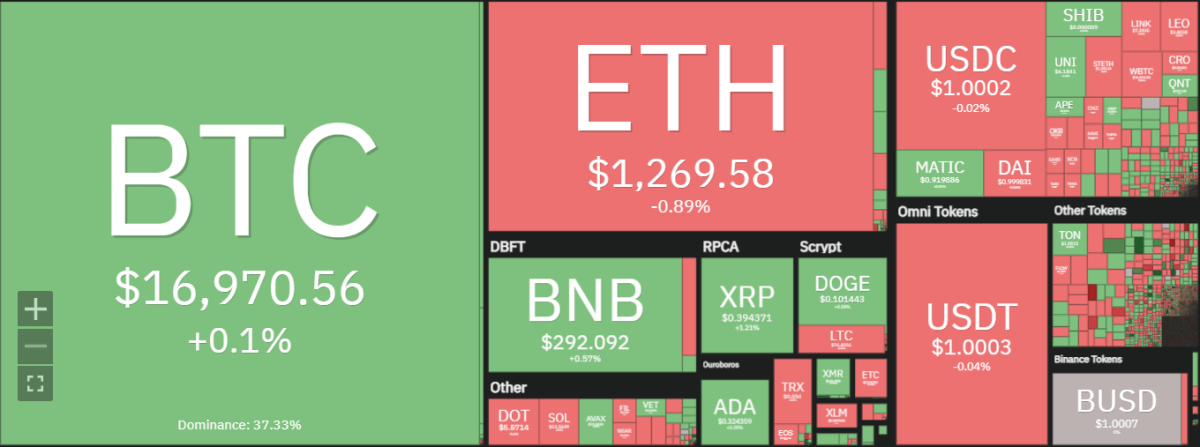

Bitcoin Price Analysis: BTC turns back to $16,969 as bullish momentum continues

Bitcoin price analysis shows an increasing trend for cryptocurrency today. Although the price faced bearish resistance earlier, the bulls managed to bring the price to $16,969 in the last 24 hours. The continuation of the green candlestick indicates that the coin value has increased again today. The hourly price prediction confirms similar market trends for BTC/USD, as the price also covered upward movements in the last four hours. However, the nearest resistance is present at the $17,116 level, where selling pressure may emerge, and bulls will need to show more strength to bypass this local pressure area.

BTC/USD 1-Day Price Chart: Bitcoin rate rises 0.16 percent

The one-day Bitcoin price analysis brings encouraging news for cryptocurrency buyers, as the price has increased significantly during the day. The coin is currently trading at $16,969 at the time of writing and the chances are there for further increases in the price level if bulls show consistency. The coin has already gained 0.16 percent overnight, which is a big achievement for the bulls.

The price trends have been in constant variation for the past week, but now a continuation of the bullish trend can be seen on the price chart, which started yesterday.

The BTC/USD price appears to be crossing the curve of the moving average, indicating a bullish trend. Furthermore, the BTC/USD price path appears to be moving upwards, indicating a rising market with further opportunities for increased movement.

Volatility is relatively on the higher side, the upper Bollinger band value is 17,246, while the lower value is $16,917. The Relative Strength Index (RSI) chart is showing a very weak upward curve as more buying activity is taking place in the market, and the RSI level has reached an index of 40.58 near the center line of the neutral zone, but the mild upward curve suggests against the opposition from bearish side.

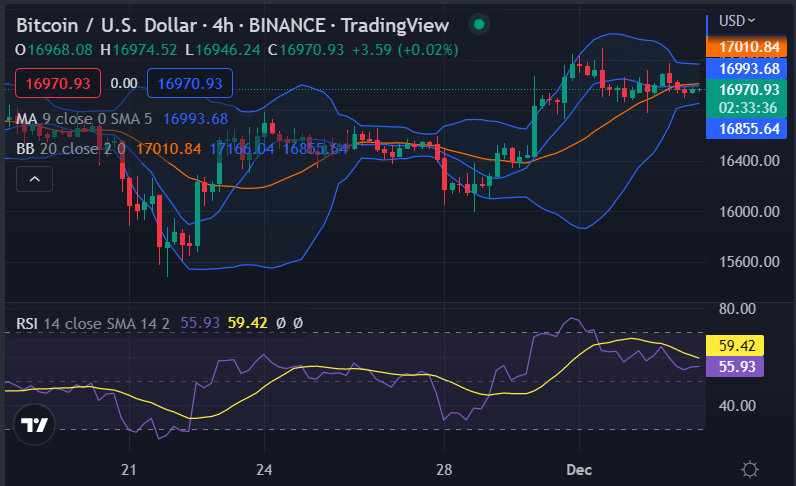

Bitcoin Price Analysis: BTC prices increased significantly to $16,969

The hourly Bitcoin price analysis is also in support of the buyers today as the price has steadily increased. The green candlesticks mark a price rise in the last four hours. The price has reached near the upper limit of the volatility indicator as the buyers are currently controlling the market trends. Right now Cryptocurrency value is found at $16,969 after gaining significant value. The moving average value in the four-hour price chart stands at the $16,993 level after crossing over the SMA 50 curve.

Volatility is mild on the 4-hour chart, with the upper band of the Bollinger Bands indicator present at the $17,166 mark, and the price moving towards the upper band, while the lower band is present at the $16,855 mark. The RSI graph shows horizontal movement as the indicator trades at index 59.42, suggesting that selling pressure is building at today’s price level.

Bitcoin price analysis conclusion

To summarize, Bitcoin price analysis shows that a significant increase in the BTC/USD market value was observed today, of 0.16 percent. The green candlestick marks an upgrade in the coin’s value over the past 24 hours. We expect Bitcoin to continue upside-down in the coming hours. However, a small correction may also take place as the price is already trading near the upper limit of the Bollinger Bands on the 4-hour chart and the RSI curve is also flattening.

While you wait for Bitcoin to move forward, check out our long-term price predictions on Chainlink, VeChain and Axie Infinity.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com has no responsibility for investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.