Inflation didn’t come out of nowhere – Bitcoin Magazine

This is an opinion editorial by Federico Rivi, an independent journalist and author of the Bitcoin Train newsletter.

We are raising interest rates “because we are fighting inflation. Inflation has come out of virtually nothing.” This was said by the President of the European Central Bank, Christine Lagarde, presenter of the Irish talk show Late Late Show on Friday 28. October 2022. Words that apparently contradict a statement that came shortly afterwards in the same interview. she saidis caused “by Russian President Vladimir Putin’s war in Ukraine. […] This energy crisis is causing massive inflation that we must defeat.”

The price increase

The day before the interview, the European Central Bank had raised interest rates by another 75 basis points, bringing the total rate of growth used in the last three meetings to 2%: the highest level since 2009. In all likelihood, it will not end there, as the Governing Council plans to “increase interest rates further to ensure a timely return of inflation to its medium-term target of 2 per cent”.

According to the latest data, inflation in the Eurozone has actually reached levels never seen in the last 20 years: +9.9% in September compared to the same month last year. Countries such as Latvia, Lithuania and Estonia experience price increases of 22%, 22.5% and 24.1% respectively.

In the widespread consensus on the meaning of the term inflation, but there is a major inconsistency. A distortion of the real concept that leads managers, experts – and consequently the media – to attribute different causes to the word, depending on the convenience of the moment. When in reality the cause is always and only one.

Inflation and price increases are different

For many, inflation is now synonymous with rising prices. This is not only a widespread opinion, but an opinion that has also been adopted by economic textbooks and the official language. According to the Cambridge Dictionary, inflation is “a general, continuous rise in prices.”

But is this really the case? Bitcoin teaches one thing: Don’t trust, verify. And in verifying, a problem emerges: the reversal of cause and effect.

Inflation is treated as the effect of a particular event: an energy crisis, a chip shortage, a drought can all lead to higher prices of goods and services in certain sectors. But in reality, inflation, in its original meaning, does not mean the rise in prices, it indicates the cause.

The clue comes directly from etymology: inflation comes from the Latin word inflationitself a derivative of blow upi.e to pump. Think of blowing up a balloon: the action blow up (inflation) is when air is blown from the mouth into the balloon: the cause. The immediate consequence is the expansion of the volume of the balloon taking in air: the effect.

Pumping new air into the balloon is the action that causes it to expand. The same reasoning applies to money: the very act of printing money is inflation and the consequence is an increase in prices. This reversal of cause and effect was already referred to in the late 1950s as semantic confusion by one of the most prominent economists of the Austrian school, Ludwig von Mises:

“There is today a most reprehensible, even dangerous, semantic confusion which makes it extremely difficult for the non-expert to understand the true state of affairs. Inflation, as this term has always been used everywhere and especially in this country, means to increase the amount of money and notes in circulation and the amount of bank deposits subject to control. But people today use the term “inflation” to refer to the phenomenon that is an inevitable consequence of inflation, that is, all prices and wage rates tend to rise. The result of this deplorable confusion is that there is no concept left to suggest the cause of this rise in prices and wages.”

If there can therefore be many causes for price increases, there cannot be as many causes for inflation because it is itself the origin of price increases. It would be much more comprehensive and intellectually honest to say that the decline in purchasing power could be due to several factors, including inflation, i.e. the printing of money.

Money flood

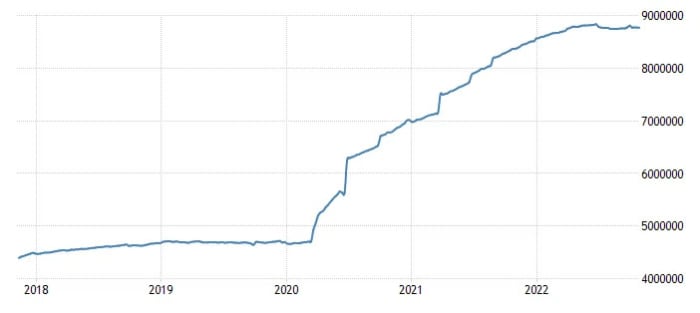

So how has the European Central Bank behaved in terms of money issuance in recent years? The most effective figure to understand this is the ECB balance sheet, which shows the equivalent value of assets held: those assets that Eurotower does not pay for but acquires by creating new currency. As of October 2022, the ECB held almost 9 trillion euros. Before the pandemic, at the beginning of 2019, it had about 4.75 trillion. Frankfurt has almost doubled its money supply in three and a half years.

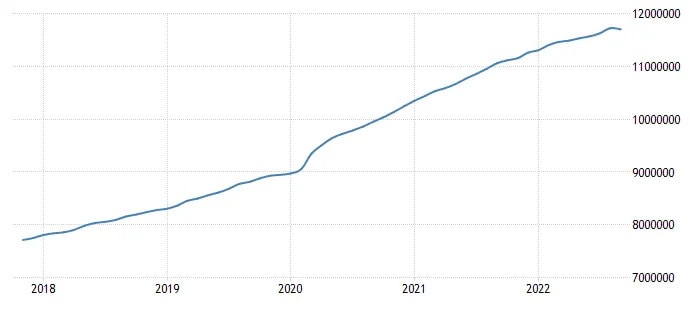

If we measure the amount of euros circulating in the form of banknotes and deposits – the number defined as M1 – the figure is a little more reassuring, but not much: at the beginning of 2019 there were almost 8.5 trillion euros in circulation, today it is 11, 7 trillion. A growth of 37.6%.

Are we then really sure that this rise in prices – or as it is mistakenly called by everyone, inflation – comes from nowhere? Or that it is just a consequence of the war in Ukraine? Given the amount of money injected into the market over the last three years, we should count ourselves lucky that the average price increase in goods and services is still stuck at 10%, due to the restrictions of the pandemic and the subsequent economic crisis we are entering.

What does Bitcoin have to do with all this? Bitcoin has everything to do with it because it was born as an alternative to the financial disasters that central banks continue to make themselves responsible for. An alternative to the bubbles of unsustainable growth alternating with devastating crises caused by the market manipulation of the interventionist utopia. Bitcoin cannot tell the world that “inflation came out of nowhere,” because the code is public and anyone can check the monetary policy. A policy that does not change and cannot be manipulated. It is fixed and will remain so. 2.1 quadrillion satoshis. Not one more.

This is a guest post by Federico Rivi. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.