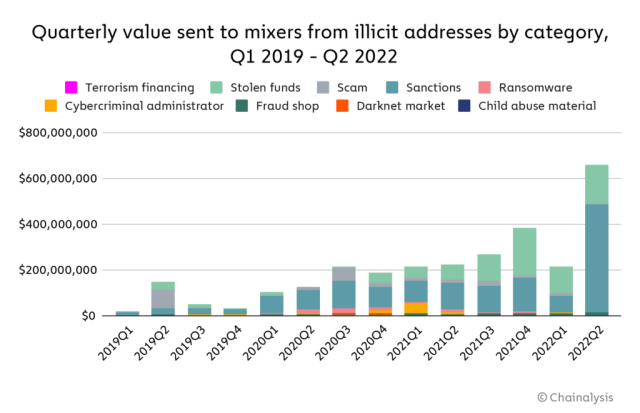

Cryptocurrencies received by these mixers fluctuate significantly from day to day, so researchers find it more useful to use long-term measures. The 30-day moving average of funds received by mixers reached $ 51.8 million in mid-April, a record high, Chainalysis reported. The high water mark represented almost double the incoming volumes at the same time last year. In addition, illegal wallet addresses accounted for 23 percent of the funds sent to mixers this year, up from 12 percent in 2021.

Rogues’ gallery

As the graph below illustrates, the increases come in particular from higher volumes sent from addresses linked to illegal activity, such as ransomware attacks, cryptocurrency fraud and stolen funds carried out by groups sanctioned by the US government. To a lesser extent, volumes sent from centralized exchanges, DeFi or decentralized financial protocols also drove the rise.

Chain analysis

A breakdown of volumes related to illegal sources shows that the rise is mainly driven by sanctioned entities – mainly of Russian and North Korean origin – followed by cryptocurrency thieves and fraudsters engaging in cryptocurrency investments.

Chain analysis

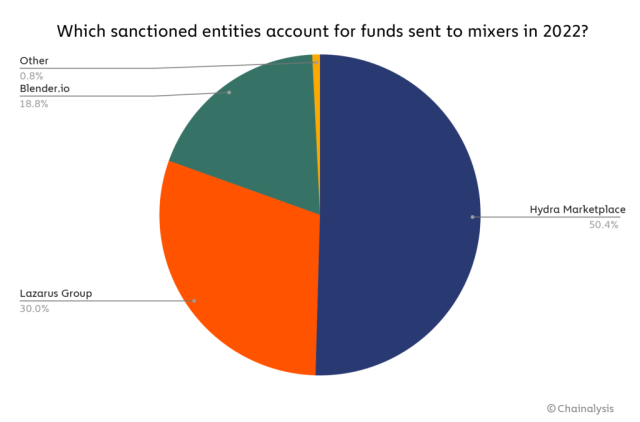

The penal units are led by Hydra, a Russia-based dark web market that serves as a haven for criminals to buy and sell services and products to each other. In April, the US Treasury Department sanctioned Hydra for obstructing the group’s efforts to liquidate its poor revenues. Two North Korean hacker groups – one known as Lazarus and the other as Blender.io – accounted for most of the remaining volume from sanctioned groups.

Chain analysis

Despite their usefulness, mixers suffer from a critical Achilles heel: Large transactions make them inefficient, which means that they work less efficiently when people use them to deposit large amounts of cryptocurrency.

“Since users receive a” mix “of funds contributed by others, if a user floods the mixer and contributes significantly more than others, much of what they end up with will consist of the funds they originally put in, making it possible to track the funds back to their original source, “explained Thursday’s report. “In other words, mixers work best when they have a large number of users, all of whom mix comparable amounts of cryptocurrency.”